Hello, dear colleagues!

I will start with yesterday's macroeconomic data that was released to the market. Perhaps the main release of yesterday's trading day was preliminary data on US GDP for the fourth quarter. There were no surprises, the indicator coincided with the previous value and the current forecast was 2.1%. Such GDP dynamics were influenced by the decline in imports, which probably became an echo of the trade differences between the US and China.

But initial applications for unemployment benefits were slightly weaker than the forecast of 215 and reached a value of 216 thousand. The price deflator also turned out to be worse than the expectations of 1.7% and amounted to 1.6%.

As for Europe, the unemployment rate in the eurozone came out better than the forecasts of 7.5% and amounted to 7.4%. Data on consumer prices in Germany did not surprise anyone and coincided with the forecast values: 1.7% on an annual basis and minus 0.6% every month.

Now, let me remind you about the events that are expected today on the penultimate day of weekly trading.

First, France will report preliminary data on GDP for the 4th quarter, consumer spending, and the consumer price index. Second, Germany will provide data on retail sales, seasonally adjusted and non-seasonally adjusted. Third, reports on the consumer price index and preliminary GDP data for the fourth quarter will be released for the eurozone.

A whole block of macroeconomic data will come from the US today: personal incomes and expenditures of Americans, the labor cost index, the basic price index of personal consumption expenditures, the Chicago purchasing managers' index, and the consumer sentiment index from the University of Michigan. The time of the release of these statistics and forecasts can be found in the economic calendar.

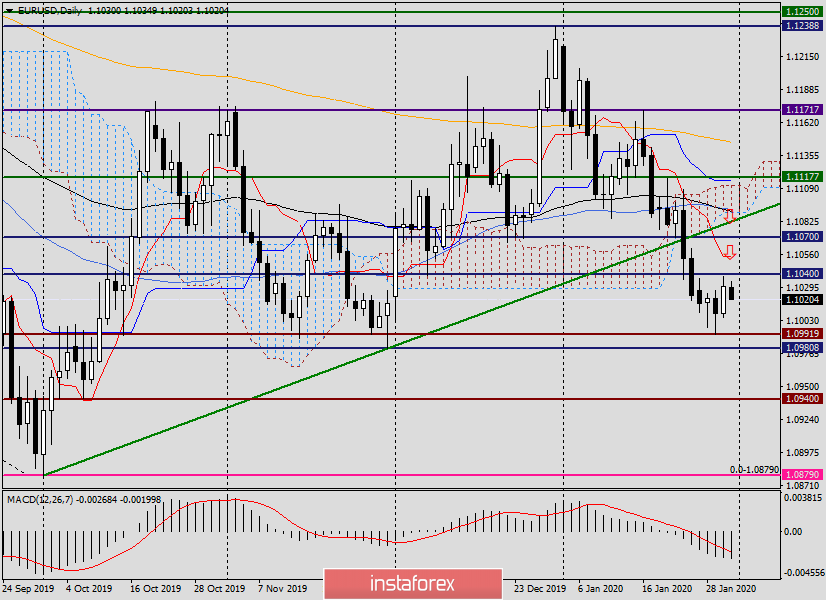

It's time to move on to the EUR/USD price charts, and let's start with the daily timeframe.

Daily

As a result of yesterday's growth, the pair strengthened and ended Thursday's session at 1.1030. In the previous review of the euro-dollar, I assumed that there is a probability of a reversal for a correction. And so it happened. However, at the moment, the pair is declining, but all the main events of today's trading day have yet to be experienced, and much in the price dynamics of the main currency pair may change.

I do not know what statistics will be released from the eurozone and the United States and what its impact will be on the dynamics of the EUR/USD exchange rate, however, judging by the technical picture, the rise of the quote may well find its continuation. In this scenario, the nearest target of the likely growth will be the mark of 1.1040, in case of overcoming which the rate will go to the Tenkan line of the Ichimoku indicator, which passes at 1.1055. I believe that much will be resolved here. If the Tenkan is broken, the road to the well-known level of 1.1070 will open. The longer-range targets of the euro are located in the area of 1.1090-1.1105.

In a downward scenario and updating yesterday's lows at 1.1006, support will be tested again at 1.0992, where the minimum trading values were shown on January 29. If this level is truly broken, then we can judge that the euro-dollar trades are controlled by bears.

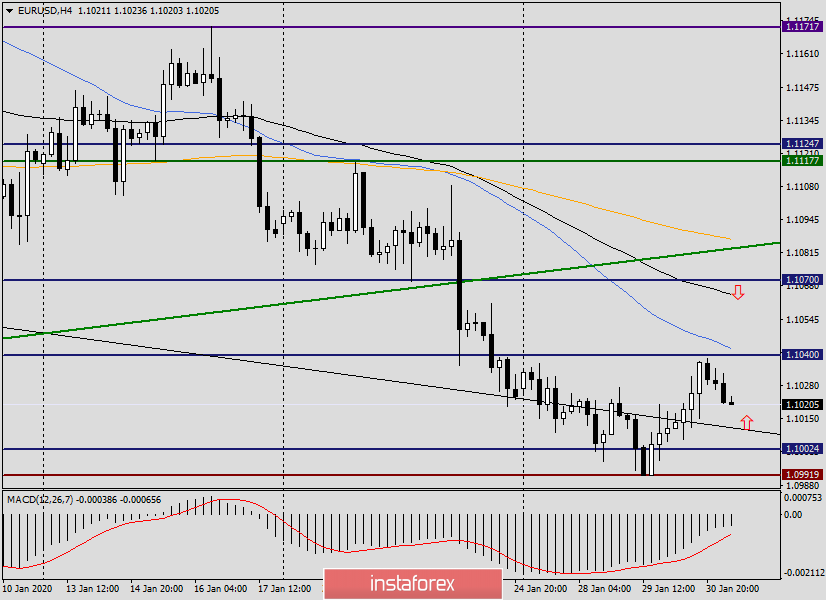

H4

In this timeframe, the idea of selling near 1.1040 and 1.1070 is confirmed by finding 50 simple and 89 exponential moving averages, respectively. And longer-distance purchases, near 1.1086, where the 200 Exhibitor is located, are also included in the purchase zone on certain daily charts.

Therefore, opening short positions on the EUR/USD pair, in my personal opinion, is the main trading idea.

However, those who want to buy a pair have their chances. Since yesterday's reversal on the correction (while the correction) may well be continued, you can try to buy the euro from the current price (1.1023) or wait for a small pullback to the area of 1.1010-1.1000, where it is appropriate to look at the purchases, especially when the characteristic patterns of Japanese candlesticks appear.

Good luck with trading!