Looking at the single European currency, I just want to give up, because this fighter stubbornly refuses to fight and continues to decline. From time to time, its main pair supports it. This happened yesterday, only the worst data on open vacancies in the United States over the past couple of years did not allow the single European currency to continue to decline.

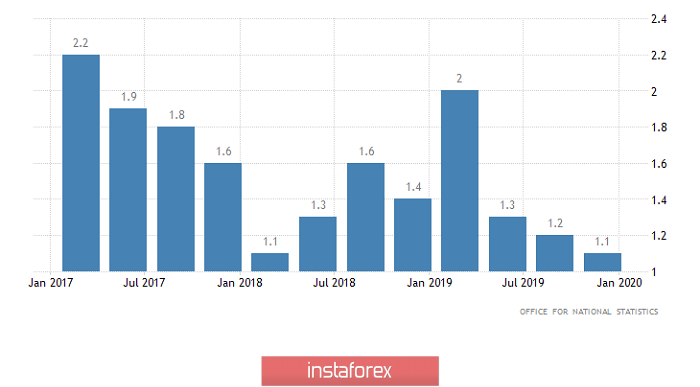

The pound was the first to report yesterday, and several published macroeconomic data allowed it to slightly improve its position, which, however, causes laughter. So, the GDP growth rate slowed down from 1.2% to 1.1%, but in fact, they predicted a slowdown to 0.9%. In addition, the previous results were revised for the better, from 1.1% to 1.2%. Nevertheless, the UK economy has been slowing down for three consecutive quarters, which, of course, should cause concern.

GDP growth rate (UK):

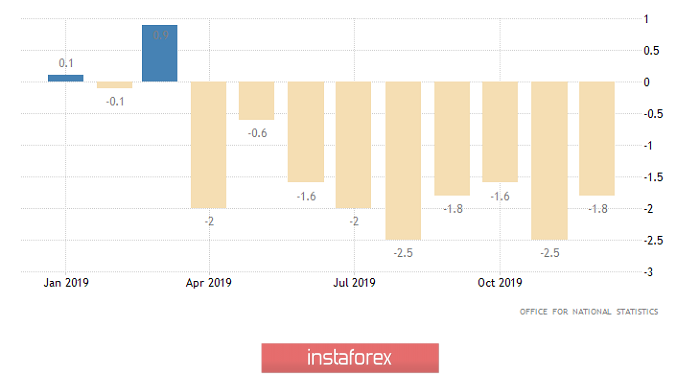

Nevertheless, there is some improvement in the industry, as the rate of decline in production slowed down from -2.5% to -1.8%. Although it should be noted that slowdowns were expected to -1.0%, the data were still not as good as predicted. But most importantly, industrial production has been declining for nine consecutive months.

Industrial Production (UK):

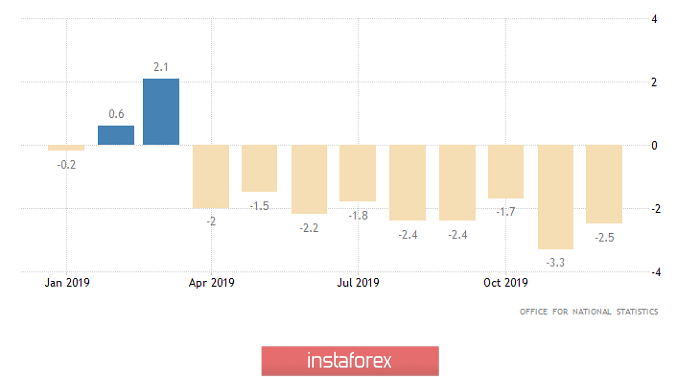

At the same time, the manufacturing industry is in even worse shape, as the decline there has slowed, but from -3.3% to -2.5% with a forecast of -1.2%. That is, the actual value was more than twice as worse. And of course, the decline in manufacturing lasts the same nine months.

Manufacturing (UK):

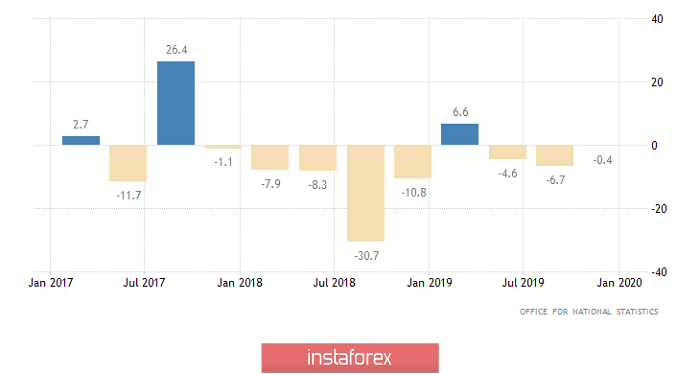

In addition, investors were also pleased with orders in the construction sector along with data on GDP. The decline of which slowed down from -6.7% to -0.4%. But orders in the construction sector are directly related to the real estate market, which is the main criterion for determining the investment attractiveness of the United Kingdom. Moreover, the decline in orders lasts for the third quarter in a row, and if we consider their growth in the first quarter of last year to be unusual and wrong, it has been more than two years.

