Economic calendar (Universal time)

Today is dedicated to reporting on business activity in the manufacturing sector, therefore, among the important events of the economic calendar, one can note:

8:55 index of business activity in the manufacturing sector in Germany,

9:30 manufacturing activity index in the UK manufacturing sector,

15:00 index of business activity in the US manufacturing sector.

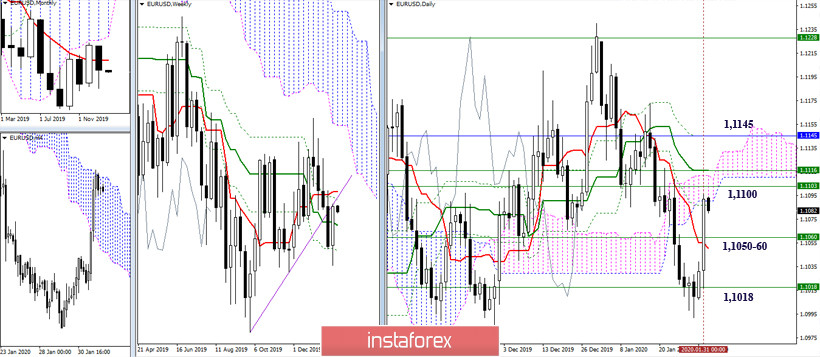

EUR / USD

The players on the upside managed to achieve excellent results towards the close of the week and month. As a result, the final support of the weekly golden cross (now 1.1018) not only kept the situation, but also served as the basis for the implementation of a large-scale high-grade rebound. The zone of the nearest most important resistances in this area is now concentrated within 1.1100-45 (daily cloud + final boundaries of the daily dead cross + weekly Tenkan + monthly Tenkan). On the other hand, reliable consolidation above can significantly affect the current distribution of forces and open up new horizons for players to increase. The inability to cope with these resistances can provoke consolidation and doubts about the ability of players to increase to maintain their positions. Today, support is located at 1.1060-50 (weekly Kijun + daily Tenkan) and 1.1018 (weekly Fibo Kijun).

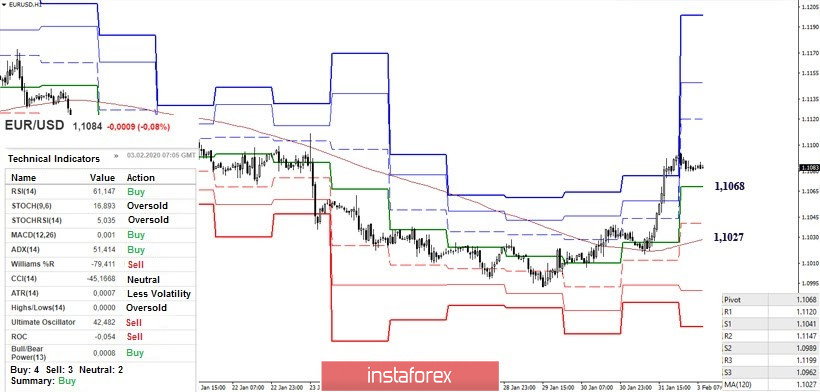

In the lower halves, the advantages are completely on the side of the players to increase. Further upward milestones within the day are the resistance of the classic Pivot levels 1.1120 - 1.1147 - 1.1199. The first important support for the downward correction is now the central Pivot level of the day (1.1068). Moreover, consolidating below will change the current balance of forces, making it the main reference point for reducing the weekly long-term trend, currently located at 1.1027.

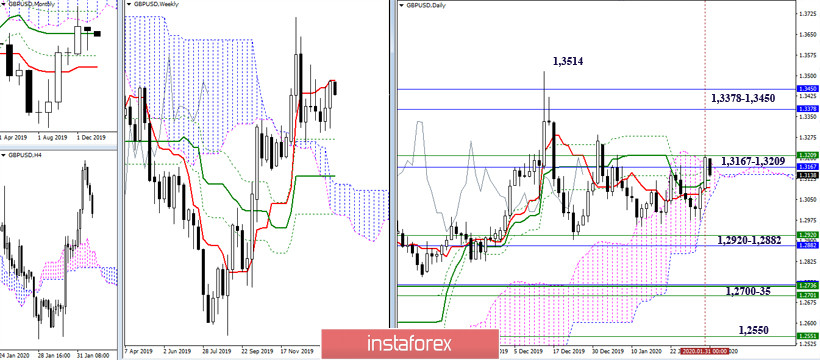

GBP / USD

The pair reached the key resistances of this area 1.3167 - 1.3209 (monthly Kijun + weekly Tenkan + daily cloud). The consolidation above will allow us to consider ways to exit the existing consolidation, while the next most important step will be the resistance zone in the region of 1.3378 - 1.3450 - 1.3514. Breaking through it will allow you to enter the monthly cloud (1.3378), eliminate the monthly dead cross (1.3450) and restore the upward trend (1.3514). If the pair is unable to leave the borders of the current consolidation, then we are waiting for another test of its lower borders (1.2920 - 1.2882) in order to further reduce the support for high halves in the region of 1.2700-35 and 1.2550.

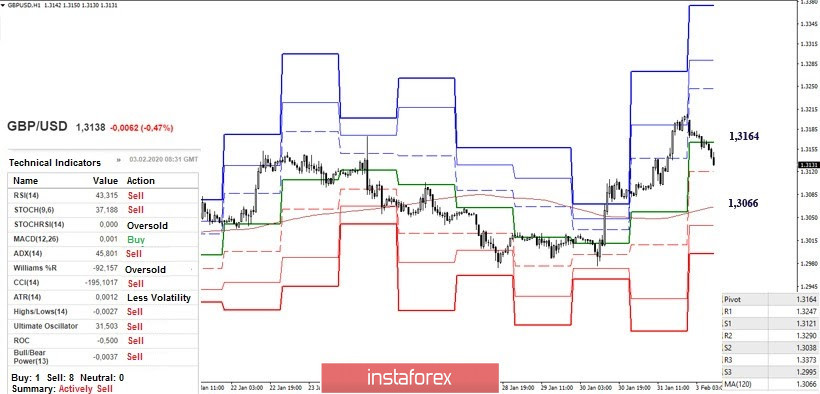

In the last days of the last week and month, the players did an excellent job and won new highs. The essence of the further development of the situation now comes down to whether the bulls can hold their positions. First you need to gain a foothold on the milestones reached. At the moment, we are witnessing the development of a decline, the correction is strengthened by the fact that the pair has already lost the central Pivot level of the day (1.3164) and is now testing intermediate support for S1 (1.3121). Further, the interests of the players to decline will be directed to the weekly long-term trend (1.3066). Consolidating below levels out most of the opponent's efforts and strengthens the prospects for the return of bearish sentiment.

Ichimoku Kinko Hyo (9.26.52), Pivot Points ( classic ), Moving Average (120)