Economic calendar (Universal time)

In today's economic calendar, a little more attention can be paid to the publication of the following data:

9:30 consumer price index (UK),

13:30 the number of issued building permits + producer price index (USA).

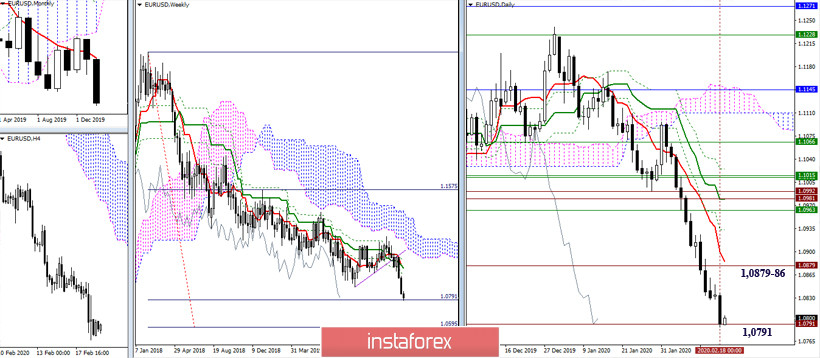

EUR / USD

The pair arrived at their next destination and support was met for the first target of the weekly target for breakdown of the cloud (1.0791). Thus, slowing down is possible. If an upward correction develops, the nearest resistance of the upper time intervals is very far from the price chart (1.0879-86 area) today. Therefore, it is unlikely to be relevant. On the other hand, reliable overcoming of support (1.0791) will create conditions allowing to consider 100% fulfillment of the weekly goal (1.0595).

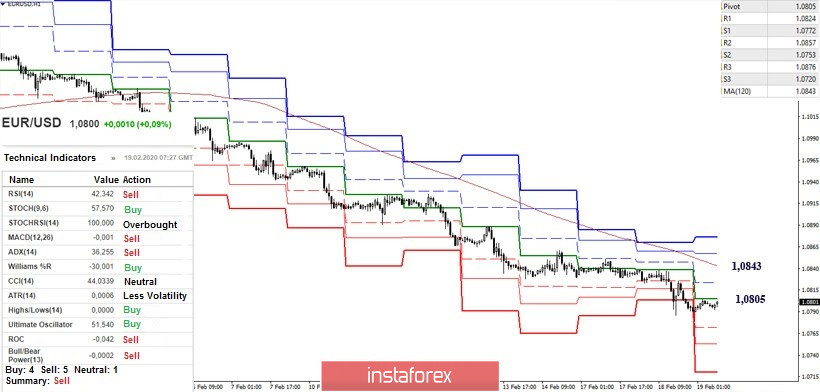

A meeting with a support level (1.0791) delayed the advancement of players on the decline. As a result, the pair is currently in the zone of incipient correction. Meanwhile, the benchmarks of a possible upward movement in the lower halves are 1.0805 (central Pivot-level of the day) and 1.0843 (weekly long-term trend). If you exit the correction zone and continue to decline, the intra-day classic support will be the classic Pivot levels, which are located today at 1.0772 - 1.0753 - 1.0720.

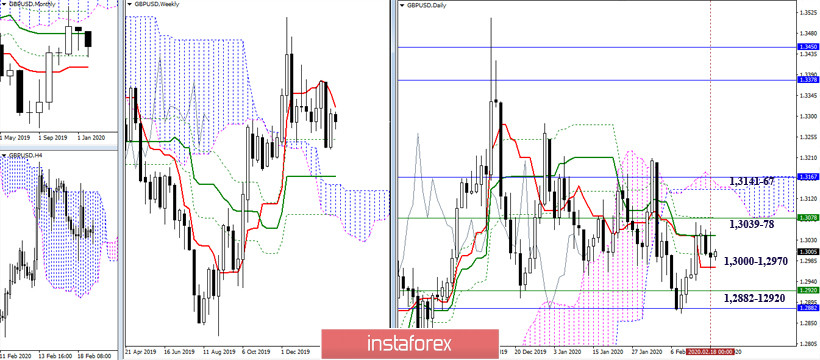

GBP / USD

The intermediate support, designated at 1.3000 - 1.2970 (daily Tenkan + Fibo Kijun), restrain the recovery of bearish positions and moods, for which it is important to be able to test key support 1.2882 - 1.2920 again (Fibo Kijun of the week and month). On the other hand, advancing to the upper borders (1.3141-67) of the current consolidation zone blocks the area of nearest resistance 1.3039-78 (daily cross + weekly Tenkan).

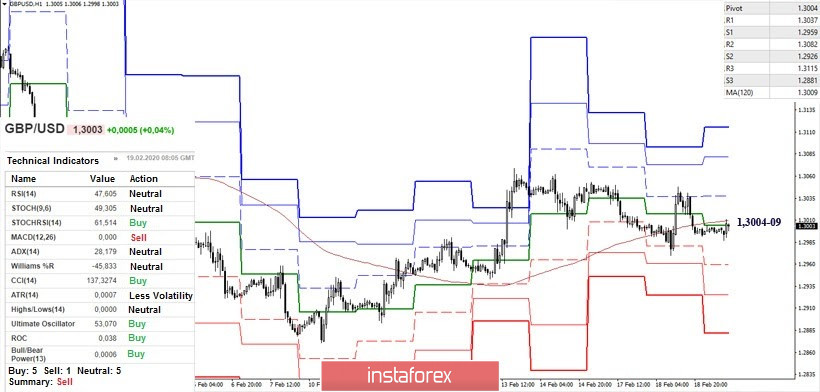

In the lower halves, the situation is still concentrated at key levels. Today, they (the central Pivot level and the weekly long-term trend) have joined forces in the area of 1.3004-09. Now, consolidation above may contribute to the fact that the players on the increase will make a new attempt to update the maximum (1.3069) and overcome the attraction of the central levels of the consolidation zone of the high halves (1.3039-78). At the same time, working out below these levels (1.3004-09) will increase the bearish chances of a continued decline. The Pivot levels S1 (1.2959), S2 (1.2926), S3 (1.2881) act as supports and reference points within the day.

Ichimoku Kinko Hyo (9.26.52), Pivot Points ( classic ), Moving Average (120)