To open long positions on EURUSD, you need:

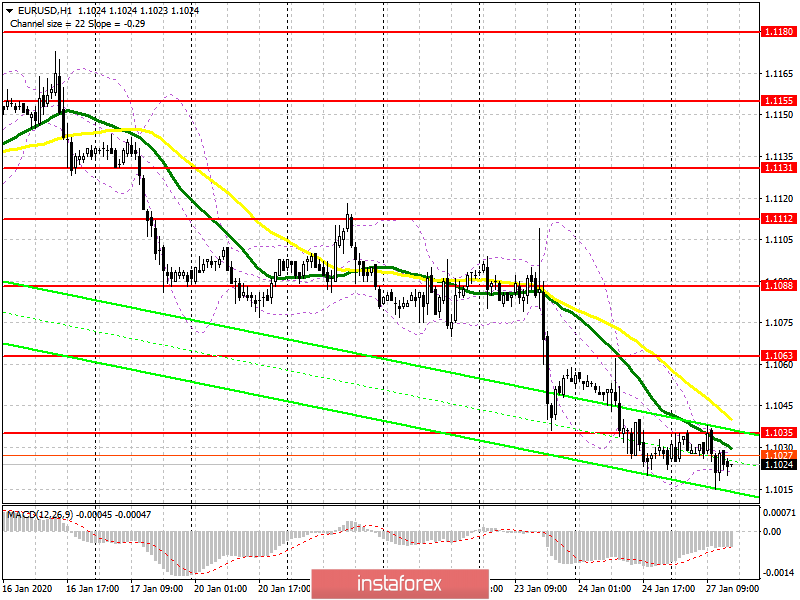

Data on the decline in the German business environment indicator, which indicates a slight pessimism among manufacturers, led to continued pressure on the euro in the first half of the day. Also, the bulls did not manage to regain the level of 1.1035, which I paid attention to in my morning review. On the other hand, the technical picture has not changed much, and buyers are still focused on the area of 1.1035. Fixing above this range will lead to an upward correction in the area of 1.1063 and 1.1088, where I recommend fixing the profits. In the scenario of EUR/USD falling in the second half of the day further along the trend, given that the report on sales in the primary housing market can support the dollar, it is best to look at long positions only after the support update 1.1004 or buy immediately on a rebound from the lows of 1.0982 and 1.0964.

To open short positions on EURUSD, you need:

The bears coped with the morning task, and the formation of a false breakout at 1.1035, which I paid attention to here, led to a further decline in the euro, but it was not possible to achieve a larger sell-off. While trading will be conducted below the resistance of 1.1035, the pressure on the euro will remain, which may lead to an update of the lows of 1.1004 and 1.0982, where I recommend fixing the profits. If the market activity in the direction of the euro's decline does not follow even after strong data on sales in the US housing market, then it is best to postpone short positions in EUR/USD until the resistance is updated at 1.1063 or sell immediately for a rebound from the maximum of 1.1088.

Indicator signals:

Moving averages

Trading is conducted just below the 30 and 50 moving averages, which keeps the chance of a decline in the euro.

Bollinger Bands

Breaking the upper limit of the indicator, which coincides with the resistance of 1.1035, will be a signal to buy the euro.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - Moving Average Convergence / Divergence) Fast EMA Period 12. Slow EMA Period 26. SMA Period 9

- Bollinger Bands (Bollinger Bands). Period 20