Hello, dear colleagues!

After the murder of Iranian General Soleimani by the Americans, it was quite logical to expect an escalation of the conflict between the US and Iran. It's been a long time coming. Against this background, protective assets began to enjoy increased demand, including the Japanese yen, which is a safe-haven currency.

Iran, as promised, responded to the Americans by firing several missiles at their bases in Iraq. All the more surprising was the reaction of the markets, which believed that the further growth of the conflict will not happen. Given the nature of the owner of the White House, there is no doubt that the US will not leave the attack of its military bases in Iraq unanswered. Nevertheless, the demand for protective assets has disappeared, and what we see on the USD/JPY charts is a clear confirmation of this.

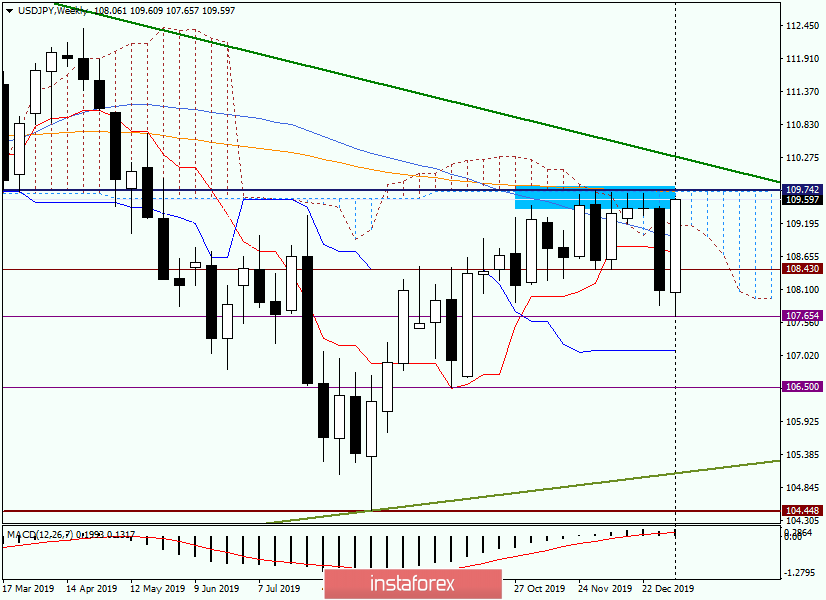

Weekly

At the moment, the "bullish absorption" candle is being formed on the weekly chart, which in fact will be such in the case of closing weekly trading above 109.48. If trading ends above 109.74 and 144 exponential moving average, there will be little doubt that the market for USD/JPY has come under the control of the bulls.

The bears are in a very difficult situation right now. They had a great opportunity to continue the decline that had started a week earlier, but something went wrong. Now, it is even difficult to imagine what sellers need to do to regain control of this tool. Yes, today investors have yet to digest the labor reports from the United States, which are scheduled for publication at 14:30 (London time). However, it is difficult to imagine the degree of negativity at which the dollar will collapse. Something extraordinary is going to happen. Judging by the weekly TF, it is premature to conclude, although there is a high probability of a reversal of the pair in the north direction. A very high probability. Let's see what will nonfarm bring.

