4-hour timeframe

Technical data:

The upper channel of linear regression: direction - upward.

The lower channel of linear regression: direction - downward.

The moving average (20; smoothed) - down.

CCI: -76.8617

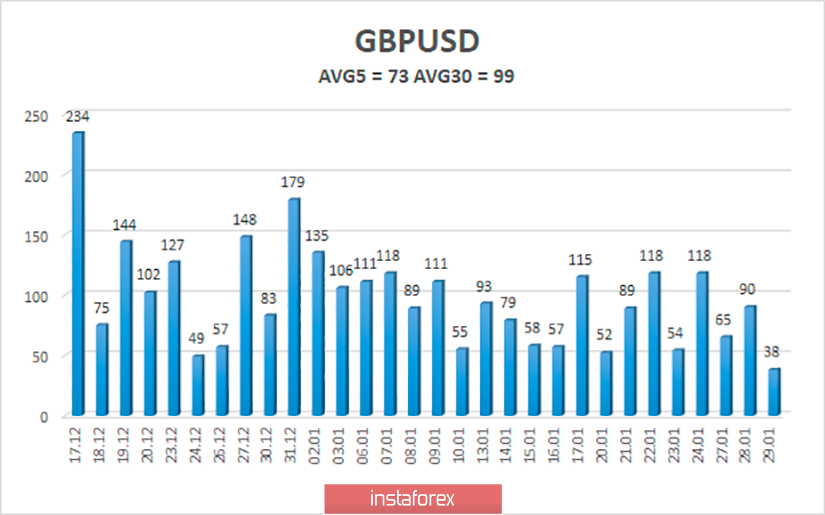

Today, January 30, the GBP/USD currency pair showed the lowest volatility over the past 30 trading days – 38 points. In principle, this review could be safely completed. The currency pair continues to remain on an indistinct downward movement and can not overcome the area of 1.3000–1.2970, which keeps the pair from further falling, which, from our point of view, is justified fundamentally and macroeconomically. Traders are either waiting for the results of the Bank of England meeting or Brexit on January 31. However, the fact remains that the quotes of the pound-dollar pair are almost immobilized, which creates obstacles for conducting active trading. The downward trend persists and a new reversal of the Heiken Ashi indicator downwards signals the resumption of the downward movement.

Meanwhile, analysts and currency market experts continue to argue among themselves about the Bank of England's key rate and its possible change at the January meeting of the regulator. Opinions do differ, as some believe that the rate will remain unchanged in January, while others believe that it will be lowered. The most interesting thing is that there are enough reasons for easing monetary policy. First, it is the continuing deterioration (over the past few months) of macroeconomic statistics. Except for the last 2 weeks, when some indicators of the state of the British economy began to "resurrect", the situation remains quite complex and hopeless, given Brexit. Second, the Bank of England, led by Mark Carney, has long been beating around the bush on rate cuts. Two members of the monetary committee voted twice in a row for a reduction, and two more members said they were ready to support a reduction in January. Thus, we already have potentially 4 "yes" votes out of 9 possible ones. You must agree that with such a preliminary voting scenario, it is very difficult to say unequivocally that the rate will not be lowered. So it turns out that the key question of the day is whether the British regulator will change the rate? If so, the British pound may head down again today. If not, the volatility and activity of traders may not change at all during Thursday. Also, most experts agree that if the rate is not lowered today, the Bank of England will hint with all its might that the regulator will use this tool to stimulate the economy at the next meeting. That is, the rhetoric from Mark Carney is expected to be "dovish" in any case. We believe that if the rate cut does not happen, then Carney's rhetoric will remain unchanged, that is, as "neutral" as possible. In any case, there are a lot of questions before today's summing up of the British Central Bank's meeting, so there may be surprises.

Apart from the Bank of England meeting, no other macroeconomic data is expected from the UK today. There will be all the same publications in the States, among which the GDP for the fourth quarter occupies a special place. However, despite a whole scattering of potentially interesting data on Thursday, we are inclined to the option that no drastic changes in the mood of traders will occur today. In any case, you need to be prepared for various "surprises".

From a technical point of view, microscopic correction is now taking place. Given that its size at the moment is about 30 points, it is even difficult to say whether this movement can be considered a correction. One way or another, the reversal of the Heiken Ashi indicator downwards signals a possible resumption of the downward movement. The trend remains downward, so the shorts remain relevant, but at the same time, the bears have serious problems on the approach to the level of 1.2970.

The average volatility of the pound-dollar pair over the past 5 days is 73 points. According to the current volatility level, the working channel as of January 30 is limited to the levels of 1.2944 and 1.3098. Judging by the general trend, the pair will again strive for the lower border of the channel, but today much will depend on the fundamental background of the pound-dollar pair.

Nearest support levels:

S1 - 1.3000

S2 - 1.2970

S3 - 1.2939

Nearest resistance levels:

R1 - 1.3031

R2 - 1.3062

R3 - 1.3092

Trading recommendations:

The GBP/USD pair is still maintaining a downward trend, however, it is correcting again. Thus, traders are now recommended to sell the pound with the targets of 1.2970 and 1.2939 after the next turn of the Heiken Ashi indicator down. It will be possible to buy the British currency after the pair's reverse consolidation above the moving average line with the first targets of 1.3092 and 1.3123.

In addition to the technical picture, you should also take into account the fundamental data and the time of their release.

Explanation of the illustrations:

The upper channel of linear regression - the blue lines of the unidirectional movement.

The lower channel of linear regression - the purple lines of the unidirectional movement.

CCI - the blue line in the indicator regression window.

The moving average (20; smoothed) - the blue line on the price chart.

Murray levels - multi-colored horizontal stripes.

Heiken Ashi - an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.