The euro managed to hold on and stop the wave of sell-offs that was formed last Thursday, after the European Central Bank made statements regarding interest rates and the future of monetary policy. The improvement in the Eurozone's manufacturing sector at the beginning of this year, although not as significant, is already good news for investors.

The data that came out last Friday indicated that the decline in the Eurozone's manufacturing sector slowed as compared to December, and the German services sector will continue to compensate for job cuts in the manufacturing sector.

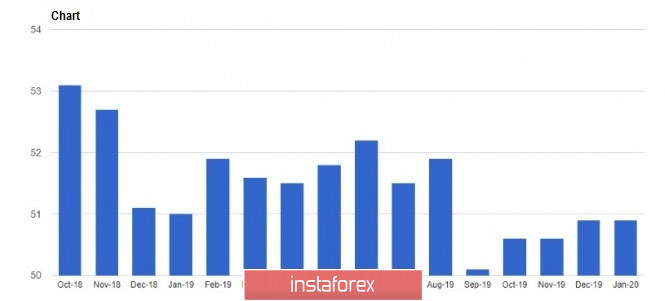

In France, the preliminary index of supply managers for the manufacturing sector rose to the level of 51.0 points in January, against 50.4 points in December last year. It had a forecasted growth of 50.6 points. Meanwhile, the preliminary purchasing managers' index (PMI) for France's services sector fell slightly to 51.7 points in January, as compared to its 52.4 points in December.

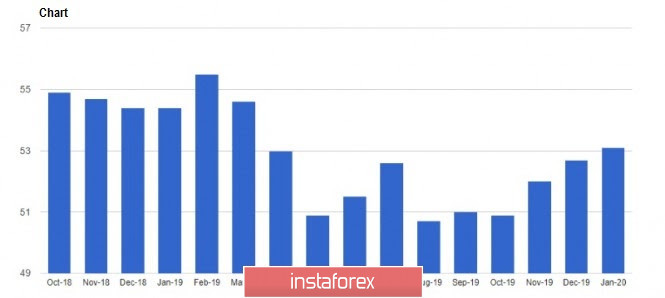

As I noted above, the weakness of the German manufacturing sector is gradually being offset by good activity in the service sector, even though many experts previously feared that production problems would spread to this sector. According to the Markit report, the preliminary PMI for Germany's manufacturing sector rose slightly to 45.2 points in January, as compared to 43.7 points in December. It was forecasted to be at 44.2 points. On the other hand, Germany's service sector remained above 50 points, indicating its growth. The report says that the PMI rose to 54.2 points in January, as compared to 52.9 points in December. It had a forecasted growth of 53.0 points.

Against this background, the overall indicator for the Eurozone has also grown. Although it is not necessary to talk about a more significant economic recovery at the beginning of this year, the first signs of a return of activity may force major players to gradually review their portfolios. According to the data, the preliminary PMI for the Eurozone's manufacturing sector rose to 47.8 points in January, gradually approaching the level of 50 points, whereas in December, this indicator is at the level of 46.3 points. Meanwhile, the service sector remained at a fairly high level, where the index was at 52.2 points in January, as compared to 52.8 points in December.

US 'business activity also showed growth in early 2020. According to preliminary data from HIS Markit, the US composite PMI rose to 53.1 points in January 2020, from its 52.7 points in December. The same as in the Euro area, the main increase in activity was related to the services sector. Meanwhile, the PMI for the manufacturing sector, however, fell to 51.7 points in January, from its 52.4 points a month earlier.

Problems in the manufacturing sector are directly related to low production orders and reduced exports due to the trade wars. Low rates of global economic growth can also be put on par with these problems.

The report of the European Central Bank on Friday regarding GDP and inflation is another confirmation of the weak Eurozone economy. Analysts forecasted real GDP growth in the Eurozone at 1.1% in 2020, 1.2% in 2021 and 1.4% in 2022. On the other hand, inflation in the Eurozone is expected to be at 1.2% in 2020, against a target of around 2.0% and 1.4% in 2021.

As for the technical picture of the EUR / USD pair, the prospects for the recovery of the Euro today will directly depend on the data of activity in the German business environment and on the level of 1.1040, since only the return of this range will allow buyers of risky assets to return to 1.1070 and update 1.1110. If pressure persists and there is no activity among the major players in the 1.1040 area, we can expect the bearish trend to remain in the area of the 1.1000 and 1.10960 lows.

GBP / USD

Despite a good report on the UK services sector, the major players took advantage of the moment and recorded profits, which led to a decline in the pound on Friday afternoon. Overall, the report is not as bad as expected, which leaves room for the Bank of England to maneuver with interest rates. In other words, when returning to the service sector, the English regulator will not rush to lower rates.

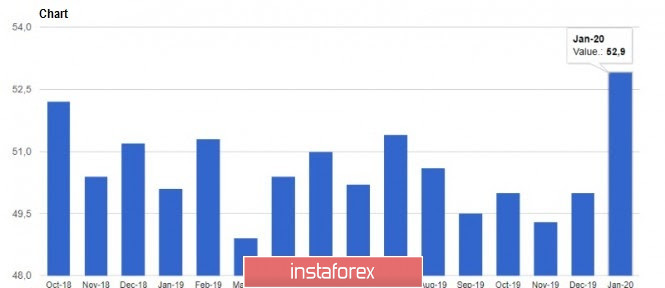

According to Markit, the preliminary PMI for the Euro zone's services sector rose to 52.9 points in January, which exceeded economists' forecasts. Let me remind you that back in December, the service sector was one step away from a 50-point reduction, and economists had expected a rise to 51.5 points. There was also a slight increase in manufacturing activity, thus, UK's preliminary manufacturing PMI was at 49.8 points in January, against 47.5 in December, with a forecast of 49.0 points.