4-hour timeframe

Technical data:

The upper channel of linear regression: direction - upward.

The lower channel of linear regression: direction - downward.

The moving average (20; smoothed) - sideways.

CCI: 51.9685

Today, January 31, the EUR/USD currency pair started with an attempt to resume the downward trend. Volatility and the activity of market participants remain "at zero", although this week was full of important macroeconomic events and reports. However, traders did not consider that all the information provided is worthy of more active trading, so the euro-dollar pair continues to move very weakly. At the moment, the quotes have worked out the moving average line and could not gain a foothold above it. Thus, a rebound from this line can trigger the completion of the correction and the resumption of the downward movement. We still believe that the fundamental background remains on the side of the US currency. However, given the latest macroeconomic statistics from overseas, the situation with the euro currency may begin to level out in the coming weeks, which gives some chances for the formation of an upward trend. Especially because the bears are not able to overcome an important support area, which is expressed by the area of 1.0900-1.1000, which is located in the vicinity of the pair's two-year lows. However, in any case, to be able to talk about the chances of forming an upward trend, you need to at least overcome the moving average, which is not yet available.

We've already talked about a lot of macroeconomic data this week. A particularly large amount of information was received yesterday. However, the pair continues to trade with an average daily volatility of about 30 points, which indicates an extremely small number of active Forex market participants at this time. Today, traders will again receive a large package of information. The most significant publication will be the consumer price index in the euro area (preliminary value). According to experts, inflation in the EU will accelerate by the end of January by 1.4% compared to January 2019. This is slightly higher than a month earlier (1.3% y/y). Any acceleration in inflation for the euro currency and the eurozone is now a good factor. However, we would like to note once again that the consumer price index remains far from the ECB's target level. The probability of accelerating inflation in January is really good since inflation in Germany over the same period is also expected to increase from 1.5% y/y to 1.7% y/y. However, there may be some disappointing news from the European Union today. The second extremely important indicator to be published today - GDP for the fourth quarter (also an inconclusive value). However, experts predict a decline in GDP to +1.1%. Thus, it will again be difficult for the euro to find support from market participants. We have said in recent surveys that the US GDP is starting to be alarmed by its slowing growth rate. However, as we can see, the situation in the European Union is still worse. If the US GDP has slowed to 2.1% over the past year and a half, then the European GDP may fall to 1.1%. And this is the case in about everything. For example, European inflation may accelerate to 1.4%, while American inflation rose to 2.3% in the last month. Thus, even if there are certain chances of strengthening the euro currency, they are low and will mostly be due to another technical need to adjust.

In the second half of the day, data on personal incomes and expenditures of the American population will be published in the States. These indicators, according to experts' expectations, will add 0.3% in December, but these data alone are unlikely to cause serious movements in the market. We can say that European data will be the drivers of the market today. More precisely, it is possible since this week the euro-dollar pair could not be stirred up even with the help of the Fed meeting and US GDP data. Closer to the end of the trading day, the Chicago PMI and the University of Michigan consumer confidence index will be published.

Thus, we have a continuing downward trend, which can be maintained today if the data and the EU are weak. Otherwise, the bulls may become more active and try to overcome the moving average, which will allow us to expect the formation of an upward trend soon.

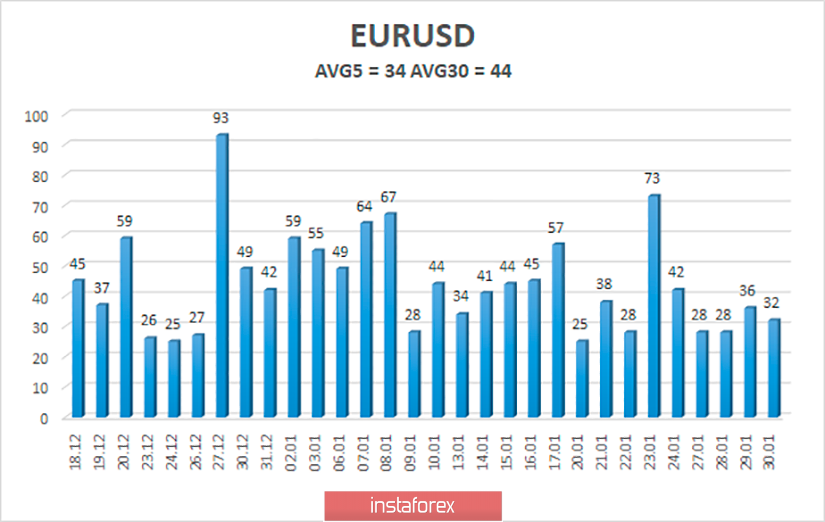

The average volatility of the euro-dollar currency pair has dropped to 34 points in recent days, despite a strong fundamental background. Thus, on the last trading day of the week, we expect approximately the same trading strength, and the volatility channel will be limited to the levels of 1.0998 and 1.1066 today.

Nearest support levels:

S1 - 1.1017

S2 - 1.0986

S3 - 1.0956

Nearest resistance levels:

R1 - 1.1047

R2 - 1.1078

R3 - 1.1108

Trading recommendations:

The euro-dollar pair may complete the correction near the moving average. Thus, sales of the European currency with the targets of 1.0998 and 1.0986 remain relevant now, but after the Heiken Ashi indicator turns down. It is recommended to return to buying the EUR/USD pair with the target of 1.1078 not before fixing the price above the moving average line, which will change the current trend to an upward one.

In addition to the technical picture, you should also take into account the fundamental data and the time of their release.

Explanation of the illustrations:

The upper channel of linear regression - the blue lines of the unidirectional movement.

The lower channel of linear regression - the purple lines of the unidirectional movement.

CCI - the blue line in the indicator window.

The moving average (20; smoothed) - the blue line on the price chart.

Murray levels - multi-colored horizontal stripes.

Heiken Ashi - an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.