To open long positions on EURUSD, you need:

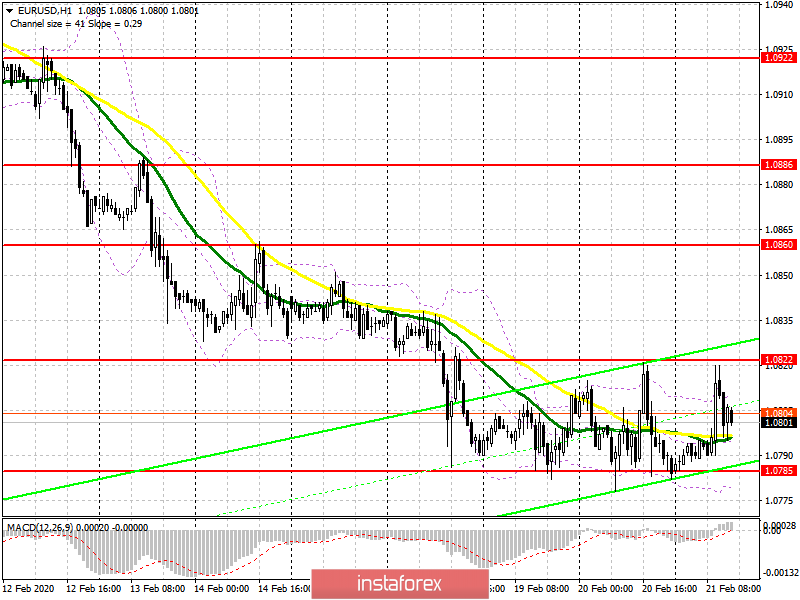

Buyers of the euro took advantage of the good data on the PMI indices, which rose for the services and manufacturing sectors. They maintained an important support level of 1.0785, however, they did not manage to get above the resistance of 1.0822. The task for the second half of the day remains the breakdown of the area of 1.0822, which will lead to an update of the highs of 1.0860 and 1.0886, where I recommend fixing the profits. However, everything will now depend on data on similar indices for the United States. Good indicators will again return the pressure on EUR/USD, which will lead to a repeat test of the minimum of 1.0785. If it breaks, I recommend that you postpone long positions on the euro until the test lows of 1.0765 and 1.0740.

To open short positions on EURUSD, you need:

The bears did not take long to wait and returned to the market after an unsuccessful attempt to break the resistance of 1.0822, which I paid attention to in my morning review. Apparently, the sellers are counting on good reports on the American economy, which are scheduled for the second half of the day. Only a break in the support of 1.0785 will drop EUR/USD in the area of the lows of 1.0765 and 1.0740, where I recommend fixing the profits. In the scenario of the pair's growth in the second half of the day, only the formation of a false breakdown in the area of 1.0822 will signal the opening of short positions in the euro. I recommend selling immediately for a rebound only after testing the maximum of 1.0860.

Signals of indicators:

Moving averages

Trading is conducted in the area of 30 and 50 moving averages, which indicates market uncertainty in the short term.

Bollinger Bands

A break of the lower border of the indicator at 1.0780 will increase the pressure on the euro.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20