4-hour timeframe

Technical data:

The upper channel of linear regression: direction - up.

The lower channel of linear regression: direction - down.

The moving average (20; smoothed) - up.

CCI: 32.0338

The British pound also showed an upward movement on Monday, January 6, based on a strong and optimistic indicator of business activity in the services sector for December Markit. However, after that, in the US trading session, traders ignored the similarly positive indexes of Markit business activity in the US. Thus, we believe that the US macroeconomic statistics have not been worked out, so today we can expect a resumption of the fall of the pound-dollar pair. The calendar of macroeconomic events in the UK today is empty, so traders will have to focus exclusively on the index of business activity in the service sector ISM, which is projected with a very high value.

In previous reviews of 2020, we have already said that the Bank of England, despite the ghostly signs of recovery in the UK economy (which so far has no prospects), it is high time to intervene in the economy of Albion, until it continues to slow down. We have already said that the only thing that is holding back the British Regulator from easing monetary policy now is concerns about the future consequences of Brexit and uncertainty with the question, will Brexit not be "tough"? The Bank of England holds such a trump card as a rate cut, like a sharpie - an ace up his sleeve, clearly intending to save it in the most extreme case. We have already dealt with these issues, however, what about the Fed?

The latest minutes of the Fed meeting showed that the mood among members of the monetary committee has not changed. The Committee is on hold and does not plan any changes to the key rate at this time. Jerome Powell and company believe that they have done enough to support the US economy and now there is a period when you just need to watch the lagging results of the impact of a softer monetary policy on macroeconomic indicators. Nevertheless, as before, the Fed is concerned about various negative "global events" and the trade war with China, which seems to have embarked on the path of de-escalation, but the "first phase" of the agreement is still not signed. Also, the Fed is worried about low inflation and its long-term expectations. In general, standard FOMC rhetoric.

However, some traders are confident that the Fed will continue to lower rates in the long term. This opinion became especially popular after the outbreak of the military conflict in the Middle East, which is now unknown what will have consequences for the United States. Thus, in the next few months, a rate cut by the Bank of England is still most likely, which will certainly weaken the British pound. If the bears are ready for new sales of the pair, then this step by the Bank of England may not be necessary.

Boris Johnson, who is currently on holiday in the Caribbean, came under a barrage of criticism, of course, from the Labor Party. According to Jeremy Corbyn, Johnson had to immediately interrupt his vacation and return to London to solve the problems associated with the resonant murder of Colonel Soleimani on the orders of Donald Trump. Although there is some reason in Corbyn's words, this message looks like "waving your fists after a fight." Johnson himself wrote on social media: "General Qasem Soleimani threatened our interests and was responsible for the destructive behavior in the region. Given his leading role in the actions that led to the deaths of thousands of innocent citizens and Western specialists, we will not mourn his death."

The technical picture shows the strengthening of the British pound to the Murray level of "8/8", which was followed by a rebound, suggesting a resumption of the downward movement. At the same time, if traders manage to overcome the level of 1.3184, the bulls will have a chance to continue forming a new upward trend.

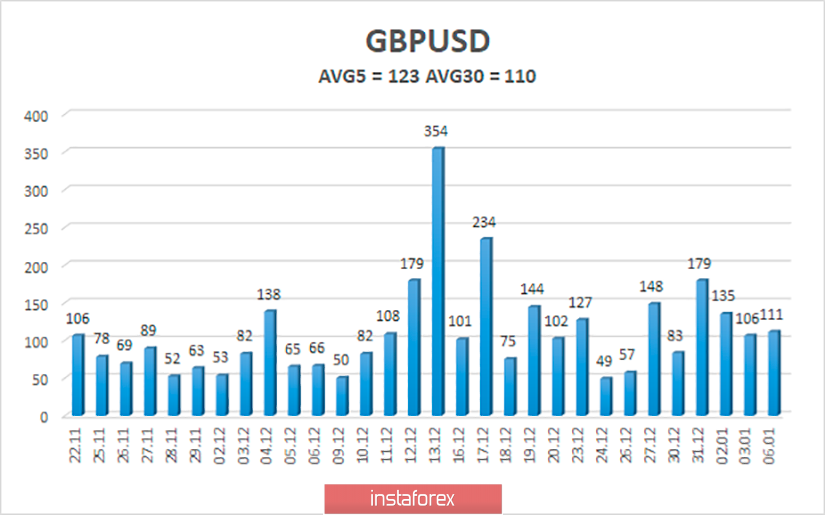

The average volatility of the pound-dollar pair over the past 5 days is 123 points, remaining at a fairly high level. According to the current level of volatility, the working channel on January 7 is limited to the levels of 1.3042 and 1.3288, and we believe that the pair will once again strive for its lower border.

Nearest support levels:

S1 - 1.3123

S2 - 1.3062

S3 - 1.3000

Nearest resistance levels:

R1 - 1.3184

R2 - 1.3245

R3 - 1.3306

Trading recommendations:

The GBP/USD pair has started a new round of upward movement. Thus, traders are advised to buy the British pound with targets of 1.3245 and 1.3288, if the bulls manage to overcome the Murray level of "8/8". It is recommended to return to selling the pound-dollar pair in the case of reverse consolidation of quotes under the moving average line with the targets of 1.3062 and 1.3042.

In addition to the technical picture, you should also take into account the fundamental data and the time of their release.

Explanation of the illustrations:

The upper channel of linear regression - the blue lines of the unidirectional movement.

The lower channel of linear regression - the purple lines of the unidirectional movement.

CCI - the blue line in the indicator regression window.

The moving average (20; smoothed) - the blue line on the price chart.

Murray levels - multi-colored horizontal stripes.

Heiken Ashi - an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.