Orders in the construction sector (UK):

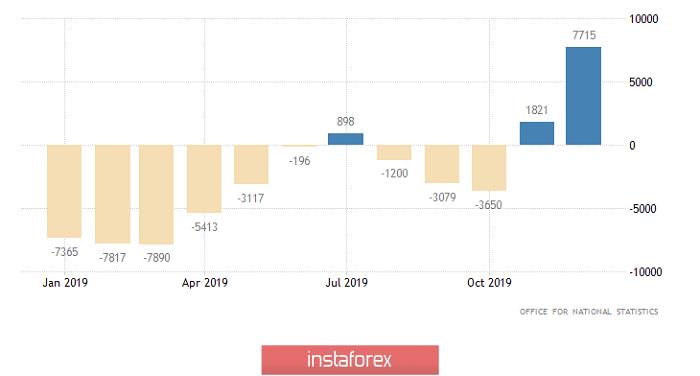

It is immediately evident that there is only one decline and deceleration everywhere. But the optimism of the pound was caused by the fact that they predicted a much worse development of events. To simply put it, the growth of the pound was more likely an emotional outburst. But in fairness, we must admit that it was not without really positive news, as the trade surplus amounted to 7.7 billion pounds which is extremely unusual, as the trade balance has been surplus for two consecutive months. It is usually scarce, and they predicted it, in such a way to return to normality, since the deficit was supposed to be 2.6 billion pounds.

Trade balance (UK):

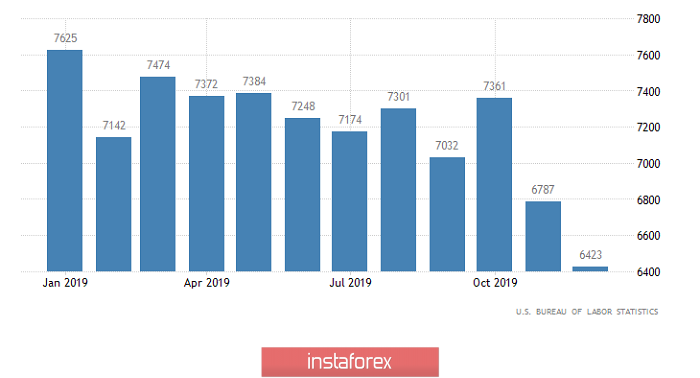

However, the most interesting thing happened in the evening, when JOLTS data on open vacancies in the United States, was published. The fact is that the number of open vacancies decreased from 6.8 million to 6.4 million, although it was supposed to increase to 7.0 million. At the same time, this is the lowest figure in the last two years. The last time a lower value was recorded was only in December 2017. But the most important thing is that a decrease in the number of open vacancies clearly suggests that the prospects for reducing unemployment are rather illusive. Especially against the background of a significant increase in the share of physically abled people in the total population. So rather, you need to prepare for a further increase in unemployment. But the most indicative is that only a single European currency, in fact, did not react to this news while the pound was able to strengthen its position a little more.

Number of Job Openings JOLTS (United States):

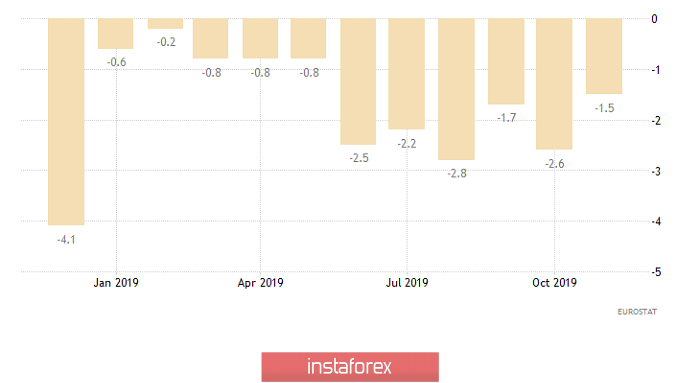

Nevertheless, the pessimistic mood of the single European currency is quite justified. The recent data on the largest countries in the euro area do not cause any optimism at all. Well, today's data on industrial production in Europe should, so to speak, put all the dots over i. Not only has industrial production in Europe been declining for the past thirteen consecutive months, but the rate of decline should accelerate from -1.5% to -2.3%. Thus, it is not surprising that investors have a single European currency that causes only continuous disappointment.

Industrial Production (Europe):

There are no prospects for single European currency to grow on the range, although it is excessively oversold, which in itself will slow down further decline. Further, it will have to continue its decline in the direction of 1.0875 under the influence of weak data on industrial production.

The pound increased largely solely on emotions yesterday, and an empty macroeconomic calendar in the UK and the United States will be an excellent backdrop for a small return from upside to downside. Thus, we are waiting for the pound to decline to 1.2900.