Over the current week, the British currency seeks to maintain its gains, although it did not manage to avoid a decline. The pound has to overcome a lot of obstacles, mainly in the form of statistical data, which from time to time disappoint the market. According to analysts, sterling expects another price "swing".

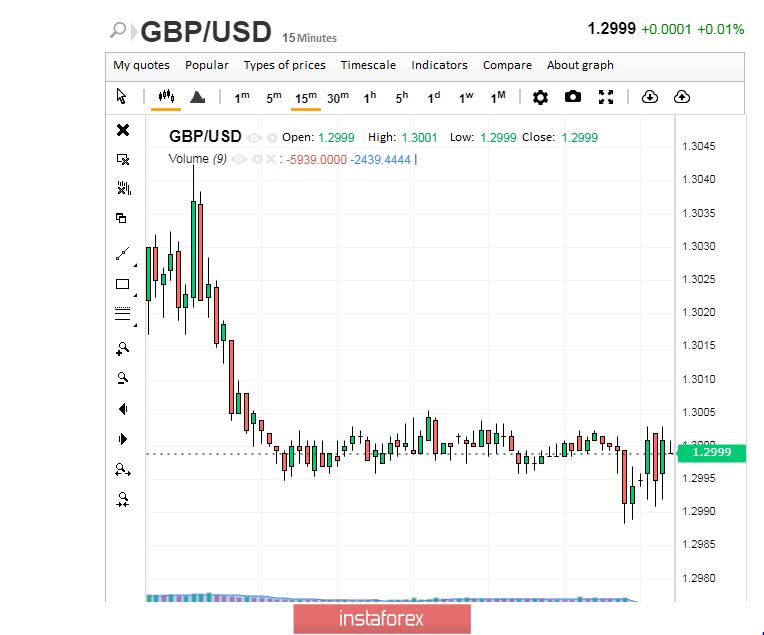

At the same time, the British currency remains stable unlike the key world currencies, which are "bent" in front of the US dollar. The pound was not broken either by ambiguities in the trade negotiations between London and Brussels or by the likelihood of a weakening monetary policy by the Bank of England. Today, February 19, it continues, as a day earlier, to ply near the psychological level of 1.2999–1.3000.

On Tuesday, February 18, the GBP / USD pair reached 1.3037, but could not stay near high positions for a long time. At the moment, the tandem is balancing between decline and growth attempts, which creates certain "swings" in the dynamics of sterling.

Currently, the British currency has long moved away from last week's maximum of 1.3068–1.3069, which was recorded after a reshuffle in the British government. Recall that Rishi Sunak was elected to the post of Minister of Finance instead of Sajid Javid. This triggered a pound rise to record highs over the past two months, analysts emphasize.

Most market participants reacted positively to the personnel changes in the management of Prime Minister Boris Johnson. They expect growth in government spending to support the British economy, which, like the pound, was not easy for Brexit. The prime minister's immediate plans are to increase spending on infrastructure, healthcare, and education.

According to experts, Sunak is a supporter of the policy of fiscal stimulus, this means that under his leadership, the chance to soften budget rules will increase significantly. However, investors are more concerned about the possibility of London and Brussels to agree on a trade deal by the end of 2020. Market participants are also alarmed by the worsening macroeconomic statistics, which increase the likelihood of a rate cut by the Bank of England.

Macroeconomic information published this week is multidirectional. On one hand, it does not disappoint the market too much, and on the other, it does not have an unambiguous interpretation. Experts also cannot call them positive. These reports include information on the British labor market, published on Tuesday.

Despite the fact that the level of employment in the country soared to a record 76.5%, the growth rate of salaries stalled. Experts recorded their slowdown to 2.9% from the previous 3.2%, which is considered a negative factor in terms of inflationary prospects. At the same time, according to yesterday's report, the unemployment rate remained the same at 3.8%. The average wage increased by 3.2% after an increase of 3.4% recorded in the previous three months. This, according to experts, provokes pressure on the pound, which may increase in the case of a weak report on British inflation.

After the published information on the labor market, which was supposed to undermine the sterling position, it surprised the market by reacting with growth. Due to this, experts believe that there is a high probability of new incentive measures from both the government and the Bank of England. It is expected that they will be aimed at reducing inflation.

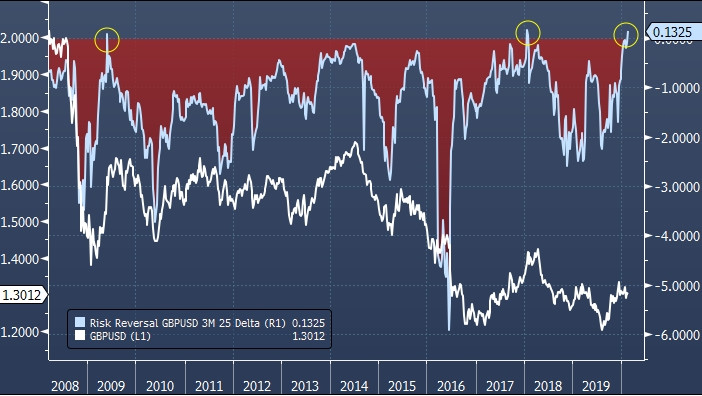

Some analysts draw attention to one of the most important indicators for the further dynamics of the pound - Risk reversal. At the beginning of this week, for the first time in two years, since January 2018, it was in the zone of positive values. This indicator soared by 13 basis points (bp), which indicates the possible strengthening of the British pound over the next three months.

Experts added that the British currency, which managed to survive Brexit almost without loss, will be able to adequately respond to any statistics. If they are not too positive, then sterling will fall but will recover in the future. They also believe that in the near future, the pound will have to go through another sharp turn. The important thing is it doesn't skid on the corners.