The US dollar ignored the good data that the US manufacturing sector improved in January this year. Most likely, the lack of response is due to the fears of a worldwide spread of the coronavirus, which could put pressure on the manufacturing sector. Stocks will increase again, and demand for new orders will fall, which will lead to another slowdown in the investment of companies.

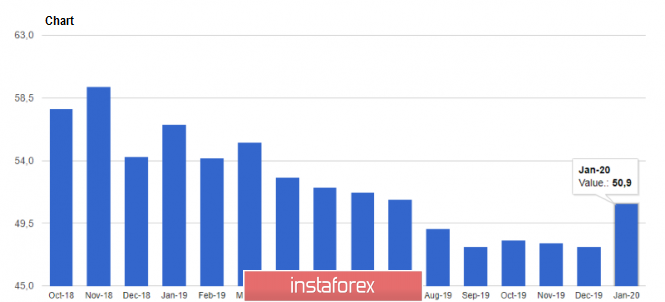

According to the Institute for Supply Management, the index of supply managers for the manufacturing sector rose to 50.9 points in January 2020, as compared from 47.2 points in December. Be reminded that a value above 50 points indicates an increase in activity. Economists had predicted that the index would only be 48.5 points.

Meanwhile, the achievement of a trade agreement between US and China, as well as the gradual growth of world trade, has a positive impact on the sector. However, problems may return if the spread of the coronavirus continues outside of China.

Yesterday, a report indicating a decrease in the construction costs in the United States was also released. According to the Ministry of Commerce, construction spending fell by 0.2% in December 2020, as compared to November's amount of $1.328 trillion. Meanwhile, economists had forecasted a growth of 0.5%. At the same time, compared to the same period of the previous year, expenses have increased by 5%.

Attention was also drawn to the Federal Reserve survey, which shows that many banks expect tougher lending standards for companies, credit cards and car loans in 2020. However, as for the real estate market, no big changes are expected, as it is unlikely that the Committee will tighten the monetary policy. A number of banks predict that demand for car loans as well as loans to buy apartment buildings will weaken, while the demand for credit cards will increase.

As for the technical picture of the EUR/USD pair, the bulls clearly declared themselves in the support area of 1.1035. Now, the entire focus is shifted to the middle of the channel, in the level of 1.1055. If buyers of risky assets are able to cope with the pressure of bears, which could be formed today after weak reports on inflation and growth in Eurozone, we can expect the trading instrument to recover in the area of highs at 1.1090 and 1.1110. On the other hand, if the EUR/USD pair falls below 1.1055, the pressure will return, and a test of the 1.1035 low with the prospect of a further decline to the larger support range of 1.1010 will be repeated.

Oil

The quotes are continuing their decline. Yesterday, the level of 49.50 for the WTI brand was updated, which causes concern in the OPEC. On Monday morning, discussions began on the possibility of an emergency meeting of the coalition, which may take place today or tomorrow, within the framework of the OPEC Monitoring Committee. There is a possibility that the meeting will result to a joint decision in reducing production by 500,000 barrels per day. These rumors, however, have not provided significant support for the oil prices yet, which continues to decline due to the threat of the spread of the coronavirus. Meanwhile, yesterday, Saudi Arabia said that it could temporarily reduce production to 1 million barrels a day. No similar steps to support the decline of oil prices came from Russia, Iran and Nigeria.

As for the technical picture, a break in the psychological mark of 50.50 can create very serious prerequisites for further reduction of quotes up to the update of the lows in the area of 48 and 45.30 dollars per barrel. Measures that OPEC may take to maintain prices may lead to a false breakout of the 50.50 level, which will keep the upward potential of oil in the area of 52 and 54.30 dollars per barrel for the WTI brand.