GBP/USD

On Friday, the British pound fell by 45 points under pressure from the overall strengthening of the dollar with the release of good labor data in the US. Non-Farm Employment Change for January amounted to 225,000 against the expectation of 163,000. Today, a large block of British economic data will be released. Expectations are mixed: GDP for the 4th quarter may show zero growth, the trade balance for December may deteriorate from -5.3 billion pounds to -10.0 billion, and the volume of production in the construction sector for December is expected to be -0.4% against 1.9% a month earlier. Industrial production is expected to grow by 0.3%, however, the previous fall was -1.2%. Also, manufacturing production may show an increase of 0.5%, but against the background of November's -1.7% growth does not look very optimistic. In part, the pound may grow slightly today (depending on the released data), but in the short term, there are no events that could return the pound to medium-term growth or deep short-term growth, as the main factor (the topic of Brexit) is becoming more and more unpleasant for British negotiators. Negotiations on the deal will begin in March, and the EU is already putting forward conditions for the UK to reduce sanitary standards for agricultural products and continue the primacy of European law. All this shows that the upcoming negotiations are definitely difficult.

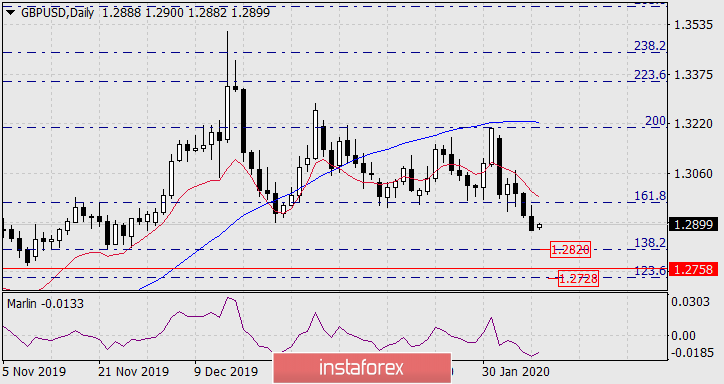

The nearest targets for the pound remain: the Fibonacci level of 138.2% at the price of 1.2820, the range of 1.2728/58 formed by the Fibonacci level of 123.6% and the maximum on June 12, 2019.

There are no graphical or indicator reversal patterns on the four-hour chart.