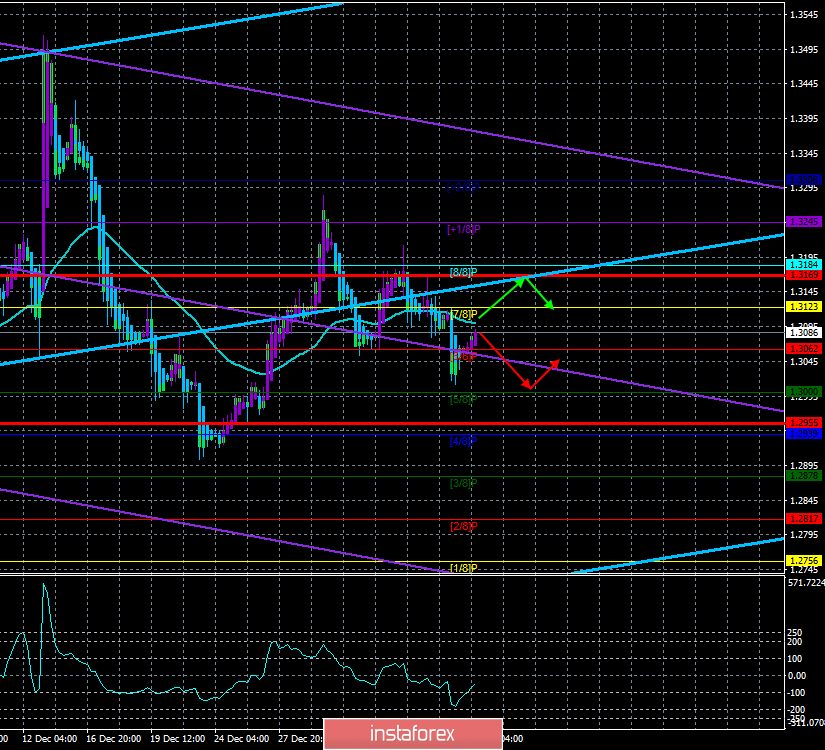

4-hour timeframe

Technical data:

The upper channel of linear regression: direction - up.

The lower channel of linear regression: direction - down.

The moving average (20; smoothed) - sideways.

CCI: -49.3722

The British pound fell with the US dollar after statements by the head of the Bank of England Mark Carney that the Central Bank may go to reduce the key rate in 2020. The fall of the British currency was not too strong, and at the moment there is already a new round of upward correction. The price has returned to the moving average line and now either rebound from it and resume moving down, or return to the flat. No important macroeconomic statistics will be published in the UK today, so market participants will have to focus only on American statistics. On Nonfarm Payrolls, unemployment, and payroll reports.

Given the fact that the pound has been slightly stuck in the area between 30 and 32 figures in recent days, we would like to once again look at what the prospects are for the British currency in the coming weeks. We have already listed repeatedly all the factors that should and will push the pound down. Yesterday, another factor added to this list - Mark Carney. First, his speech was extremely important because Carney is retiring in March 2020, so he can be as honest as possible and not be afraid of the consequences of his statements or actions. Secondly, Mark Carney finally stopped limiting himself to general phrases and bluntly stated that the UK economy continues to slow down and this is the factor that can make the British regulator still go for monetary policy easing. The head of the Bank of England, of course, also stated that members of the monetary committee are waiting for improvements in economic indicators, but due to what they are waiting for these same "improvements", he did not specify. Also, Mr. Carney allowed for a possible increase in the asset purchase program. All of these factors are potentially bearish for the British currency. We still do not know how Brexit will end for the country "according to Boris Johnson". And it can end anyway. The Prime Minister considers it his duty to implement a "divorce" with the European Union, and not too much attention is paid to the UK economy. In his comments and interviews, the Prime Minister usually touches only on political and geopolitical topics. Thus, the consequences of Brexit without a trade agreement with the European Union do not worry him too much. But they are concerned about the UK business, which over the past year has slowly started to leave Albion (those companies that have such an opportunity). Of course, moving a certain part of the business, factories and production facilities outside the UK is still a negative factor for the economy. Thus, in general, we can say that there are a lot of factors for the fall of the pound. And in the next paragraph, we will try to figure out what could trigger the strengthening of the pound.

This paragraph will be short... The strengthening of the pound can only be caused by a global improvement in the economic situation in the UK. Even if Johnson manages to conclude trade agreements with America and the European Union within one year, it will not be possible to expect improvements until 2021. Perhaps "America will help" and its macroeconomic indicators will begin to deteriorate? Or will Donald Trump return to his original idea of a "cheap" dollar and direct all efforts to devalue the monetary unit? Both options now look, if not fantastic, then hardly feasible shortly. Accordingly, in the next month or two, from our point of view, we definitely should not expect a strong strengthening of the pound. As before, we recommend in any case to correlate the fundamental analysis with the technical one and to trade down only if the technical indicators "agree".

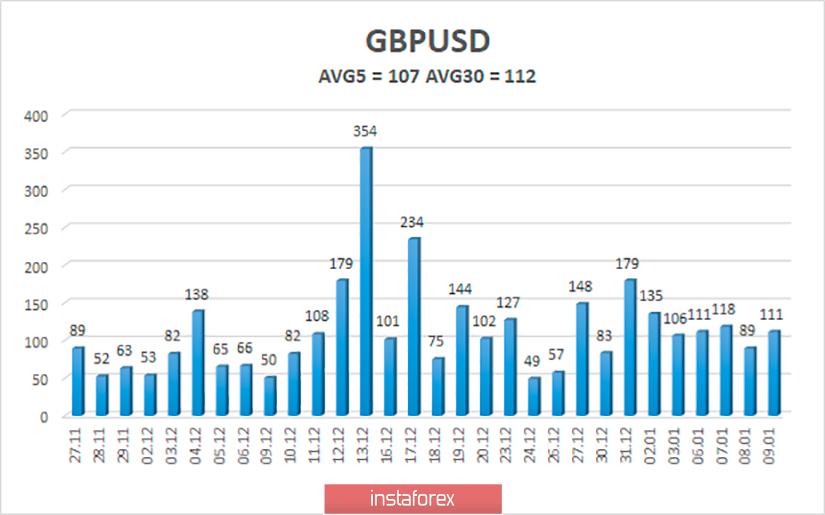

The average volatility of the pound-dollar pair over the past 5 days is 107 points, still slightly lower, but remaining at a fairly high level. According to the current level of volatility, the working channel on January 10 is limited to the levels of 1.2955 and 1.3169, however, given the current kind of flat, volatility may fall again today, and none of the channel boundaries will be worked out.

Nearest support levels:

S1 - 1.3062

S2 - 1.3000

S3 - 1.2939

Nearest resistance levels:

R1 - 1.3123

R2 - 1.3184

R3 - 1.3245

Trading recommendations:

The GBP/USD pair has returned to the moving average line again. Thus, traders are advised to buy the British pound with a target of 1.3169, if the price is fixed above the moving average, and sell the pair with a target of 1.3000, if the pair bounces off the moving average, and the Heiken Ashi indicator turns down.

In addition to the technical picture, you should also take into account the fundamental data and the time of their release.

Explanation of the illustrations:

The upper channel of linear regression - the blue lines of the unidirectional movement.

The lower channel of linear regression - the purple lines of the unidirectional movement.

CCI - the blue line in the indicator regression window.

The moving average (20; smoothed) - the blue line on the price chart.

Murray levels - multi-colored horizontal stripes.

Heiken Ashi - an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.