To open long positions on GBPUSD, you need:

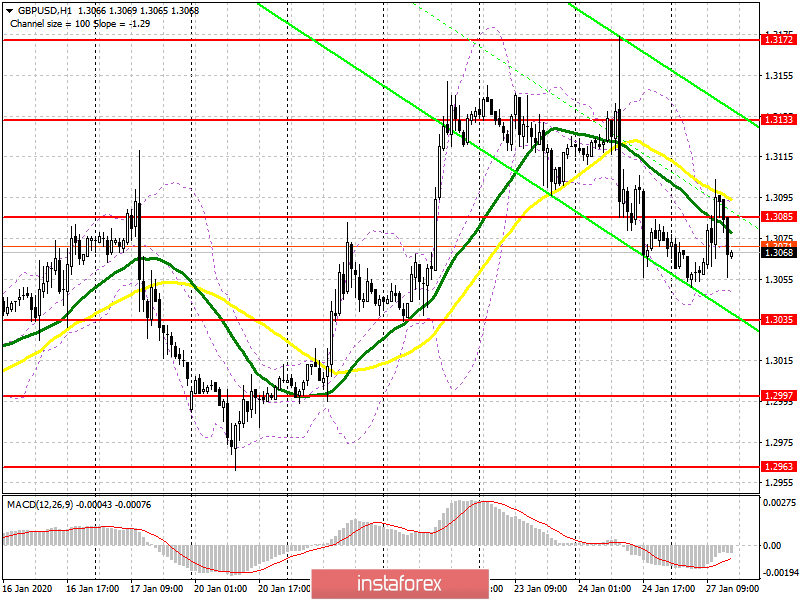

In the first half of the day, the bulls attempted to break through and consolidate above the resistance of 1.3085, but this was not enough to turn the market on its side. Problems with the breakout of the moving averages also led to a return of the price to the level of 1.3085, which remains a problem for buyers in the US session. Only a real consolidation above this range will open a direct path to the maximum of 1.3133, as well as to a more powerful resistance of 1.3172, where I recommend taking the profits. Also, in the second half of the day, the bulls will try to protect the support of 1.3035, the formation of a false breakout on which will be the first signal to open long positions in GBP/USD. I recommend buying the pound immediately for a rebound only after updating the minimum of 1.2997.

To open short positions on GBPUSD, you need:

Sellers coped with the task and did not let the pair above the resistance of 1.3085, although they allowed collecting the stops of speculative players. While trading is below the range of 1.3085, the pressure on the pound will be present, and the nearest target of the bears will be at least 1.3035, where I recommend fixing the profits. Only a break below this range will lead to the continuation of the downward trend, which, quite likely, could be formed from last Friday's high in the area of 1.3172. If the sellers of the pound miss the resistance of 1.3085 again, then it is best to consider new short positions only after updating the maximum of 1.3133 and also sell GBP/USD immediately on a rebound from the resistance of 1.3172.

Indicator signals:

Moving averages

Trading is conducted around 30 and 50 daily averages, which indicates some market uncertainty in the short term.

Bollinger Bands

Breaking the lower border of the indicator around 1.3050 will increase the pressure on the pair.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - Moving Average Convergence / Divergence). Fast EMA Period 12. Slow EMA Period 26. SMA Period 9.

- Bollinger Bands (Bollinger Bands). Period 20.