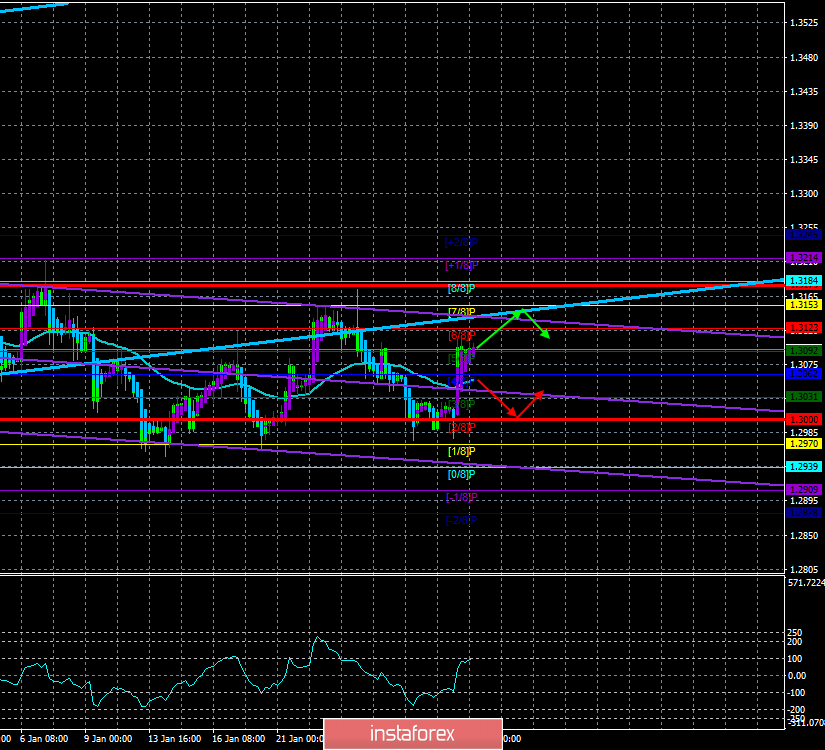

4-hour timeframe

Technical data:

The upper channel of linear regression: direction - upward.

The lower channel of linear regression: direction - downward.

The moving average (20; smoothed) - up.

CCI: 102.1827

The GBP/USD currency pair continues its upward movement on January 31, which began the day before thanks to the decisions of the Central Bank of Great Britain not to change the monetary policy parameters, as well as thanks to the vote of the members of the Monetary Committee, in which only two voted "for" the reduction in the key rate (just like at the past and the year before last). All market participants expected at least three votes in favor of the rate cut, and this discrepancy was the main disappointment for the pound-dollar bears. It is because of this that the pound received market support, as traders believed that the Bank of England did not send any signals to reduce the rate, therefore, nothing like this should be expected soon. Moreover, it is today that the UK will finally enter the so-called "transition period", which will last 11 months and will mark the last phase of the "gap" between the UK and the EU. This point may also trigger new purchases of the British pound simply based on market optimism. The pound grew in October and November based on optimism about Boris Johnson's election victory and the Brexit deal going through Parliament. With this, the British currency has increased in price very much. But from a macroeconomic point of view, things remain bad in the UK. Statistics remain weak, although some indicators have recovered in recent weeks. However, we believe that the economy cannot just start recovering out of the blue if BA has not taken any new stimulus measures if the geopolitical situation has not changed much, if the country has to lose another $ 70 billion due to Brexit in 2020, and the country's future remains extremely vague due to the high degree of uncertainty over the negotiations between London and Brussels on trade relations after the end of the "transition period". Central Bank Governor Mark Carney, for whom this meeting was the last, said that "the rate cut expected by many investors would cause inflation to rise above the target level, and the UK economy is showing signs of accelerating after Boris Johnson's election victory in December." From these words, it follows that the Bank of England expects further economic recovery without direct intervention. This time. The Bank of England is afraid of exceeding the inflation target. That's two. The Bank of England believes that the economy will continue to recover in 2020. That's three. In this situation, it is not necessary to lower the rate right now. It is better to wait a few more months and find out whether the British economy will accelerate. If not, then monetary policy can be relaxed. We have said before that Mark Carney treats the rate cut at the very least. However, as early as March 16, Andrew Bailey will take over as Chairman, who may have a very different vision of the problem. Two members of the monetary committee who regularly vote in favor of cutting the rate remain the "dove" wing of the central bank and two more can join them. Thus, it cannot be said that the BA unambiguously and unanimously took the position "not to stimulate the economy soon".

