Gold erased Friday's gains despite the fact that the United States Non-Farm Employment Change reported worse than expected data. DXY's current growth forced the XAU/USD sellers to drag the rate down.

Gold stands above a strong support zone. It remains to see how the yellow metal will react ahead and after the US inflation data will be released on Wednesday. XAU/USD could lose altitude if the Dollar Index jumps towards new highs.

Still, it's premature to talk about a strong drop in Gold as long as the price is located in the buyer's territory. The FOMC Meeting Minutes will be published on Wednesday as well. This is seen as a high-impact report. Gold is likely to drop if the report turns out to be hawkish.

XAU/USD in a demand zone

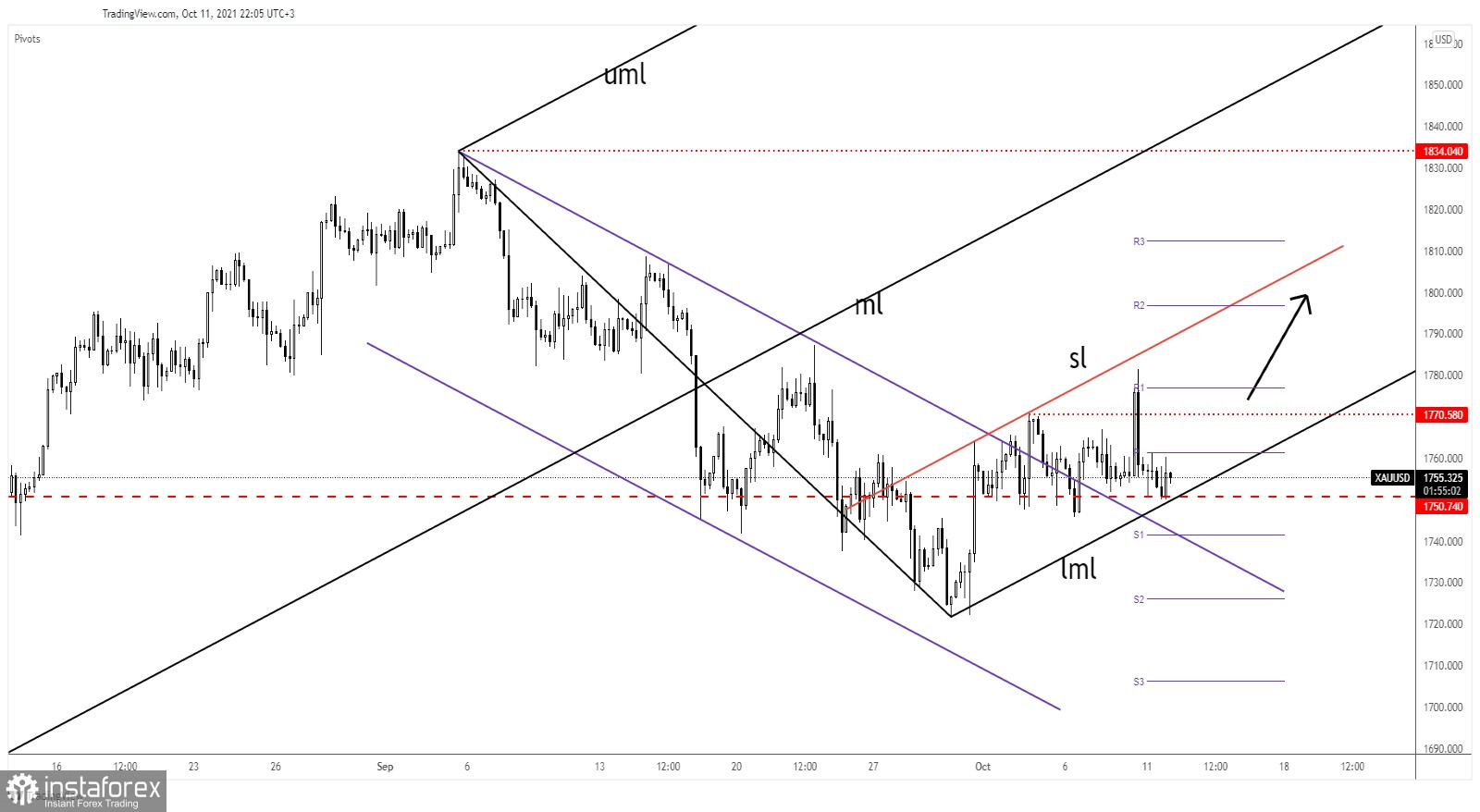

XAU/USD registered only a false breakout above 1,770.58 former high. It has climbed as high as 1,781.40 where it has found resistance. The level of 1,750.74 stands as static support, while the Ascending Pitchfork's lower median line (lml) represents dynamic support.

As long as it stays above these downside obstacles, XAU/USD could still increase. After escaping from the down channel, the price of Gold was somehow expected to grow, but its failure to stabilize above 1,770 or to reach the sliding line (sl) signaled that XAU/USD is vulnerable.

Gold forecast

XAU/USD could jump higher if it prints a bullish pattern at 1,750 or on the lower median line (lml). A false break with great separation, a pin bar, or a major bullish engulfing could signal a new upside momentum.

Making a valid breakdown below the immediate support levels could invalidate potential growth and could bring new short opportunities.