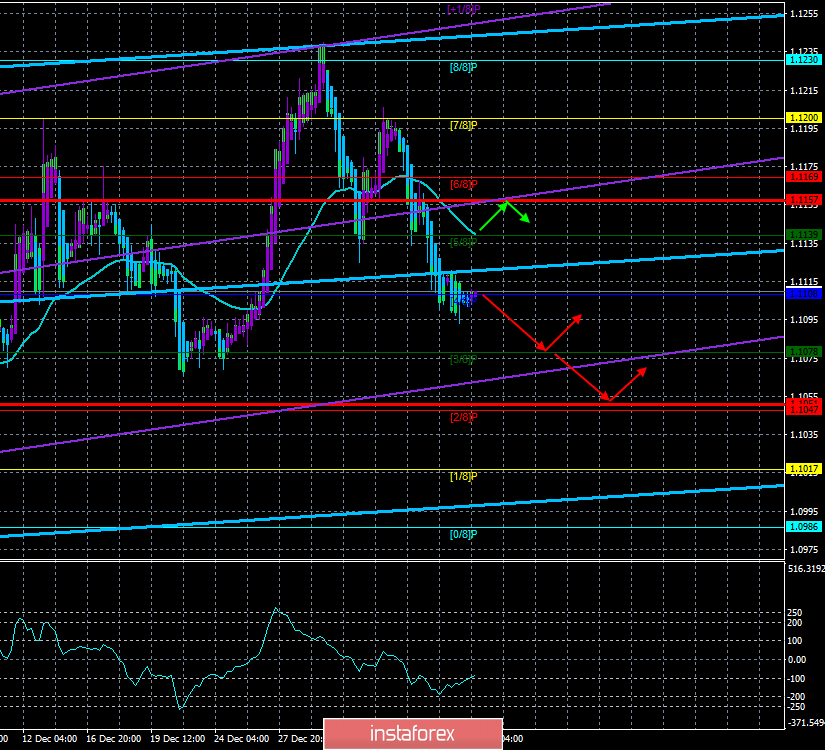

4-hour timeframe

Technical data:

The upper channel of linear regression: direction - up.

The lower channel of linear regression: direction - up.

The moving average (20; smoothed) - down.

CCI: -83.3290

For the EUR/USD currency pair, the last trading day of the week begins with the continuation of the downward movement. The euro-dollar pair has settled below the Murray level of "4/8", which gives it an excellent opportunity to continue moving down. However, we still tend to believe that on Friday, January 10, an upward correction will begin. The nature of the current movement implies quite strong impulses "on the trend", followed by quite strong corrections. The downward momentum was already there, and it is quite large. And on Fridays, traders often close positions on the eve of the weekend. Thus, today we are waiting for the pair to turn up.

The fundamental background during the last trading day of the week will not be extensive, but it is very important. All the macroeconomic data will come from overseas today. And of course, the most important indicator is NonFarm Payrolls for December. Recall that last month (November), the number of new jobs created outside the agricultural sector was 266,000, which is a lot. For December, the forecast is 164,000. Last month, however, a report from ADP failed, totaling just 67,000, and it was later revised in favor of an increase. In the same month, the ADP report was very strong, which suggests strong NonFarm. Thus, we believe that the real value of the indicator may exceed the forecast of 164K. If this happens, the US dollar is almost guaranteed to receive support from traders, since the indicators of the state of the labor market are among the most important in the States. In addition to NonFarm Payrolls, the US will also publish the unemployment rate (forecast - 3.5%) and the change in the average hourly wage in December (forecast +3.1% y/y and +0.3% m/m). These indicators will only increase or decrease the effect of publishing NonFarm.

