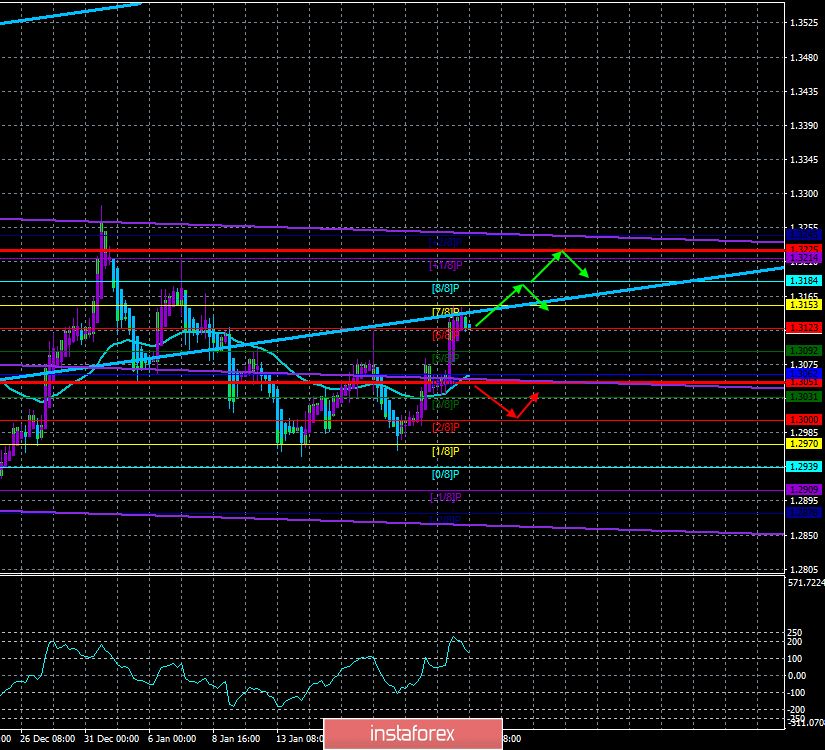

4-hour timeframe

Technical data:

The upper channel of linear regression: direction - upward.

The lower channel of linear regression: direction - sideways.

The moving average (20; smoothed) - up.

CCI: 124.8932

The GBP/USD currency pair continues its upward movement, which is not supported by any fundamental factors. Over the past day, the British pound has grown quite significantly, but no important news and statistics were available to traders. Why did the pound rise? The question remains without a clear answer. And if this is the case, then today the fall of the British currency may resume, which is generally justified by both fundamental and macroeconomic factors. Today, all traders' attention will be focused on the European Central Bank, its meeting and further comments on monetary policy. In the UK, no important macroeconomic publications are scheduled for today. Thus, traders will have to trade today using pure technology, according to the Heiken Ashi indicator.

A few days ago, we were talking about the fact that the Upper House of the British Parliament refused to approve the Brexit bill, which was previously approved by the House of Commons. The problem was the desire of the lords to make several amendments to the bill. However, today it became known that the Upper House rejected the previously announced requirements and ratified the document on the country's withdrawal from the European Union. The House of Commons reportedly blocked the Upper House's amendments, so the lords had to reject them. Now the Brexit agreement must be ratified by the European Parliament on January 29, and in Britain, the agreement must be signed by Queen Elizabeth II. Prime Minister Johnson, pleased with the long-awaited and hard-won victory, said: "Parliament has passed a bill to leave the EU, and this means that the United Kingdom will leave the Union on January 31 and we will go forward as a whole."

There is 1 week left until January 31. Next, a "transition period" will begin, within which nothing will change. The only thing is that the parties will start (or at least should start) negotiations on a trade agreement, as well as on various aspects of co-existence after December 31, 2020. However, all these events will be much later. Throughout 2020, we will still have plenty of chances to enjoy the ongoing Brexit epic. Now, macroeconomic statistics are still more important. Tomorrow in the UK, preliminary values of business activity indices in the services and manufacturing sectors will be published, and, according to experts, these indicators may increase compared to the previous month. The most important thing is that the index of business activity in the manufacturing sector can significantly increase, which causes serious worries not only in Britain but also in all EU countries and even in the States. Today, traders will have to pay more attention to technical factors, as there is nothing else to pay attention to today. Thus, a downward reversal of the Heiken Ashi indicator will indicate a correction round against the upward trend. The absence of a reversal is a continuation of an unjustified upward movement.

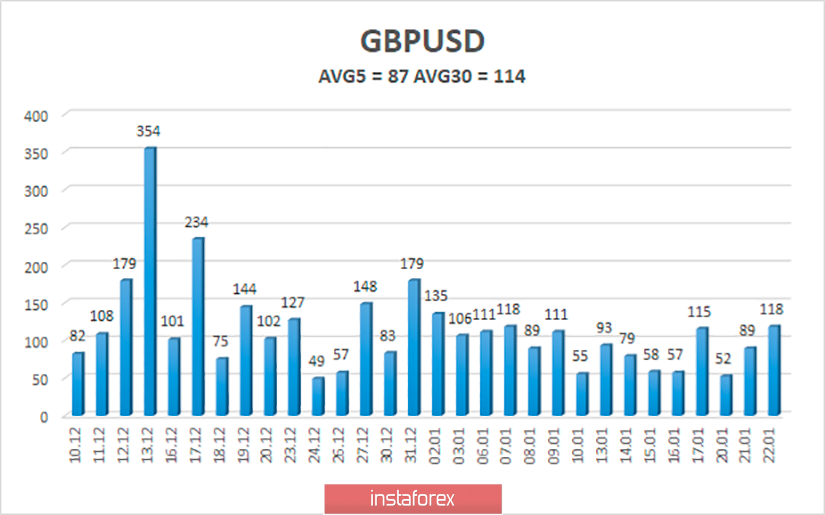

The average volatility of the pound-dollar pair over the past 5 days is 87 points. According to the current volatility level, the working channel as of January 23 is limited to the levels of 1.3051 and 1.3225. Judging by the general trend, the pair will aim for the upper border of the channel, however, it is unlikely that today we will see a strong strengthening of the pound for the second day in a row.

Nearest support levels:

S1 - 1.3123

S2 - 1.3092

S3 - 1.3062

Nearest resistance levels:

R1 - 1.3153

R2 - 1.3184

R3 - 1.3214

Trading recommendations:

The GBP/USD pair started an upward movement. Thus, traders are now advised to consider buying the pound with targets of 1.3184 and 1.3214, keeping in mind the lack of fundamental support. It will be possible to sell the British currency after the pair's reverse consolidation below the moving average line with the goals of 1.3000 and 1.2970.

In addition to the technical picture, you should also take into account the fundamental data and the time of their release.

Explanation of the illustrations:

The upper channel of linear regression - the blue lines of the unidirectional movement.

The lower channel of linear regression - the purple lines of the unidirectional movement.

CCI - the blue line in the indicator regression window.

The moving average (20; smoothed) - the blue line on the price chart.

Murray levels - multi-colored horizontal stripes.

Heiken Ashi - an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.