To open long positions on GBPUSD, you need:

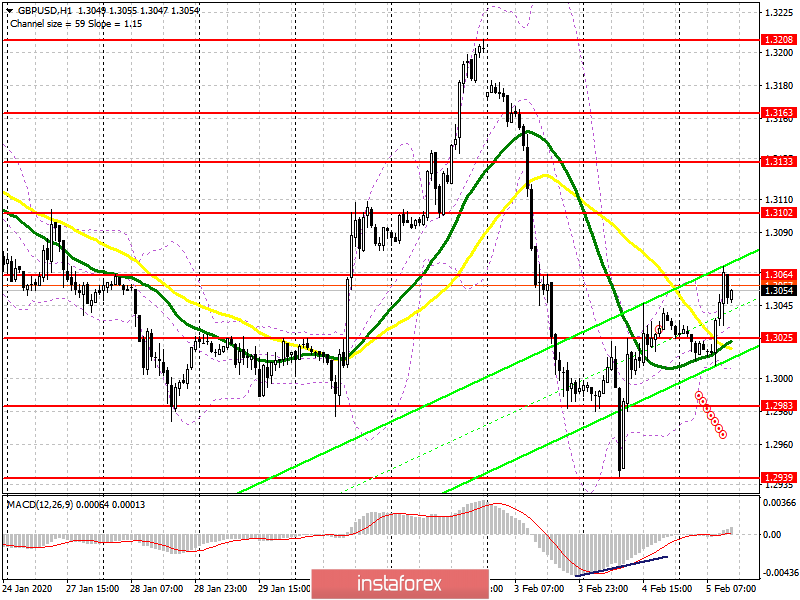

Buyers coped with the resistance of 1.3025, which I paid attention to in my morning review. The entire focus was shifted on the report on the service sector, the results were even higher than the forecast of economists, which led to a breakthrough of 1.3025 and the recovery of the pair to the area of the larger resistance of 1.3064, where many of the major players can take a break as this region indicates the balance after a sharp rise and sharp fall observed at the end and beginning of this week. As for the shorter-term prospects, a small rebound from the resistance of 1.3064 is still only profit-taking, and a repeated test of this range may lead to the formation of a new wave of growth with an exit to the maximum of 1.3102, where I recommend fixing the profits. In a scenario of falling GBP/USD in the afternoon, for example, after the release of a positive report on activity in the US service sector, long positions can look at the false breakdown in the support area of 1.3025 or then buy the pound for a rebound from a minimum of 1.2983.

To open short positions on GBPUSD, you need:

The bears are still holding back, showing no activity even after the update of the resistance of 1.3064, where only small profit-taking is noticeable for long positions gained yesterday from the level of 1.2940. The task remains to keep the price below this range, and a good ISM report for the US non-manufacturing sector will help return GBP/USD to the support area of 1.3025, where I recommend taking profits since it will be quite difficult to break below this level today. In the scenario of further growth above the resistance of 1.3064, it is best to look at short positions on the resistance test of 1.3102 or sell the pair immediately on a rebound from the maximum of 1.3133.

Indicator signals:

Moving averages

Trading is already above the 30 and 50 daily averages, which indicates a gradual return to market equilibrium.

Bollinger Bands

A breakthrough of the upper border of the indicator will maintain a bullish trend in the short term, and if the pound drops in the afternoon, it is best to return to long positions after testing the lower border of the indicator in the region of 1.3000.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages) Fast EMA Period 12. Slow EMA Period 26. SMA Period 9

- Bollinger Bands (Bollinger Bands). Period 20