After the release of data indicating that the mood of small business owners in the US improved in early 2020, the US dollar made an unsuccessful attempt to grow against risky assets, particularly against the euro. However, the speech by Fed Chairman Jerome Powell was very restrained, focusing mainly on the issues of the coronavirus, and the prospects for economic growth, which negatively affected the quotes of the US dollar.

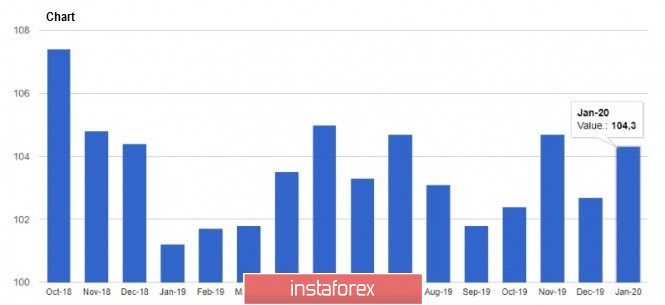

The report made by the National Federation of Independent Business (NFIB) showed that the small business optimism index in the United States rose immediately to 104.3 points in January 2020, from its 102.7 points in December. This indicates an improvement in the mood of business owners. Meanwhile, capital investment and inventory are also expected to increase, which will have a positive impact on profits and a number of other aspects. The employment index, which grew due to job creation in January this year, is doing particularly well, as more than 19% of respondents stated plans of creating new jobs. However, problems remain with qualified personnel, as more than 37% of respondents said that they could not find a qualified workforce in January.

The report from The Retail Economist and Goldman Sachs regarding the sales index was ignored by the market, as it did not represent much interest. Nevertheless, according to the data, the sales index in US retail chains remained unchanged in the week of February 2 to February 8, even though it increased by 2.2% if compared to the same period in 2019.

The attention of traders was focused on the speech of Fed Chairman Jerome Powell, who spoke a lot about the problem of coronavirus, as well as the future trends of the country's economy. He stated that the situation in China could spill over into the global economy, and that although some of the uncertainty around trade policy has dissipated, some risks still remain. Let me remind you that at the end of last year, the Fed stopped lowering rates amidst the signals that global growth is stabilizing. At the moment, the US economy looks quite resilient to global problems, however, yesterday, the Fed Chairman repeated his statements from the last meeting, and declared that the current monetary policy is appropriate, and that the Central Bank will only change it if the situation forces a more significant revision of forecasts. Among the positive changes that Powell noted is the labor market, which strengthened last year, and continued to support the economy. Meanwhile, consumer spending became more moderate by the end of 2019, and problems remain in company investments and exports.

As for inflation, Jerome Powell sees no reason to worry, even though the consumer price index is below the 2% target. In the meantime, when the reserves reach sufficient levels, the Fed will begin to gradually slow down the pace of bond purchases. Most likely, REPO operations will continue until April of this year.

As for the technical picture of the EUR/USD pair, the mere retention of buyers in the level of 1.0900 is clearly not enough to turn the market in their direction. Today, the priority of buyers is to build the lower border of the new upwards channel from yesterday's lows, and break the resistance at 1.0930. Only the break in the 1.0930 range will open a direct path to the highs of 1.0975 and 1.1030. If the pressure on the euro returns, the breakout of 1.0890 support will quickly push the trading instrument to the lows of 1.0860 and 1.0830.