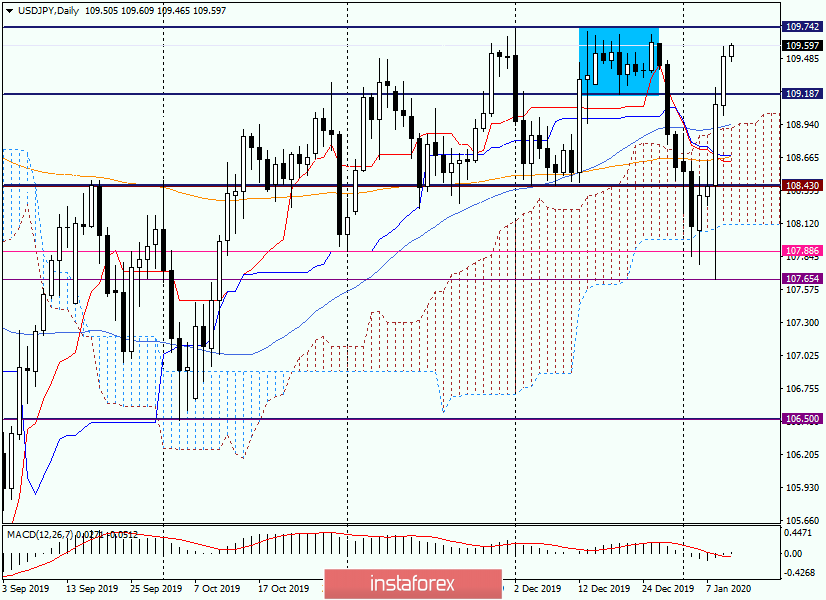

Daily

The level of 107.65 was the mark that stopped the decline and sent the pair up. And the rebound was very strong! The quote stitched up the Ichimoku indicator cloud, 144 EMA, Tenkan with Kijun and 50 simple moving average.

As you can see, at the moment, the growth does not think to stop. In this regard, it is reasonable to assume attempts to break the resistance of sellers near 109.74. If these attempts are successful, we are waiting for the rate in a strong and important price zone of 110.00-110.20. In my opinion, the further direction of the quote will be finally decided here.

From personal experience, I will suggest that such strong reversal movements just do not happen. This is usually a continuation of an existing trend or the emergence of a new one.

A false breakdown of 50 MA, Kijun, Tenkan, 144 EMA and a downward exit from the cloud also indicate the weakness of bears and the strength of bulls.

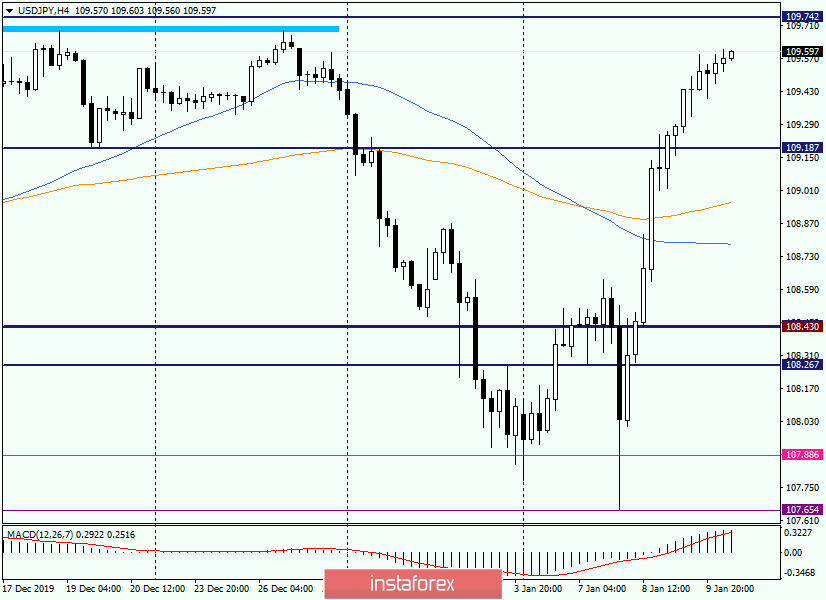

H4

As you can see, near 109.60, the upward momentum is fading. After such strong growth, it seems that the time has come to adjust the rate. You can wait for the closing of the current 4-hour candle and, in the case of its bearish nature, try to sell with the nearest goals in the area of 109.20-109.00.

Although, to be honest, I would stay on USD/JPY while out of the market. Despite the very strong bullish sentiment, the pair has already grown decently, and buying under the resistance of 109.74 is not the best idea.

Sales are against the current very strong upward momentum, so opening short positions on USD/JPY is also associated with increased risks.

Good luck!