Economic calendar (Universal time)

Today's economic calendar is quite calm again. Statistics from the UK (9:30 average wage + change in the number of unemployment claims) and Germany (10:00 economic sentiment index) can cause some recovery in the market.

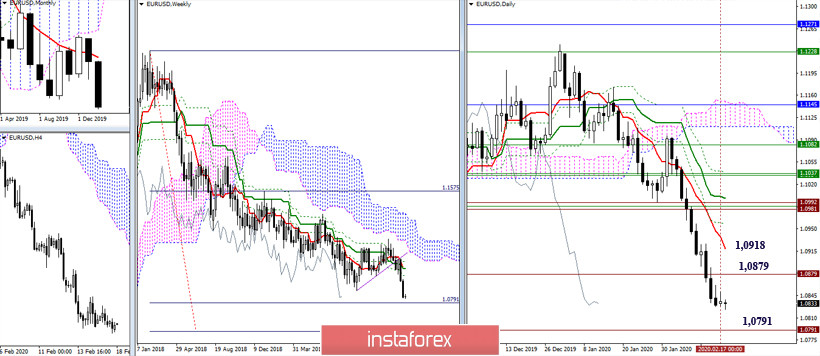

EUR / USD

After yesterday's slight slowing down, the pair updated the low once again. The downward trend remains legally capable, and correction is possible only in the future and the desires of some. The reference points for the players to decline are now the support levels for the breakdown of the weekly cloud (1.0791 - 1.0595). In case of an upward correction, the nearest resistance of the upper time intervals can now be noted at 1.0879 (historical level) and 1.0918 (daily short-term trend).

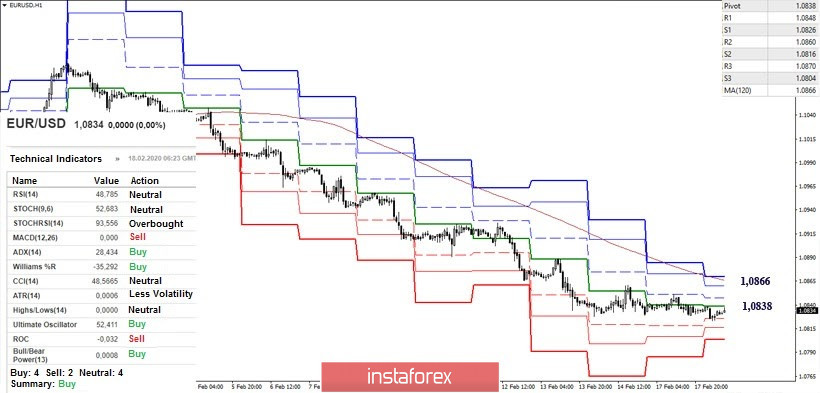

The main advantage in the lower halves belongs to the players on the downside. Nevertheless, technical instruments are ready to quickly switch to the active support of players to increase. At the moment, the current resistance is the central Pivot level (1.0838), then the weekly long-term trend (1.0866) will serve as a reference. The intraday support, in turn, remains the classic Pivot levels which is located today at 1.0826 - 1.0816 - 1.0804.

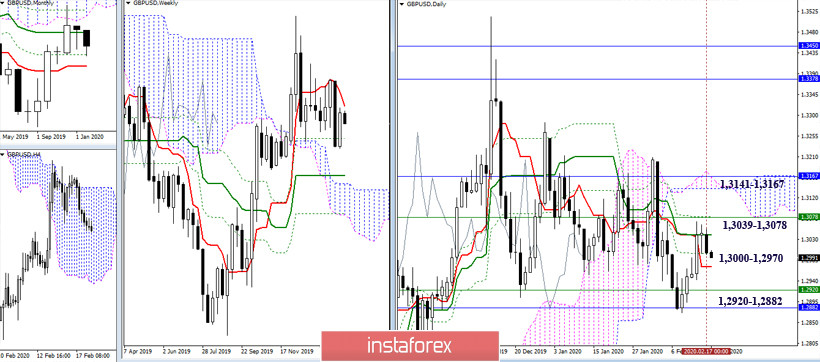

GBP / USD

The situation has not undergone significant changes. The pair remains in the zone of attraction of the central levels 1.3039-78 (daily cross + weekly Tenkan) of the current consolidation; therefore, there is no need to wait for a big clarification of the situation. At the moment, the bears are trying to regain their capabilities after the last week's upswing to return to the lower boundaries of the consolidation of 1.2882 - 1.2920 (Fibo Kijun of the week and month), but so far, their desires rest against the intermediate support of 1.3000 - 1.2970 (day Tenkan + Fibo Kijun).

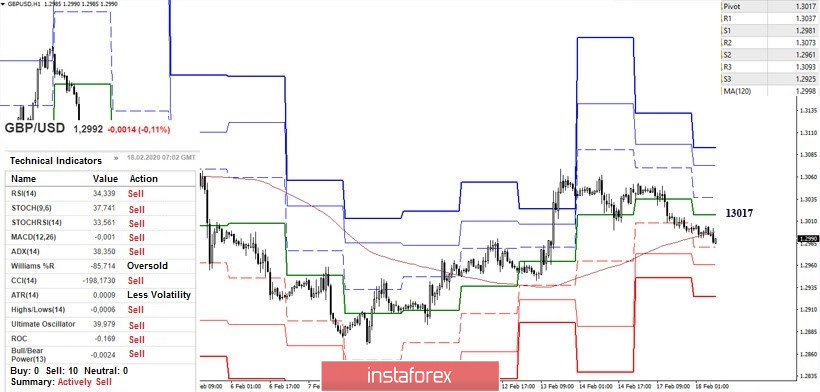

In the lower halves, the players on the upside are close to losing the support of the weekly long-term trend at the moment, and hence, the advantage that they won last week. The support and bearish signs within the day are also the classic Pivot levels S1 (1.2981) - S2 (1.2961) - S3 (1.2925). On the other hand, an initial recovery of bullish prospects today is possible with consolidation above the central Pivot level (1.3017). Further, the main value will be updating the maximum extremum of last week 1.3069 and breaking through the resistance of the higher halves (1.3039-78).

Ichimoku Kinko Hyo (9.26.52), Pivot Points ( classic ), Moving Average (120)