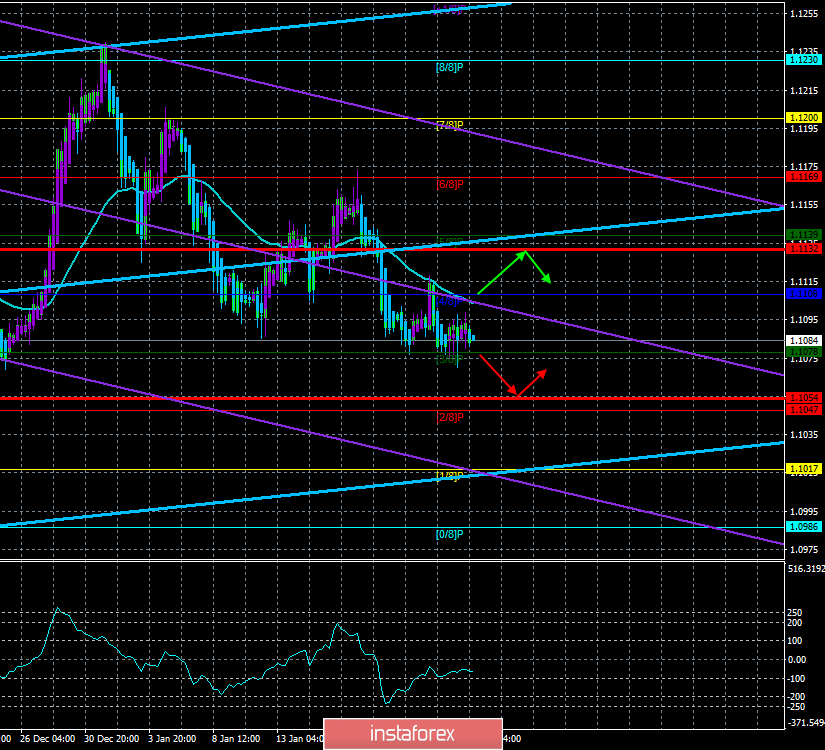

4-hour timeframe

Technical data:

The upper channel of linear regression: direction - upward.

The lower channel of linear regression: direction - downward.

The moving average (20; smoothed) - down.

CCI: -65.0248

Today, January 23, the EUR/USD currency pair begins with a sideways movement, which was observed throughout yesterday. The bulls remain extremely weak, and the fundamental background is in favor of the US dollar. In recent days, there have been few macroeconomic publications in the United States and the European Union, however, the results of the next meeting of the European Central Bank will be summed up today. There will also be an ECB press conference on monetary policy, and it seems that traders are waiting for these events, not wanting to enter the market ahead of time. We have already said that it is unlikely that members of the monetary committee will decide to lower key rates at the January meeting. Thus, the main intrigue lies in the "post-match" comments of representatives of the ECB and its head Christine Lagarde. Ms. Lagarde has been announcing "major structural changes" to the ECB since her first weeks in office, and now it is time to report to the markets. We would also like to note that Christine Lagarde's position on the bid itself is also very important. According to many experts, there is no question of lowering it now, because, after the September "easing", the economy began to show signs of recovery. We believe that these signs are extremely "ghostly", and the EU economy still requires significant stimulus, because all the factors that negatively affect it have not gone away and they may be joined by another such factor - the EU-US trade war. Thus, it is also necessary to find out what Christine Lagarde thinks about the key rates. Well, the reaction of market participants and the movement of the currency pair in the next few days will depend on her comments. If Lagarde's rhetoric boils down to "work is underway, details will be covered later, the economy is stable, there are some signs of recovery, and downside risks are easing," then there may be no reaction. We do not consider the option of "hawkish" rhetoric at all since it is unlikely. The option with "dovish" rhetoric is more likely. In this case, Lagarde will touch on the topic of a possible trade war with the United States and its consequences for the European economy, and in this case, the euro currency may fall under a new wave of sales from traders.

Meanwhile, Donald Trump has once again threatened the European Union with the introduction of 25% duties on cars if Brussels fails to agree on a trade deal with Washington. Trump believes that the agreement should be beneficial to America in the first place. Why is that? The US President answered this question in his style: "They have used our country to their advantage for many years." Now, Trump is acting as a fair leader who wants to conduct fair trade with the European Union and China, but not according to market rules. And although according to many experts, negotiations between the EU and the States are underway, it is still unknown when they will end. Trump likes to introduce duties first, and then negotiate so that the opposing party hurries to sign a trade agreement and does not take time to count on Trump's defeat in the presidential election in November 2020. Thus, the probability of introducing a duty on automotive products of the European Union is very high.

Well, the euro currency is still prone to falling, since we still can't list any factors that could support it in the medium term. Thus, the euro can only be counted on if it needs to be adjusted.

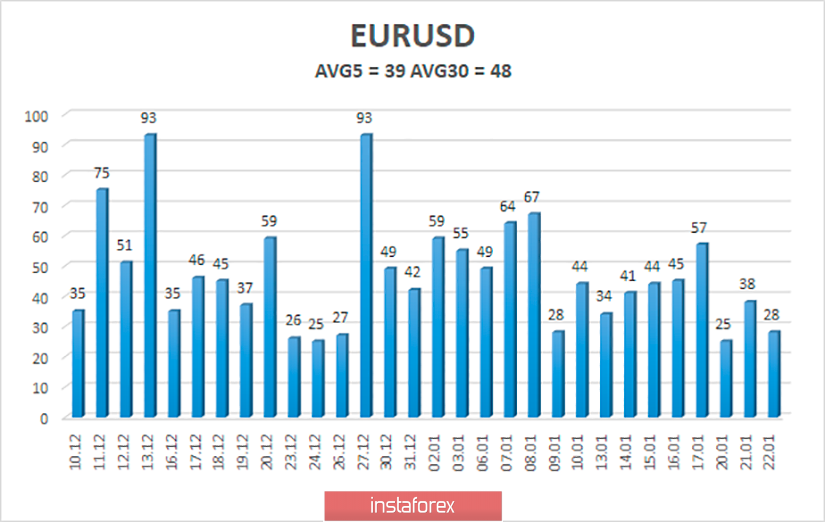

The average volatility of the euro-dollar currency pair is currently 39 points and is declining again. Thus, we have volatility levels of 1.1054 and 1.1132 as of January 23. A reversal of the Heiken Ashi indicator to the top will indicate a new round of corrective movement. Also, to continue moving down, the euro-dollar pair needs to overcome the Murray level of "3/8" - 1.1078.

Nearest support levels:

S1 - 1.1078

S2 - 1.1047

S3 - 1.1017

Nearest resistance levels:

R1 - 1.1139

R2 - 1.1169

R3 - 1.120

Trading recommendations:

The euro-dollar pair resumed its downward movement. Thus, sales of the European currency with the goal of 1.1054 (1.1047) are relevant now, if the bears manage to overcome the level of 1.1078, otherwise – a new round of correction. It is recommended to return to buying the EUR/USD pair with the goal of 1.1132 not before fixing the price above the moving average line.

In addition to the technical picture, you should also take into account the fundamental data and the time of their release.

Explanation of the illustrations:

The upper channel of linear regression - the blue lines of the unidirectional movement.

The lower channel of linear regression - the purple lines of the unidirectional movement.

CCI - the blue line in the indicator window.

The moving average (20; smoothed) - the blue line on the price chart.

Murray levels - multi-colored horizontal stripes.

Heiken Ashi - an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.