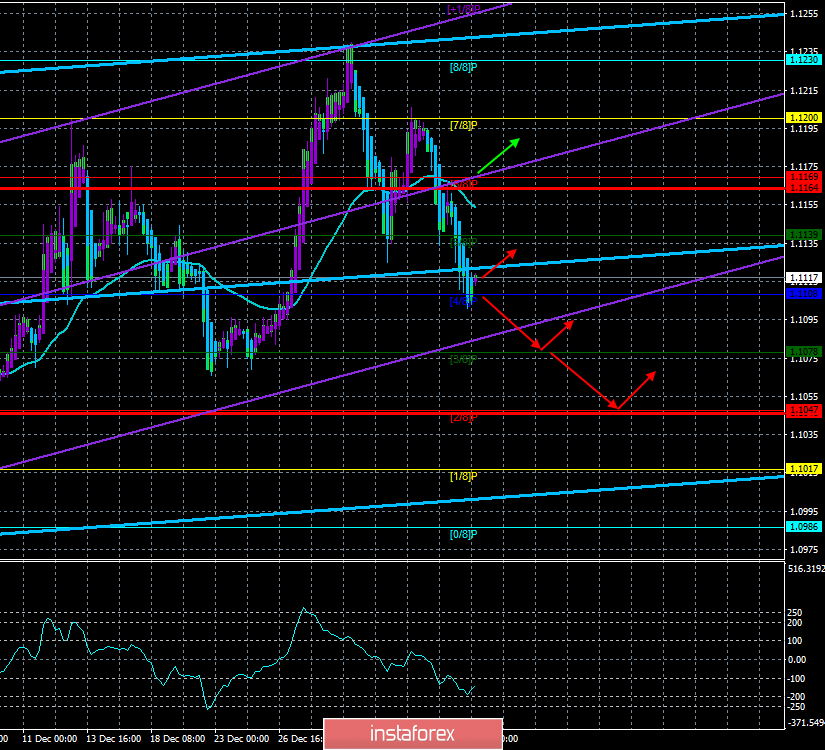

4-hour timeframe

Technical data:

The upper channel of linear regression: direction - up.

The lower channel of linear regression: direction - up.

The moving average (20; smoothed) - down.

CCI: -137.1663

For the EUR/USD currency pair, the third trading day of the week ended with a new decline in quotes, which completely fits into the general scenario. We have repeatedly said that the euro currency still does not have a strong fundamental background to show growth against the US dollar in the long term. Therefore, after a few months of correction, it is time for the euro to decline again. During yesterday's day, the euro-dollar pair fell to the Murray level of "4/8" - 1.1108 and could not overcome it on the first attempt. Thus, today, January 9, the beginning of an upward correction is possible. It should also be noted that yesterday's downward movement was justified fundamentally, as the only important report of the day (the ADP report on the change in the number of employees in the US private sector) exceeded the already high forecasts and showed an increase of 202,000 new workers.

Today, traders will get several macroeconomic reports that are identified as very interesting. The day will begin with the publication of an important indicator of industrial production in Germany. Yesterday, it became known about a strong reduction in production orders in Germany, and the index of business activity in the manufacturing sector of this country is at the lowest value among all the major EU countries. Thus, industrial production may disappoint today, although the forecasts for it was another reduction. For example, in October, there was a reduction of 5.3% y/y and in November, -3.8% y/y is expected. If these forecasts come true, the pan-European indicator of industrial production is also possible to be extremely weak.

A little later, the value of unemployment in the European Union will be published. According to experts, it will be 7.5% in November. It would seem a low value, but, for example, on this indicator, we can see the difference in power between the economies of the European Union and the States. In America, the unemployment rate is 3.5%. More important macroeconomic publications are not scheduled for Thursday, so today is a good time for the euro to adjust slightly.

