We have seen once again that if the United States has a day off, then it will also be on the markets. While the Americans celebrated Presidential Day, markets represented a horizontal line. Nevertheless, this is not surprising, since it is American banks, funds and other insurance companies that control most of the funds circulating in the financial markets. However, no macroeconomic data were published yesterday and not only in the United States, but also in Europe.

Nevertheless, one should not think that nothing happened at all yesterday. At least some ray of hope appeared in France to improve the fate of the single European currency. On the other hand, a large auction was held on government securities in the Third Republic, and their value began to show positive dynamics. More precisely, the direction of movement in this direction. Thus, the yield on 3-month bills increased from -0.609% to -0.596%. The same dynamics were observed for 12-month bills, whose yield increased from -0.586% to -0.582%. Well, the yield on 6-month bonds increased from -0.592% to -0.587%. And yes, they all have negative returns. That is, investors receive less than they invested.

Today, American traders are already in operation, so it will be somewhat more lively. Moreover, data on the labor market will be published in the UK, which, at first glance, are neutral. After all, the unemployment rate should remain at the same, record low level of 3.8%, on which it is already three months in a row except for a couple of short jump then all nine months.

The growth rate of the average wage should remain unchanged; however, only without taking into account premiums, since with them, the growth rate may slow down from 3.2% to 3.1%. There is a likelihood of a slowdown to 3.0%. But this indicator is much more important, since it reflects to a much greater extent the income of subjects of Her Majesty. The fact is that premiums are meant primarily overtime. And everyone has to linger and process. And this is not counting the fact that the statistics on average salaries do not reflect all income, in contrast to the data taking into account premiums. Thus, it turns out that household incomes should decrease, and this inevitably leads to a decrease in consumer activity.

In addition, the number of applications for unemployment benefits, although small, may increase from 14.9 thousand to 15.0 thousand. The growth, of course, is not significant, but there is still an unpleasant precipitate. Moreover, this is the most optimistic forecast, since the number of applications can increase to 22.6 thousand according to the worst estimates.

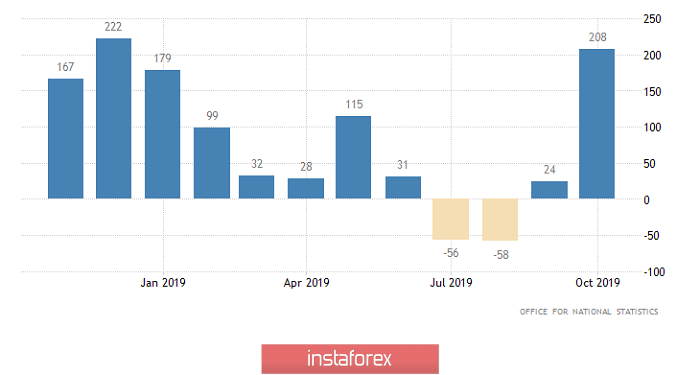

And, of course, employment, which should increase by 120 thousand, seems just fine. But only if you do not look at the previous month, when this same employment increased by 208 thousand. In other words, there is a decrease in the growth rate of employment, which means there is no hope for an improvement in the situation on the labor market. Rather, you need to start preparing for the fact that things will only get worse.

Employment Change (UK):

The euro / dollar currency pair continues to move along the level of 1.0850, with variable borders in the region of 1.0825 / 1.0860. It is likely to assume that a kind of accumulation will still remain on the market, but now, it is already possible to consider the tactics of working to break through the set boundaries.

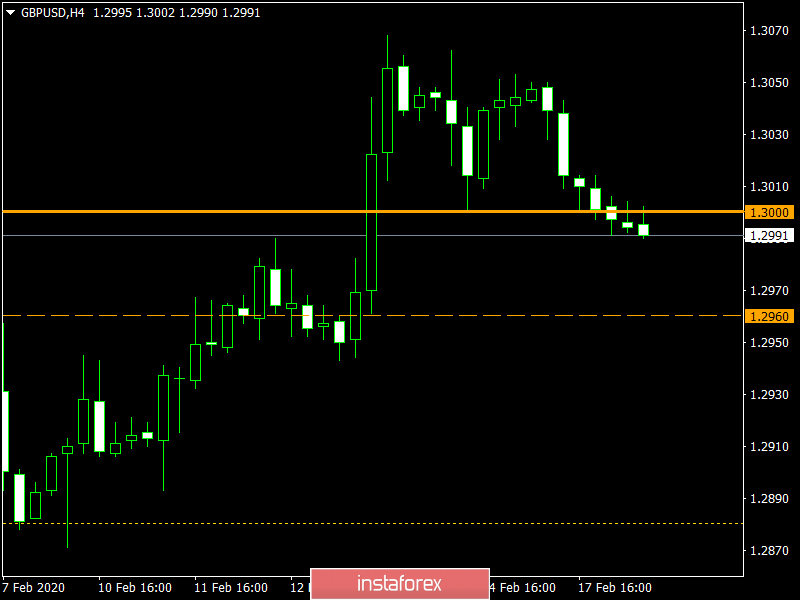

The pound/dollar currency pair returned to the psychological level of 1.3000 once again, where it entered the stage of fixing the price below it. In fact, we have a signal of a possible resumption of the downward movement, where the first interaction point is located in the region of 1.2960.