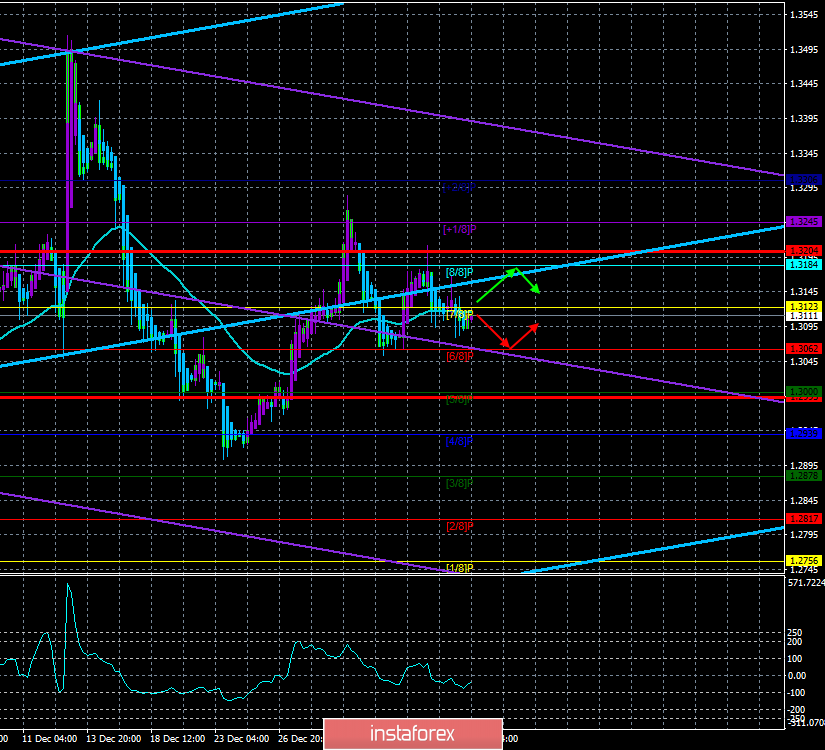

4-hour timeframe

Technical data:

The upper channel of linear regression: direction - up.

The lower channel of linear regression: direction - down.

The moving average (20; smoothed) - sideways.

CCI: -14.6043

The British pound has ceased to correlate with the euro in recent days and went flat. At least, the trades in the last few days were held close to the moving average line, which is directed sideways. January 9 also began with a featureless movement. It seems that in recent weeks we have seen the final rise of the pound to the level of 1.3500, followed by a correction to the level of 1.2900, then a correction against the correction to the level of 1.3250, then another correction to 1.3050. That is, each subsequent movement was approximately twice as weak as the previous one. Based on this, we can conclude that most of the market participants have worked and recorded profits on transactions opened earlier, and now it is time to open new strong positions that requires a significant fundamental background. At the moment, there is no such background, so traders can only wait for the momentum that will allow the pound-dollar pair to "detach" from the moving average.

No important macroeconomic statistics will be published today either in the UK or in the States. However, there will be a speech by Bank of England Governor Mark Carney, which may lift the veil on the mystery of the British regulator's plans for the coming months. Earlier, the main reason for the Bank of England's non-intervention in monetary policy was called the proximity of Brexit and uncertainty with its scenario. Now only the first point remains. We have repeatedly said that the UK business continues to experience bad times, so the Bank of England should have softened its monetary policy long ago, but this "ace" regulator wants to save for the most extreme moment. That is, most likely, monetary policy can be relaxed after January 31. Whether this is true or not, we can find out today if Mark Carney will even touch on issues of monetary policy and the UK economy.