Meanwhile, Donald Trump made an official statement to the world about Iran's attacks on American bases in Iraq. All the media immediately noted one important feature. The US President has not announced any new military action against Iran. It seems that the parties have exchanged duty strikes that were planned, and now again go into standby mode. It should also be noted that, according to the White House, none of the US militaries was injured as a result of the attack by Iran. An early warning system was triggered, which warned of the attack. Now Iran is waiting for new powerful sanctions. Trump also said that "Iran will never be allowed to have nuclear weapons." According to Trump, Tehran should abandon nuclear weapons and support for terrorism. Also, according to the leader of the United States, Russia, China, Europe, and other countries, nuclear weapons should give up. When the States abandon nuclear weapons, the US leader did not consider it necessary to report. Further, Trump said that America is now stronger than ever, Washington has powerful missiles, work is underway on hypersonic missiles. Trump also said that NATO needs to stop sitting on the sidelines and take an active part in stabilizing the situation in the Middle East. In general, this was a very resonant speech, but the most important thing is that it seems that there will be no retaliatory military strikes against Iranian targets.

The technical picture of the currency pair implies an upward correction. A rebound from the level of 1.1108 and a smooth reversal of the indicator Heiken Ashi up signal exactly this. Both linear regression channels remain directed upward and do not change their direction yet.

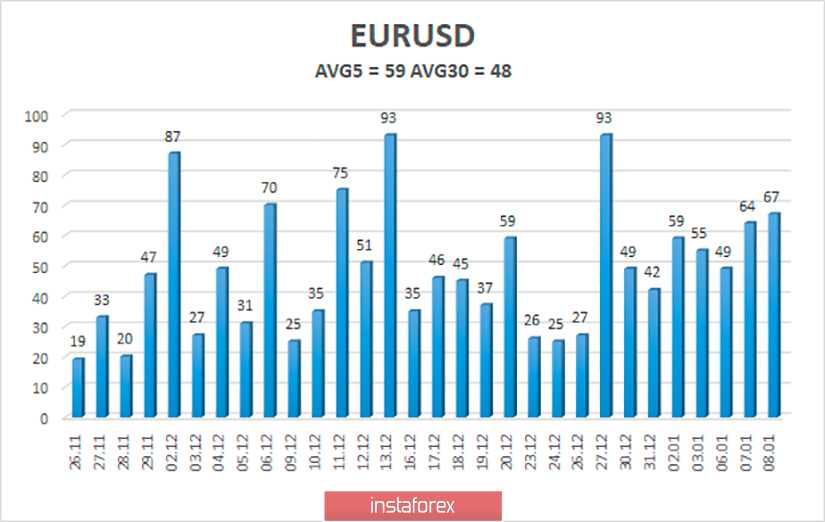

The average volatility of the euro-dollar currency pair is currently 59 points, which is the average value for the euro. Thus, we have volatility levels on January 9 - 1.1046 and 1.1164. Today, it is unlikely that any of these levels will be worked out, as the pair shows its interest in a correction.

Nearest support levels:

S1 - 1.1108

S2 - 1.1078

S3 - 1.1047

Nearest resistance levels:

R1 - 1.1139

R2 - 1.1169

R3 - 1.1200

Trading recommendations:

The euro-dollar pair resumed its downward movement and worked out the Murray level of "4/8". Thus, at the moment, traders are again recommended to consider selling the euro with the targets of 1.1078 and 1.1047, but after the correction is completed or after overcoming the level of 1.1108. It is recommended to return to the pair's purchases with the target of 1.1200 not earlier than the reverse overcoming of the moving average line.

In addition to the technical picture, you should also take into account the fundamental data and the time of their release.

Explanation of the illustrations:

The upper channel of linear regression - the blue lines of the unidirectional movement.

The lower channel of linear regression - the purple lines of the unidirectional movement.

CCI - the blue line in the indicator window.

The moving average (20; smoothed) - the blue line on the price chart.

Murray levels - multi-colored horizontal stripes.

Heiken Ashi - an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.