Today's macroeconomic statistics from overseas will also be extremely important in terms of the overall fundamental background. We would like to remind you that in general, statistics from overseas are much stronger than from the EU. That is why in the long term, it is the US currency that continues to rise in price, and the euro is limited only by corrections. The latest data from overseas, such as the index of business activity in the manufacturing sector ISM, made little thoughtful traders. And although we are talking about only one weak indicator, still some doubts are beginning to arise among market participants. If industrial production also starts to slow down in the United States, then the rest of the macroeconomic indicators may start to fall, as we are seeing now in the eurozone. And I would like to remind you that the US government sees a strong labor market as the way to stable and strong economic growth. Thus, Nonfarm Payrolls, the ADP report and the unemployment rate are among the most important indicators. Accordingly, strong Nonfarm today will show that the American economy continues to move in the right direction, despite military conflicts, trade conflicts and political conflicts within the country.

Meanwhile, Democrats continue to fight Trump. It is difficult to say whether the Democrats are only dissatisfied with the President of the United States, whether they act only in the framework of the impeachment procedure of the President. However, yesterday, the US Congress, in which the majority belongs to the Democrats, voted for a resolution that prohibits Donald Trump to personally make military decisions on Iran. Now Trump must wait for congressional permission to launch any military action in Iran. And only in the case of military action by Iran against the United States, the president will be able to decide without the participation of Congress. As in the case of impeachment, it is unknown whether the bill will be approved by the Senate, which has a majority of Republicans.

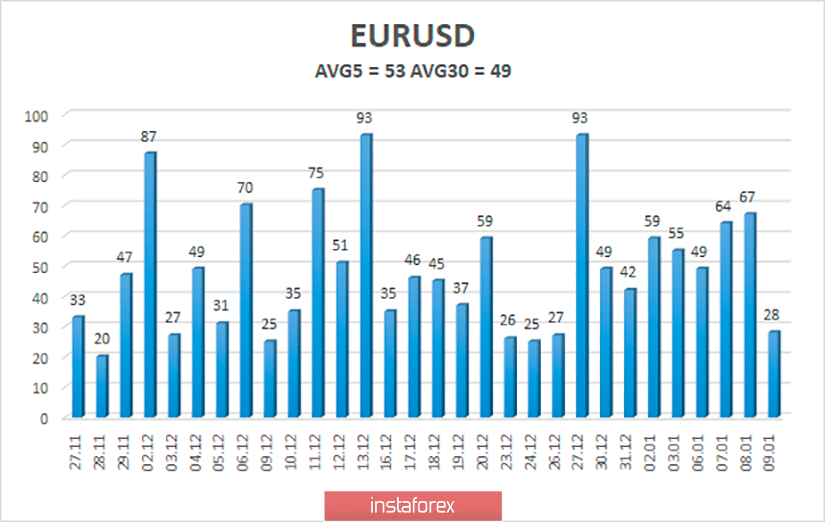

The average volatility of the euro-dollar currency pair is currently 53 points, which is the average value for the euro. Thus, we have volatility levels on January 10 - 1.1051 and 1.1157. During today's day, especially in the case of a reversal of the Heiken Ashi indicator-up, the price will tend to the upper limit of the volatility channel, but everything may change with the release of NonFarm Payrolls in the US trading session.

Nearest support levels:

S1 - 1.1108

S2 - 1.1078

S3 - 1.1047

Nearest resistance levels:

R1 - 1.1139

R2 - 1.1169

R3 - 1.1200

Trading recommendations:

The euro-dollar pair is still moving down. Thus, at the moment, traders are again recommended to remain in the sales of the euro currency with the targets of 1.1078 and 1.1051 until the Heiken Ashi indicator turns up. It is recommended to return to the pair's purchases with the goal of 1.1157 not earlier than the passing of the moving average line.

In addition to the technical picture, you should also take into account the fundamental data and the time of their release.

Explanation of the illustrations:

The upper channel of linear regression - the blue lines of the unidirectional movement.

The lower channel of linear regression - the purple lines of the unidirectional movement.

CCI - the blue line in the indicator window.

The moving average (20; smoothed) - the blue line on the price chart.

Murray levels - multi-colored horizontal stripes.

Heiken Ashi - an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.