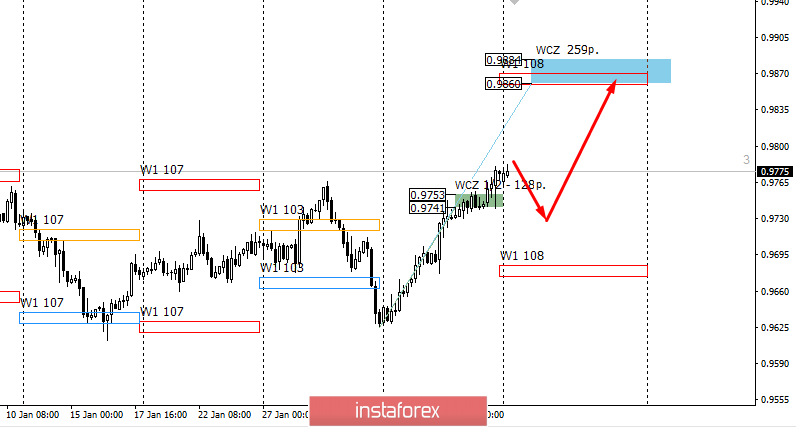

he main direction of trading for the current week is upward. The reversal pattern was formed on Friday. On the other hand, closing trades occurred above the Weekly Control Zone 1/2 0.9753-0.9741, which led to the cancellation of the bearish medium-term model. The probability of growth has increased to 75%. The main goal of the upward impulse is the weekly control zone 0.9884-0.0860.

Meanwhile, purchases from current levels are not profitable, as the pair is trading at the extreme of last week, which increases the probability of the formation of a correctional model.

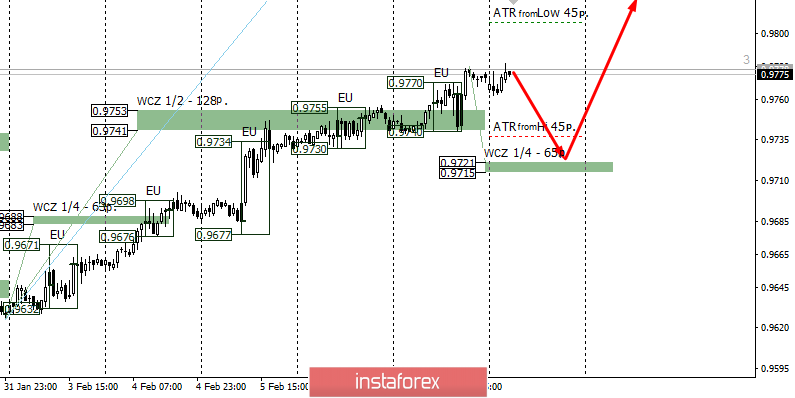

To obtain favorable prices for the purchase of this instrument, a reduction to one of the support zones will be necessary. The first zone is the Weekly Control Zone 1/4 0.9721-0.9715. Testing this zone will allow you to enter a long position with a growth prospect of more than 130 points. On the contrary, if you set a stop of no more than 30 points, you can get a risk-to-profit ratio that significantly exceeds the required 1 to 3.

Daily CZ - daily control zone. The zone formed by important data from the futures market that changes several times a year.

Weekly CZ - weekly control zone. The zone formed by the important marks of the futures market, which change several times a year.

Monthly CZ - monthly control zone. The zone that reflects the average volatility over the past year.