4-hour timeframe

Technical data:

The upper channel of linear regression: direction - upward.

The lower channel of linear regression: direction - downward.

The moving average (20; smoothed) - down.

CCI: -54.6345

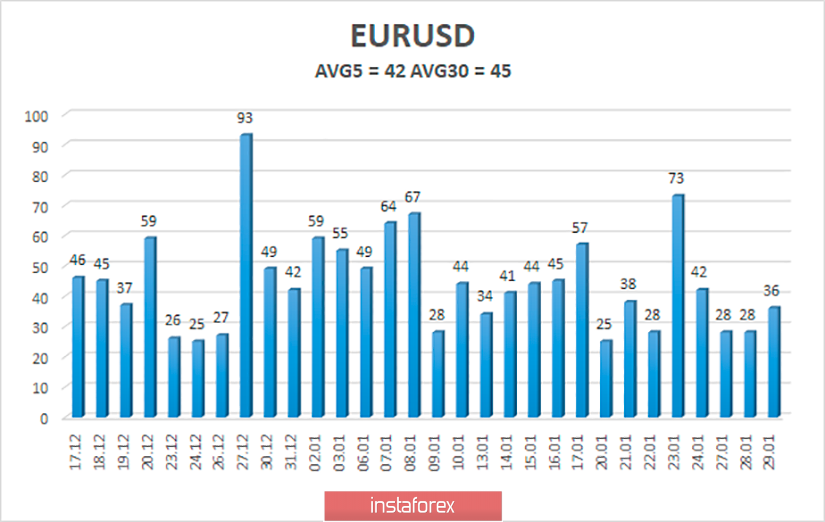

Today, January 30, the EUR/USD currency pair starts with a weak upward correction. Quotes of the euro-dollar pair returned to the Murray level of "1/8" - 1.1017. However, the downward trend is maintained, so the downward movement can resume at almost any time. The volatility of yesterday (36 points) perfectly characterizes the evening meeting of the Fed and its summing up. With the volatility of 36 points per day, it is safe to say that the regulator has not changed the key rate, and has not reported anything important or interesting to the markets. Traders simply had nothing to react to. Thus, the hopes that the Fed will stir up the market a little were not justified.

Let's look at the results of the Fed meeting in more detail. Although there was no reaction from market participants, this is still a very important event that happens only 8 times a year. The key rate remained unchanged - 1.75%. In principle, this is the decision that experts, analysts, and traders were waiting for. Much more attention was paid to the accompanying statement and press conference by Jerome Powell. And the question that interested me most was: "When will the Fed stop buying assets from the open market without calling them a QE program?". Starting October 15, 2019, the Fed began buying $60 billion in short-term securities each month. Jerome Powell and other Fed officials said that the purchase of securities should not be called a QE program since these operations serve completely different purposes. Experts and markets did not always believe Powell. However, this question could not be answered. The Fed's communique says only that the labor market remains strong, the growth rate of economic activity is moderate, and unemployment is low. Consumer spending also came under the "moderate" category, although it was "strong" a month earlier. As for inflation, the Fed is again of the opinion that in the long run, the consumer price index remains "slightly below 2%". Long-term inflation expectations have not changed much, as have the risks that cause inflationary pressures. The Fed's monetary committee also believes that the current parameters of monetary policy are sufficient to maintain sustainable economic growth and a strong labor market. "When determining the timing and size of future adjustments to the target range of interest rates on federal loan funds, the Fed will evaluate both the already implemented and expected economic data in comparison with the targets: maximum employment and inflation at the level of 2%," the communique says.

What does this all mean? This means that the Fed has not shown any signs of concern about weak industrial production and falling GDP growth. Inflation in recent months has increased to 2.3% per annum, so this figure fell out of the list of "disturbing". Also, Jerome Powell made it clear that the Fed will continue to adhere to the plan to maintain current rate levels throughout 2020. The Fed will continue to buy about 60 billion worth of securities every month until at least April 2020. Thus, the general conclusions can be placed in the phrase "no changes". We wrote at the weekend that the meeting will be passable. The only thing that traders wanted to know is how long will the asset buyback program called "non-QE" continues? The answer to this question was not received.

Thursday will also be quite an interesting day in terms of macroeconomic statistics. It will start with the publication of unemployment rates and changes in the number of applications for unemployment benefits in Germany and the European Union. The EU will also publish the level of consumer confidence and several indices/indicators that reflect the mood in the economy. All of these reports can be safely classified as secondary and not expected to provoke increased volatility. In Germany, a more interesting report will also be published – inflation (preliminary value) for January. We have already said that this report itself will not have any impact on the market, however, it can be very useful when forecasting a similar indicator for the European Union as a whole. Experts' forecasts say that this figure will be 1.7% y/y, that is, it will accelerate from 1.5%. This is potentially good news for the euro currency. Interesting data will also be published in the States today. We are talking about annual GDP data for the fourth quarter (preliminary value), as well as the index of spending on personal consumption. The first indicator is extremely important and interesting since, in the last year and a half, the GDP growth rate decreased to +2.1% in the third quarter of 2019. Will the slowdown continue in the fourth?

It is quite difficult to predict where the price will move today. By and large, all traders' attention will be directed to the US GDP report. If it is much higher than the forecast (+2.1%) or, on the contrary, lower, this may provoke a sharp change in the direction of movement and its strengthening. Although we believe that today will also be weakly volatile trading without any major changes in the market. From a technical point of view, the pair is now being corrected, as indicated by the Heiken Ashi indicator. Thus, the down trade remains relevant – you only need to wait for the downward turn of this indicator, which will indicate the completion of the correction.

The average volatility of the euro-dollar currency pair is currently 42 points. However, only one day out of the last five ended with a value above 42 points. Thus, we have volatility levels of 1.0968 and 1.1051 as of January 30. A downward reversal of the Heiken Ashi indicator will indicate the resumption of a downward movement.

Nearest support levels:

S1 - 1.0986

S2 - 1.0956

S3 - 1.0925

Nearest resistance levels:

R1 - 1.1017

R2 - 1.1047

R3 - 1.1078

Trading recommendations:

The euro-dollar pair started a new round of correction. Thus, sales of the European currency with the targets of 1.0986 and 1.0982 remain relevant now, but after the Heiken Ashi indicator turns down. It is recommended to return to buying the EUR/USD pair with the target of 1.1078 not before fixing the price above the moving average line, which will change the current trend to an upward one.

In addition to the technical picture, you should also take into account the fundamental data and the time of their release.

Explanation of the illustrations:

The upper channel of linear regression - the blue lines of the unidirectional movement.

The lower channel of linear regression - the purple lines of the unidirectional movement.

CCI - the blue line in the indicator window.

The moving average (20; smoothed) - blue line on the price chart.

Murray levels - multi-colored horizontal stripes.

Heiken Ashi - an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.