What follows from this? First, we believe that today is unfavorable for opening new positions. Today will be the official Brexit and what will be the reaction of the market to this event - is unknown. In any case, the fundamental background remains on the side of the US dollar, and the pound-dollar pair is fixed above the moving average, so we have a discrepancy between technical and fundamental factors. From a technical point of view, the pair can continue its upward movement, since the Heiken Ashi indicator continues to color the bars purple. Thus, there are no signs of correction at the moment. Also, no macroeconomic publications are planned for today in the UK, and data from overseas will not be the most important.

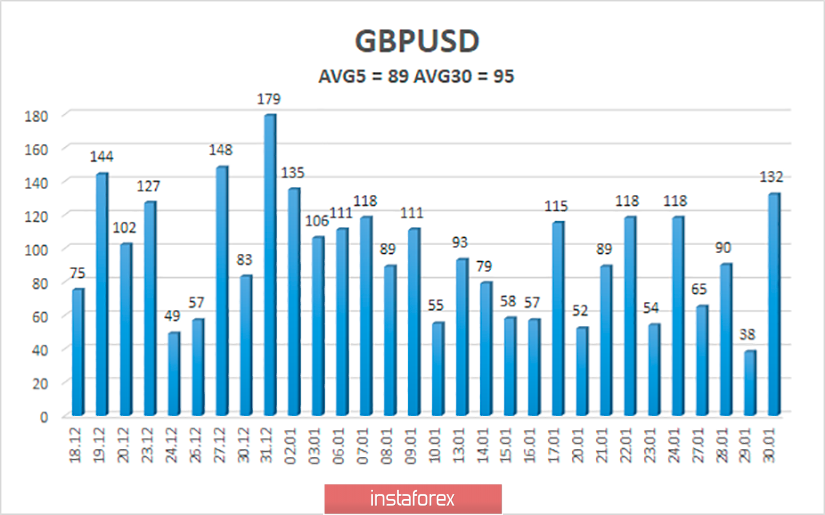

The average volatility of the pound-dollar pair has increased to 89 points over the past 5 days. According to the current volatility level, the working channel will be limited to the levels of 1.3001 and 1.3179 as of January 31. Today, the pair may continue its upward movement, however, a downward reversal of the Heiken Ashi indicator will indicate at least the beginning of a correction.

Nearest support levels:

S1 - 1.3092

S2 - 1.3031

S3 - 1.3000

Nearest resistance levels:

R1 - 1.3123

R2 - 1.3153

R3 - 1.3184

Trading recommendations:

The GBP/USD pair has started an upward movement, which may be very short-lived. Thus, traders are now advised to buy the pound with the targets of 1.3123 and 1.3153, but be extremely cautious or refrain from buying the pair at least until Monday. It is recommended to return to selling the British currency after the pair reverses below the moving average line with the first targets of 1.3031 and 1.3000.

In addition to the technical picture, you should also take into account the fundamental data and the time of their release.

Explanation of the illustrations:

The upper channel of linear regression - the blue lines of the unidirectional movement.

The lower channel of linear regression - the purple lines of the unidirectional movement.

CCI - the blue line in the indicator regression window.

The moving average (20; smoothed) - the blue line on the price chart.

Murray levels - multi-colored horizontal stripes.

Heiken Ashi - an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.