To open long positions on EURUSD, you need:

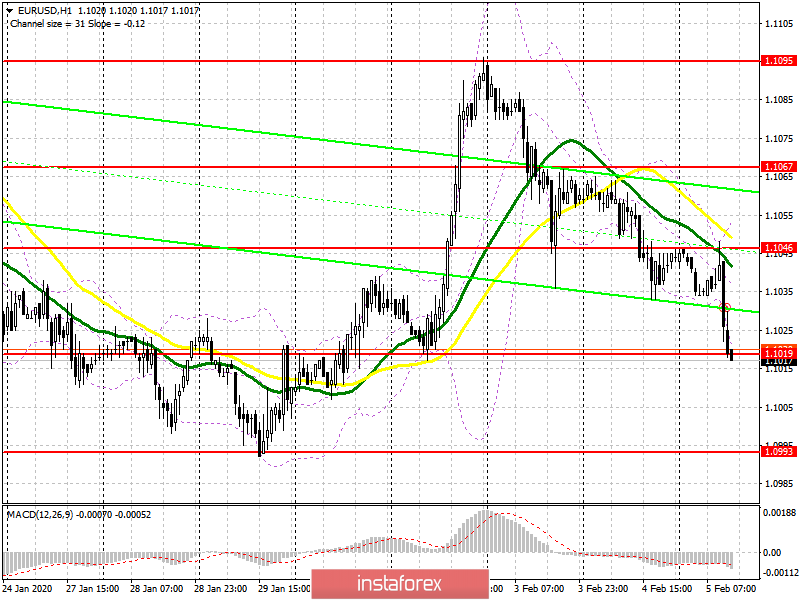

In the morning review, the calculation was based on good indicators for the eurozone services sector, which, unfortunately, failed to provide the necessary support for the European currency, even though they were better than economists' forecasts. The lack of growth in Germany and the decline in Italy could serve as reasons for buyers' caution. Now the bulls need to protect the support level of 1.1019, to which the pair has now fallen. A lot will depend on statements made by the President of the European Central Bank, Christine Lagarde. The formation of a false breakdown in the area of 1.1019 will be the first signal to open long positions, which will return the euro to the daily maximum in the area of 1.1046, but its breakdown will lead to an update of the larger level of 1.1067, where I recommend fixing the profits. If Lagarde's statements adhere to a softer monetary policy, the euro may continue to decline to the lows of 1.0993 and 1.0964, from which I recommend opening long positions immediately for a rebound. However, it is worth understanding that a breakout of the support of 1.1019 will completely break the upward trend in the euro formed on January 29.

To open short positions on EURUSD, you need:

Sellers coped with the morning task and returned the pair to the support of 1.1019, which determines the future of the upward movement in the euro. A breakout and consolidation below this range will push EUR/USD even lower to the area of the lows of 1.0993 and 1.0964, where I recommend taking the profits. If the speech of the head of the European Central Bank is interpreted by the market in favor of euro buyers, then it is best to consider new short positions only after forming a false breakdown in the resistance area of 1.1046 or sell immediately on a rebound from the maximum of 1.1067. We should not forget that the report on the US ISM non-manufacturing index is also published today, and weak indicators may force traders to lock in profits in short positions, which will lead to an upward correction of EUR/USD in the second half of the day.

Indicator signals:

Moving averages

Trading is conducted below the 30 and 50 moving averages, which indicates the gradual end of the upward trend and the formation of a bearish trend.

Bollinger Bands

Volatility is quite low and it will be possible to talk about a return to the market of real buyers only after the breakdown of the upper limit of the indicator in the area of 1.1065.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages) Fast EMA Period 12. Slow EMA Period 26. SMA Period 9

- Bollinger Bands (Bollinger Bands). Period 20