4-hour timeframe

Technical data:

The upper channel of linear regression: direction - upward.

The lower channel of linear regression: direction - downward.

The moving average (20; smoothed) - sideways.

CCI: -9.1441

The GBP/USD currency pair once again failed to develop an upward movement. After working off Murray's level of "7/8" - 1.3153 twice, the bulls never managed to overcome this level. As a result, the downward movement resumed again, as the pair settled below the moving average line. Thus, the initiative for the pound-dollar pair is again in the hands of the bears. On Monday, January 27, there will be no important macroeconomic publications in the UK and the States. However, this week, the Bank of England will hold a meeting at which at least an increase in the number of members of the monetary committee voting "for" an immediate reduction in the key rate is expected, which in itself is already a bearish factor. And there will also be the long-awaited event that the British people have been waiting for for the past three and a half years - Brexit. It is on January 31, that is, this Friday, that the UK will officially start Brexit with a "transition period", and in 11 months, if Boris Johnson does not change his mind about postponing the completion of this period, he will officially leave the European Union. We do not believe that the beginning of a "transition period" can help the pound in any way. Of course, the markets may be flooded with a new wave of euphoria, since Britain still "did it", but what real reasons can there be for buying the British currency? The country is beginning to move away from the European Union; in terms of relations with the EU over the next 11 months, nothing will change for the British. Instead, negotiations will begin on a trade agreement, which, if signed, will enter into force on January 1, 2021. The UK will continue to lose money (about $ 70 billion a year), respectively, and macroeconomic statistics may continue to deteriorate.

From our point of view, the meeting of the Bank of England is much more important, where, according to many experts, the number of members of the monetary committee supporting monetary policy easing will increase to at least three out of nine. Thus, the Bank of England as a whole will either again take a wait-and-see position to look at the consequences of the first weeks of the "transition period", or still go for a reduction in the key rate to provide immediate assistance to the country's economy. In the first case, the fall in the pound may be restrained or absent altogether. In the second, a new wave of sales of the British currency will almost certainly take place, since a lower rate is always a bearish factor. In favor of the fact that the Bank of England will not lower the key rate, say the latest macroeconomic reports from the UK. It is worth recognizing that data on business activity in the services and manufacturing sector a few months ago, which was under the mark of 50.0, is now racing at full speed to the area above this mark. However, does this suggest that the UK economy is starting to recover? And most importantly, what could start the economic recovery? Now it looks as if the latest increase in business activity is just an accident. Like any currency, any indicator cannot be constantly reduced. Perhaps we are dealing with a banal rollback now. What is important - how the Bank of England will react to this data.

From a technical point of view, it is now reasonable to expect a resumption of the downward movement, since the moving average has been overcome. However, given the big problems for the bears on the approach to the level of 1.3000, we can assume that the pound-dollar pair will remain in a kind of flat for some time. In any case, a fall to 1.3000 is the main scenario as long as the pair is below the moving average line.

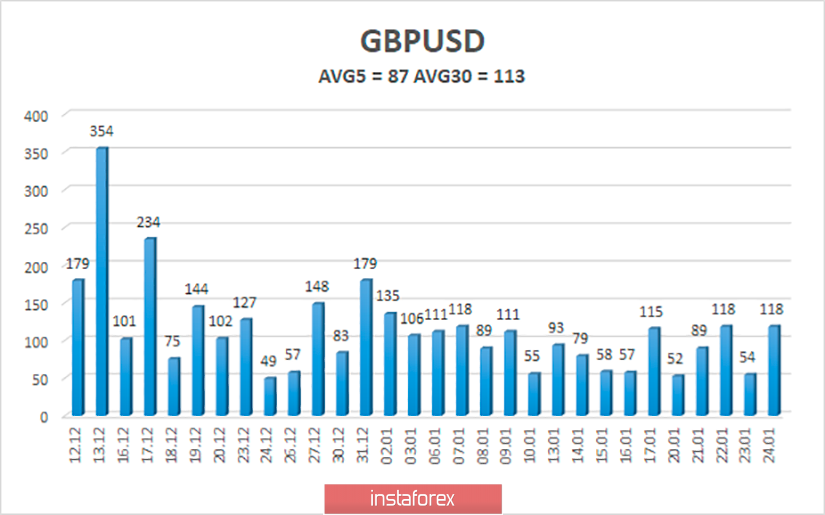

The average volatility of the pound-dollar pair over the past 5 days is 87 points. According to the current level of volatility, the working channel on January 27 is limited to the levels of 1.2984 and 1.3158. Judging by the general trend, the pair will tend to the lower border of the channel, a reversal of the Heiken Ashi indicator up may indicate a resumption of the upward movement.

Nearest support levels:

S1 - 1.3062

S2 - 1.3031

S3 - 1.3000

Nearest resistance levels:

R1 - 1.3092

R2 - 1.3123

R3 - 1.3153

Trading recommendations:

The GBP/USD pair is in an incomprehensible movement with a downward trend. Thus, traders are now encouraged to consider selling the pound with targets of 1.3000 and 1.2984. It will be possible to buy the British currency again after the pair's reverse consolidation above the moving average line with the first goals of 1.3123 and 1.3153.

In addition to the technical picture, you should also take into account the fundamental data and the time of their release.

Explanation of the illustrations:

The upper channel of linear regression - the blue lines of the unidirectional movement.

The lower channel of linear regression - the purple lines of the unidirectional movement.

CCI - the blue line in the indicator regression window.

The moving average (20; smoothed) - the blue line on the price chart.

Murray levels - multi-colored horizontal stripes.

Heiken Ashi - an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.