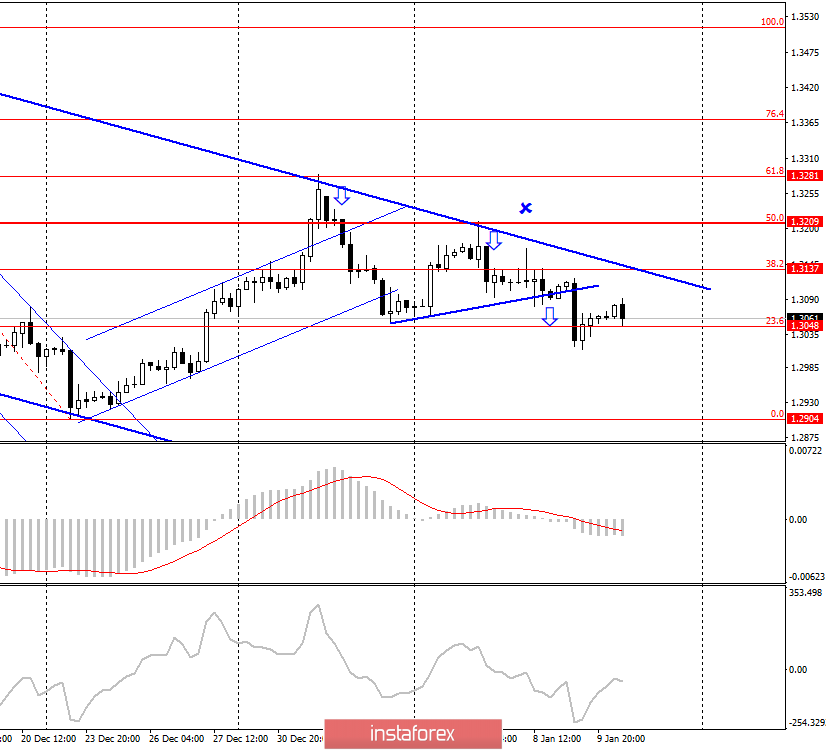

GBP/USD - 4H.

The GBP/USD pair rebounded from the corrective level of 61.8% (1.3281), then from the corrective level of 50.0% (1.3209) and the upper line of the downward trend corridor, and on January 8 - closed under the correction line. All three signals are marked with down arrows in the illustration. At the moment, the pair has again performed a reversal in favor of the euro and started the growth process, however, I expect the resumption of the process of falling in the direction of the corrective level of 0.0% (1.2904). Closing the quotes above the upper line of the downward corridor will cancel all sell signals. Today, the divergence is not observed in any indicator. The new fixing of the pound-dollar exchange rate under the Fibo level of 23.6% (1.3048) will again increase the chances of a further fall in the direction of the last corrective level on the current Fibo grid of 0.0% (1.2904).

Forecast and trading recommendations for GBP/USD:

The current trading idea is to sell the pound with a target of 1.2900, as many as three sales signals have been received. I recommend moving the Stop Loss levels outside the trend range or placing them behind the nearest corrective levels.