Dear colleagues!

The end of January passed for the GBP / USD currency pair under the sign of two important events. On Thursday, January 30, the Bank of England seized, which resulted in a decision to remain the interest rate unchanged at the level of 0.75%. Considering the fact that approximately 50% of market participants expected a rate cut from the Bank of England (but this did not happen), the British currency showed a significant strengthening across the entire spectrum of the foreign exchange market.

The second important point for the British pound was the actual British withdrawal from the European Union, which occurred on January 31 at 20:00 UTC just as planned. Right now, most Britons believe that they have become independent and freed from the bonds of the European Union. However, not everyone agrees with this and Scotland is an example. Later on, we will know what lies ahead for the British economy and the British citizens themselves, as well as its national currency.

Against the backdrop of these events, last week the British currency became the growth leader against the US dollar, and the GBP / USD pair showed a 1.04% gain.

However, we will not start with the weekly results (which, in principle, have already been indicated), but with how the first month of 2020 ended for the pound / dollar pair.

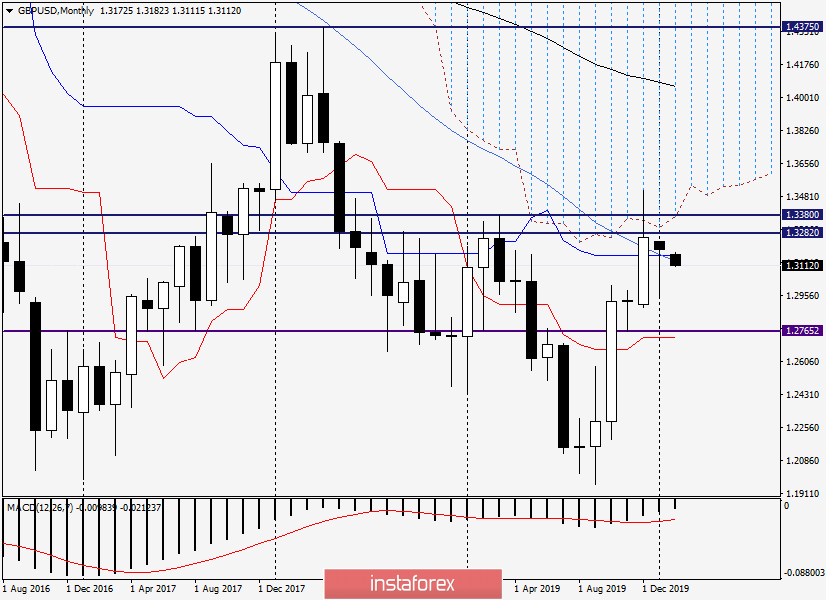

Monthly:

The pound ended the January trading against the US dollar with a slight decrease, but there is one very important point. Towards the end of last month, against the backdrop of the events described above, the British pound managed to recoup almost all losses against the American currency that had been incurred earlier.

As a result, a candle appeared on the monthly chart with an extremely long lower shadow (or tail) and the closing price of the January trading at a very significant and important mark is almost 1.3200. The actual closing price of January at the InstaForex terminal is 1.31999, which, in my opinion, is very symbolic, although it is only one point below. Moreover, the market takes into account such facts.

I will express an opinion based on my personal experience. Growth occurs after such candles with simply huge tails, as per rules. But do not forget that there are exceptions in each rule, so we'll see. In my opinion, the forecast for a month is not often accurate and correct as too many important and unforeseen events can occur during this time. Of course, in the forecast for the whole month, you can write anything you like, any of this will come true. On the other hand, you can simply write that the pair will fall or grow, and here a card already lies down. In other words, roulette.

This is all to the fact that I do not recommend using monthly forecasts for trading because it is extremely unproductive, moreover, it can lead to serious losses up to the loss of the entire deposit.

On monthly charts, one should focus only on unconditional facts and signals, such as in our case, with a long lower shadow and a very decent closing price for the January trading.

