4-hour timeframe

Technical details:

Higher linear regression channel: direction - sideways.

Lower linear regression channel: direction - downward.

Moving average (20; smoothed) - up.

CCI: -5.9140

The GBP/USD currency pair returned to the moving average line on February 18 and threatens to consolidate below it again. Thus, once again, the bulls do not have the strength and desire to continue forming an upward trend, the makings of which appear due to the consolidation of quotes of the pound/dollar pair above the moving average. However, we do not see anything surprising, since the pound remains extremely weak. There are no reasons for its purchases (especially long-term ones) now. But there are plenty of reasons to get rid of the British currency. And we are more interested in the moment why the pound has not become cheaper in recent months. However, as in the case of the euro, the luck will end sooner or later. Most likely, the same thing will happen with the pound.

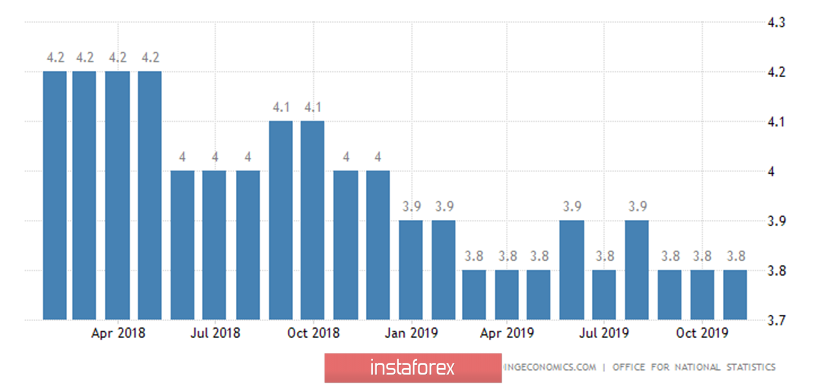

There will be no important or significant publications in the United States on Tuesday, but some interesting reports will come from the UK. First, the unemployment rate for December. It should be noted immediately that the unemployment rate remains one of the strongest indicators of the state of the economy for Britain. It is the one with the least questions since it is consistently at its minimum values of about 3.8%. However, it is also an indicator that traders rarely react to. Rather, it is more statistical.

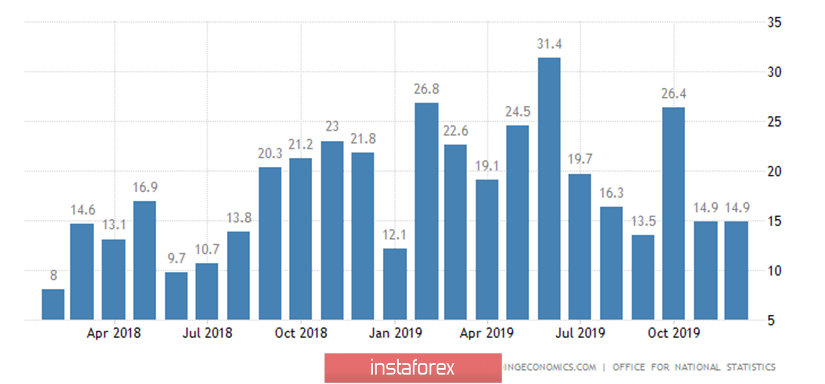

The same can be said about the rate of change in the number of applications for unemployment benefits. It is rare when it happens that the real value of this indicator is very different from the forecast, which provokes more active trading on the market. Usually, this indicator also attracts very little attention from market participants. However, according to experts' forecasts, the unemployment rate in December will remain unchanged – 3.8% and the number of new applications for benefits will be 22,600.