Meanwhile, British Prime Minister Boris Johnson and European Commission Chief Ursula von der Leyen met in Downing Street. According to the official communique of the British government, the meeting was positive. Boris Johnson once again stressed that the main thing for him is to implement Brexit as quickly as possible, the issues of ratification of the "deal" by the European Parliament and the Upper House of the British Parliament were discussed. Also, according to the report, Boris Johnson wants a new positive and friendly relationship with the European Union, based on a shared history, interests and values. Johnson made it clear to Ursula von der Leyen that the "transition period" would not be extended. In turn, the European Commission communique reports that Ursula von der Leyen warned Boris Johnson about all the risks associated with Brexit. The head of the European Commission informed the British Prime Minister that the EU fully respects the decision of Britain to leave the Alliance, but no relationship can be as close as membership in the EU. Ursula von der Leyen also said that Brussels will negotiate in good faith on trade relations after the end of the "transition period", but "there is not enough time for an agreement to be reached first and then ratified by the parties before the end of 2020". Thus, it was not a negotiation, but a discussion of future negotiations, no more than a friendly visit of the head of the European Commission to London. The parties did not agree on anything and remained with their opinions. London wants to negotiate as quickly as possible and sign an agreement by the end of 2020. The European Union is not going to "drive horses" and insists on the opinion that such a large agreement for 1 year will not be achieved. Also, Brussels hints to London that Britain will not have the same trade conditions as the EU member states.

From a technical point of view, the pound-dollar pair is now flat. Thus, we believe that now we need to wait for its completion and only then resume trading. Given that the calendar of events is almost empty today, lateral movement may persist on January 9th.

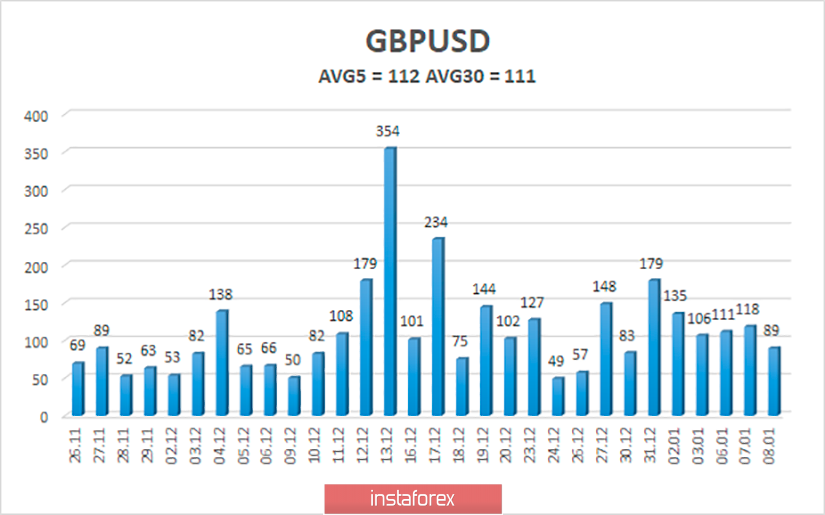

The average volatility of the pound-dollar pair over the past 5 days is 112 points, slightly lower, but remaining at a fairly high level. According to the current level of volatility, the working channel on January 9 is limited to the levels of 1.2993 and 1.3204, however, given the current flat, volatility may decrease today, and none of the channel boundaries will be worked out.

Nearest support levels:

S1 - 1.3062

S2 - 1.3000

S3 - 1.2939

Nearest resistance levels:

R1 - 1.3123

R2 - 1.3184

R3 - 1.3245

Trading recommendations:

The GBP/USD pair returned to the moving average line. Thus, traders are advised to buy the British pound with a target of 1.3184 if the price is fixed above the moving average, and sell the pair with a target of 1.3062, if the pair remains below the moving average, and the Heiken Ashi indicator turns down. It is the levels of 1.3062 and 1.3184 that now form the side channel in which the pound-dollar pair moves.

In addition to the technical picture, you should also take into account the fundamental data and the time of their release.

Explanation of the illustrations:

The upper channel of linear regression - the blue lines of the unidirectional movement.

The lower channel of linear regression - the purple lines of the unidirectional movement.

CCI - the blue line in the indicator regression window.

The moving average (20; smoothed) - the blue line on the price chart.

Murray levels - multi-colored horizontal stripes.

Heiken Ashi - an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.