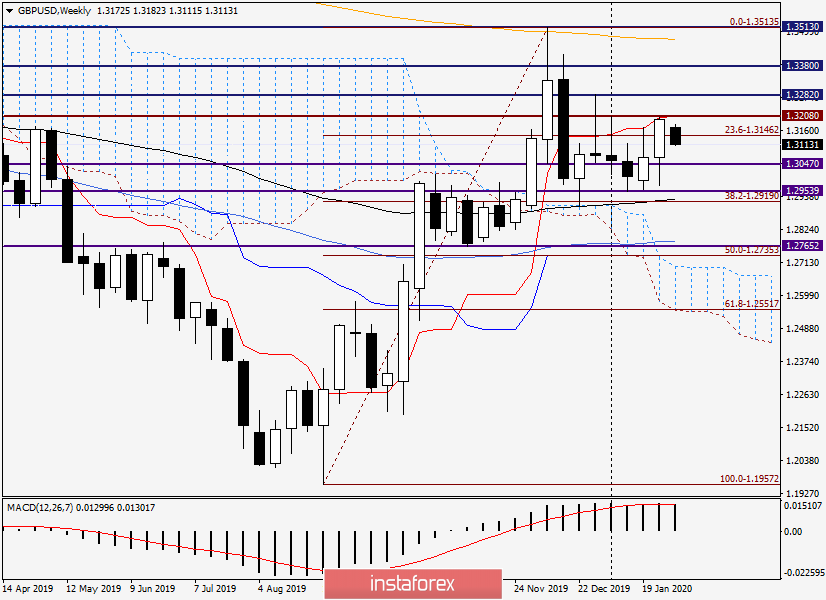

Weekly:

The weekly schedule is a completely different matter, which includes only five trading days, and here you can safely make forecasts. We will deal with these forecasts now if there will be appropriate signals and / or grounds for this.

So, the GBP / USD pair completed the last trading week with steady growth, where at the end of trading, it ran into the Tenkan line of the Ichimoku indicator.

However, current trading on the pound opened with a price gap down, and at the moment, the quotes are at the level of 1.3143. I believe that this is not critical at all and nothing terrible has happened at the moment to continue the upward trend. The mass of extremely important macroeconomic indicators that are planned for this week can change everything for several times.

If we summarize the analysis of the weekly timeframe, then to continue the upward trend, the pound bulls need to close the current week at least above the Tenkan line of the Ichimoku indicator which is located at 1.3208. I believe that this is not such a distant landmark, and the pound bulls will be able to do this. If we designate a farther reference point at the top, then this, of course, is the level of 1.3282.

The downward scenario will become real if the trading closes on February 3-7 below the last (previous) lows of 1.2974. In the case of a breakdown of strong and significant support 1.2954, the bearish management of the GBP / USD pair will become even more obvious.

In my opinion, this such are the prospects for the pair on the weekly timeframe.

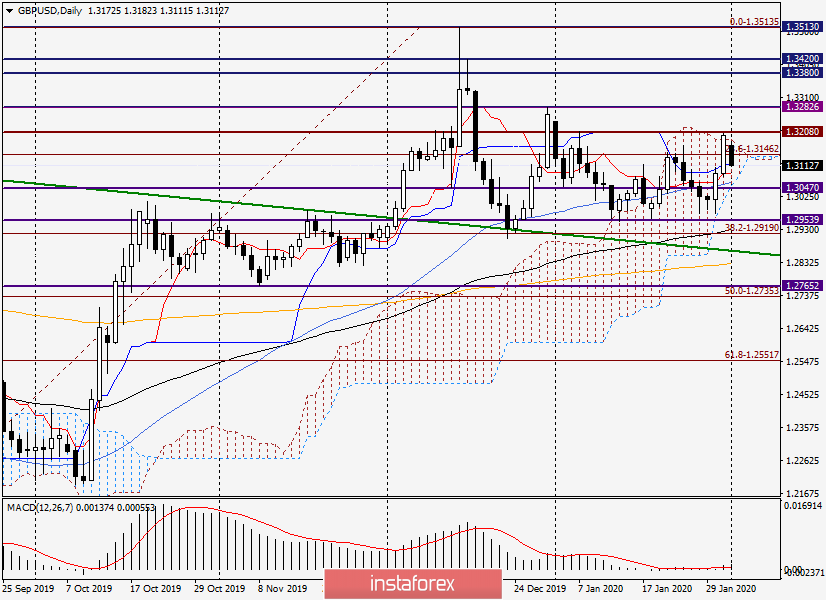

Daily:

In short, the upward scenario will signal the exit up from the cloud of the Ichimoku indicator and the close of trading above its upper border, along with a breakdown of seller resistance at 1.3208.

The bearish scenario provides for a decrease deep into the clouds, where in the price zones 1.3117-1.3064 there are Kijun and Tenkan lines, as well as 50 simple moving average and lower border of the daily Ichimoku cloud.

Furthermore, the selected price zone looks pretty good for opening long positions on the pound/dollar pair. If all of the above is broken and the quotes are fixed below the lower border of the cloud, it is worth considering sales on the rollback to the selected zone.

In the coming days (tomorrow or the day after tomorrow) I will write another review on GBP / USD, in which I will consider smaller time intervals (H4 and H1), where I will try to find the best points for opening deals on this currency pair.

Have a nice day!