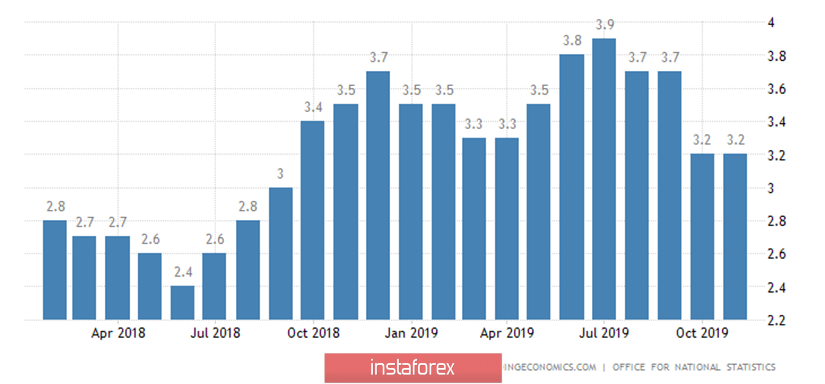

The latest and most significant report today is the change in UK wages for December. In recent months, as the graph shows, the rate of wage growth in the Foggy Albion has begun to decline. And since this indicator is quite important, it is not surprising that it has started to show a negative trend recently, following a whole host of other important indicators, such as GDP or industrial production. Taking into account bonuses, the salary increase in December should be 3%, and without bonuses – 3.3%. In any case, both forecast values are lower than the values of the previous month (November) so we can expect a deterioration in the figures. Well, for the British pound, this deterioration will mean another potential reason for resuming its own decline. As we have said many times, nothing in the UK is changing for the better, so on what basis should we expect the strengthening of the British currency? One Boris Johnson from time to time provokes small purchases of the pound by his actions. However, there is also nothing positive (at least in the short term) in his actions for the British pound and the UK. Thus, the pound will remain prone to falling. In the near future, namely in early March, negotiations between Brussels and London will officially begin on a trade agreement that will be valid between the Kingdom and the Alliance after 2020 and information about this process will begin to be available to traders. Accordingly, starting in March, the fate of the British currency will largely depend on the course of negotiations.

From a technical point of view, the pound may consolidate below the moving average today, which will return the pair to a downward trend. The lower channel of linear regression is directed downward, so it is the downward movement that is now more preferable. Not to mention the fundamental factors.

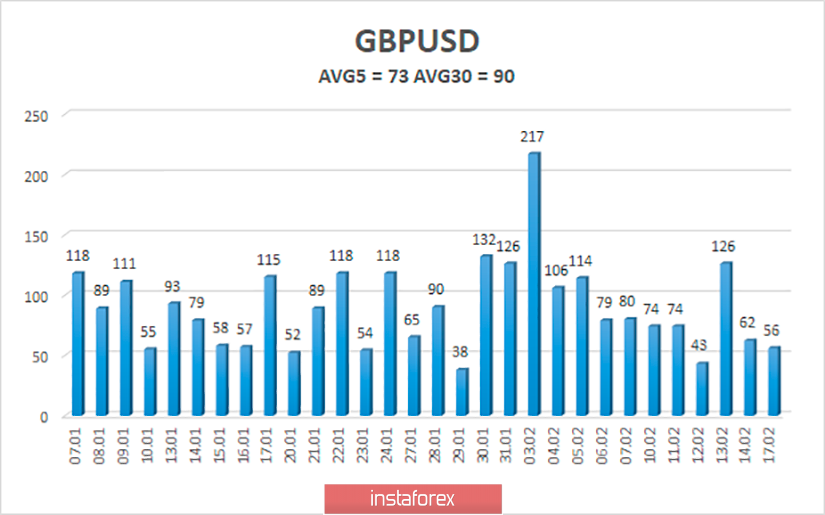

The average volatility of the pound/dollar pair over the past 5 days has dropped to 73 points and continues to fall. According to the current volatility level, the working channel on February 18 will be limited to the levels of 1.2929-1.3075. There will be few important macroeconomic statistics today, so it is unlikely that volatility will be high.

Nearest support levels:

S1 - 1.2970

S2 - 1.2939

S3 - 1.2909

Nearest resistance levels:

R1 - 1.3000

R2 - 1.3031

R3 - 1.3062

Trading recommendations:

The GBP/USD pair is trying to change the upward trend to a downward trend. Thus, purchases of the pound with targets of 1.3031 and 1.3062 can be considered if the pair remains above the moving average. However, we still do not see why the British currency can now perform growth in fundamental terms. It is recommended to return to more reasonable sales of the pound after fixing the price below the moving average line with the first targets of 1.2970 and 1.2939.

In addition to the technical picture, you should also take into account the fundamental data and the time of their release.

Explanation of the illustrations:

The highest linear regression channel is the blue unidirectional lines.

The lowest linear regression channel is the purple unidirectional lines.

CCI - blue line in the indicator window.

Moving average (20; smoothed) - blue line on the price chart.

Murray levels - multi-colored horizontal stripes.

Heiken Ashi is an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.