EUR/USD

Analysis:

The main direction of the euro's movement in the short term is set by a bearish wave that has been counting since the middle of last year. Since September, a counter wave has been developing, which has become a correction. The price is at the lower border of the potential reversal zone. The decline that began on December 21 has a reversal potential.

Forecast:

There is a high probability that the beginning of the rollback will develop into a larger wave structure. Today, the price pullback that started yesterday is expected to end and return to the downward rate. You can expect a reversal at the end of the day or tomorrow. A breakout of the support zone down within a day is unlikely.

Potential reversal zones

Resistance:

- 1.1220/1.1250

Support:

- 1.1160/1.1130

Recommendations:

Euro purchases are not very promising today. The main attention is recommended to be paid to the search for selling signals of the instrument in the area of the calculated resistance.

AUD/USD

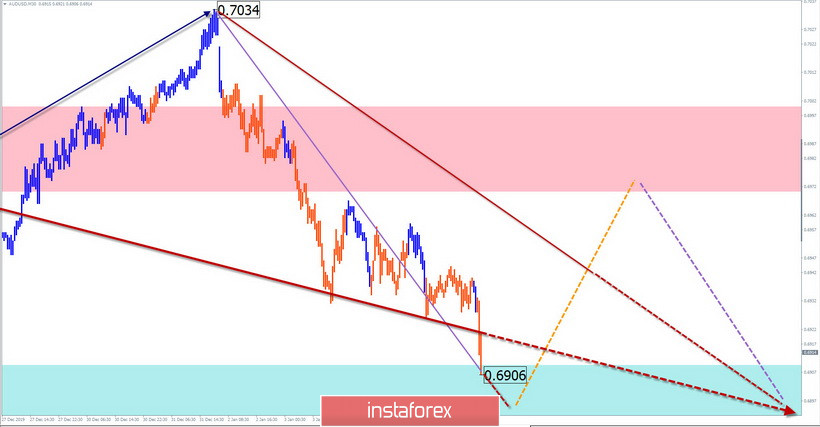

Analysis:

On the "Aussie" chart, the downward wave continues to form. The formation started in September and has the appearance of an upward pennant. The downward section from December 31 has a high wave level. This may be the beginning of the final part of the main wave.

Forecast:

Over the next day, the general lateral mood of the pair's movement is likely. A short-term rebound is expected from the settlement support in the next session. Next, the price of the pair is waiting for a reversal and a repeated decline.

Potential reversal zones

Resistance:

- 0.6970/0.7000

Support:

- 0.6910/0.6880

Recommendations:

Buying "Aussie" today can be very risky. There is a high probability of counter-rollbacks. It is recommended to refrain from entering the pair's market for the duration of the correction and look for entry points to short positions at the end of it.

GBP/JPY

Analysis:

The downward wave that began in the middle of last month has a reversal potential. Given the incompleteness of the main trend wave, this means the transition of the current movement to a higher level of correction of the entire wave. In its structure, there was a zigzag (A-B). The downward section from December 31 and the subsequent rollback to it do not yet go beyond the reversal structure.

Forecast:

Today, the cross chart is expected to continue the price growth that began on January 6, until its full completion. In the first half of the day, you can expect a short-term price decline to the support zone.

Potential reversal zones

Resistance:

- 143.30/143.60

Support:

- 142.40/142.10

Recommendations:

Today, short-term purchases of the instrument are possible. When the price reaches the control resistance, it is recommended to start tracking the reversal signals to find points of sale of the cross.

Explanations: In the simplified wave analysis (UVA), waves consist of 3 parts (A-B-C). The last incomplete wave is analyzed. The solid background of the arrows shows the formed structure and the dotted background shows the expected movements.

Attention: The wave algorithm does not take into account the duration of the tool movements in time!