The threat of the spread of the new coronavirus outside of China has triggered a full-blown panic wave in Asian financial markets, and there is no doubt that this panic will spread all over the world. As of 6:00 Universal time, the Shanghai Composite is losing 3%, Nikkei 225 0.98%, while stock exchanges in Australia, New Zealand, and South Korea are in the red zone. Moreover, there is a sharp demand for bonds, it began on Wednesday evening, when the yield on bonds of Canada and the USA went down, as well as oil which declined to a 2-month low.

In the conditions of total growth in demand for protective assets, you can not expect a resumption of demand for commodity currencies, the Japanese yen will be the favorite of the day, and partly the US dollar. Just as Gavrila Princip's shot in August 2014 which served as a formal reason, but not the reason for the start of world war 1, so the threat of a new virus spreading is only an excuse, but not the reason for the upcoming collapse of global financial markets, which is becoming more difficult to contain.

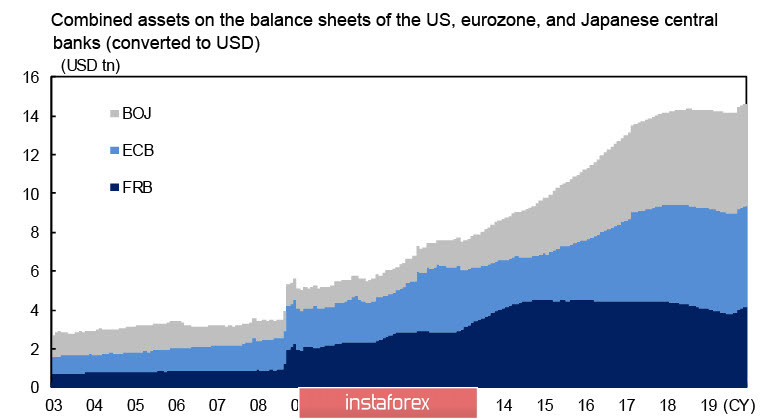

The volume of assets on the balance sheets of the Bank of Japan, the ECB and the Fed resumed growth. The Fed claims that a $ 60 billion bond repurchase program every month is not QE at all, but if not QE, then what?

Flooding the markets with cheap money is inevitable, which stimulates market participants to invest in risky assets. Mizuho Bank believes that the expansion of balance sheets, combined with growing optimism about the global economy, will help stock markets rise to new record levels, but what happens if the expansion of balance sheets occurs along with panic? What tools do central banks have to keep the situation under control, even if the apparent easing of monetary policy does not produce the necessary result?

At the moment, stability in the marketst is maintained solely by the inertia of thinking, since the world's leading central banks lack mechanisms to influence the development of negative trends. That is why even minor threats form a cumulative effect that can plunge the world economy into a full-fledged crisis, the consequences of which will be more serious than in 2008/09.

EUR/USD

The ECB meeting is expected to bring no surprises. The main focus will be on the presentation of the press conference by Christine Lagarde and the official presentation of the new strategic review of the ECB's monetary policy, and attention will also be paid to whether the ECB will give any comments after signing the 1st phase of the US-China trade deal and signing the Brexit agreement. The prospects for the euro will become a little more weighty if these events are evaluated positively.

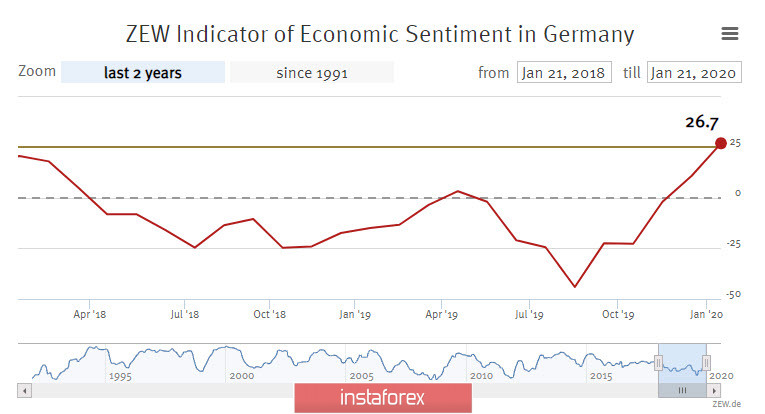

A ZEW report on economic sentiment in the eurozone published on Tuesday showed steady growth, in Germany the index rose from 10.7p to 26.7p, while in the eurozone as a whole - from 11.2 to 25.6p. Such a strong result adds to the confidence of the ECB and allows expecting on the growth of euro following the results of the day.

EUR/USD declined to the support zone of the short-term trend of 1.1060 / 80, and taking into account fundamental factors, buying at current levels with a target of 1.1178 and further 1.1240 looks promising, but such an outcome is possible only if the panic goes down. If the demand for protective assets intensifies, then it is quite possible to move to 1.0979 amid the risk aversion.

GBP/USD

The pound is held in the upward channel as confidence increases that the Bank of England will refrain from lowering the rate at a meeting on January 30. There are several reasons, and they are more political than fundamental - Brexit will happen the day after the meeting, Friday's PMI is expected to be high, which will reduce the probability of voting to reduce the rate of two vacillating Cabinet members. Meanwhile, the labor market report turned out to be slightly better than the forecast, and the CBI reported an improvement situation with industrial orders.

If the PMI in the labor market is above 52p, then the pound has a chance to go higher to 1.3265, if not, then the trade will go in the current range with a lower border of 1.3080. In the long run, the pound is still weak; possible growth in the coming days is due solely to short-term factors.