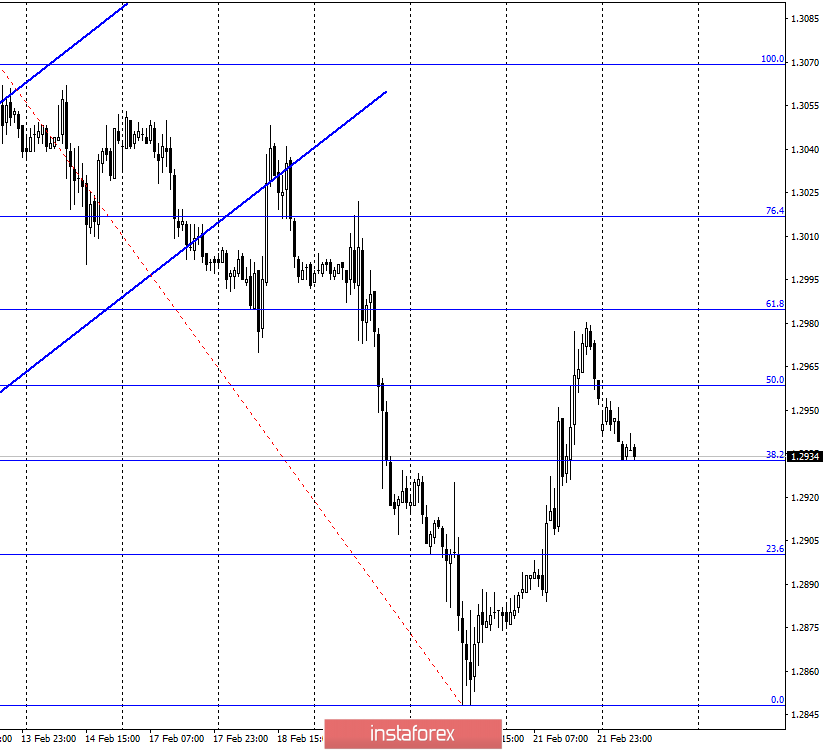

GBP/USD – 1H.

Hello, traders! According to the hourly chart, the GBP/USD pair rose to the area between the 50.0% and 61.8% Fibonacci corrective levels from the last fall of the pair. A reversal in favor of the US currency has already been made, so there are indirect reasons to assume a resumption of the fall in the exchange rate. Closing the pair's quotes below the Fibo level of 38.2% (1.2933) will increase the probability of continuing the fall. Rebound - will work in favor of some growth in quotes.

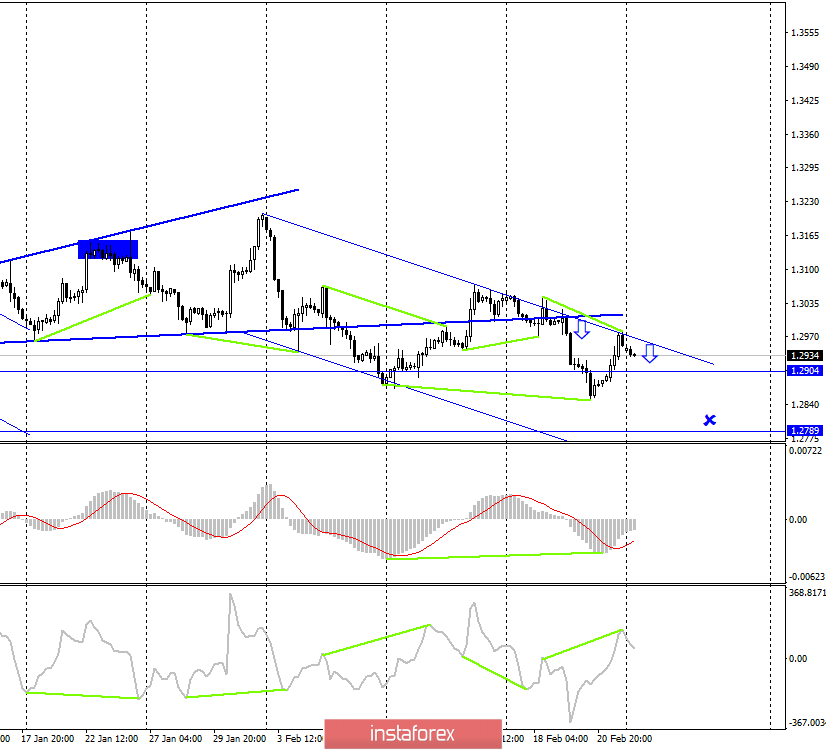

GBP/USD – 4H.

As seen on the 4-hour chart, the GBP/USD pair made another return to the upper line of the descending trend corridor and another rebound from this line. Thus, on February 24, a reversal was made in favor of the US dollar and the fall of quotes in the direction of the second target level of 1.2789 can be resumed. Based on the COT report, this behavior of traders and the pair itself is expected, however, we will return to this report later. So far, I can conclude that bull traders are not able to close over the trend area, so the "bearish" mood persists; bear traders are very reluctant to increase sales of the British. Closing the rate of the pound/dollar pair over the trend area will work in favor of the pound and cancel all trading signals for sale.

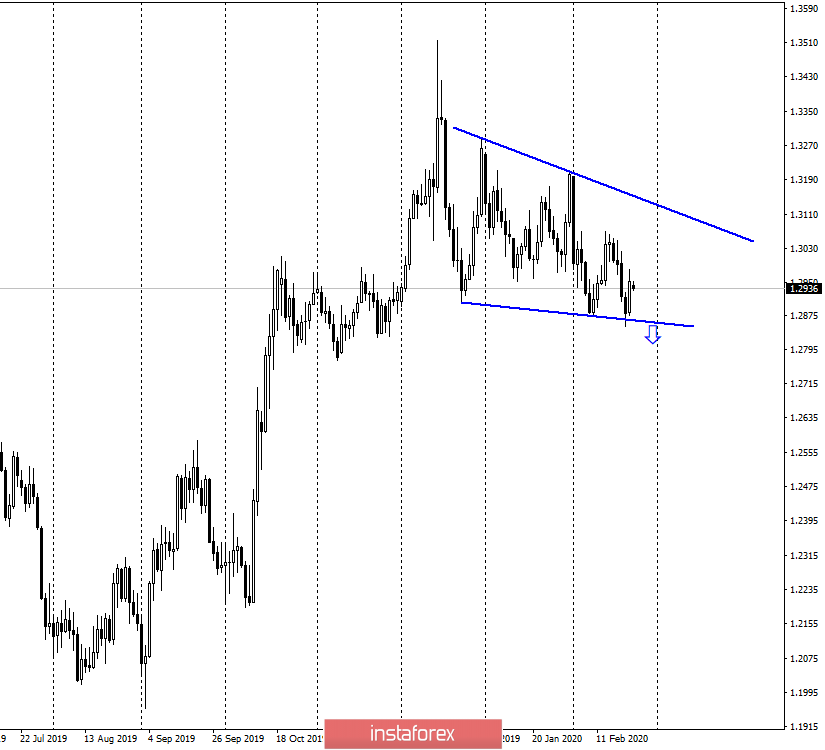

GBP/USD – Daily.

The daily chart shows a narrowing triangle, which is more like just two trend lines. I do not expect growth to the upper line of this triangle at this time since the pair rebounded from the upper line of the descending corridor on the 4-hour chart. Thus, we can conclude that the pair is currently being held from further falling by the descending trend line on the daily chart. Closing quotes below will increase the chances of continuing the fall of the British dollar.

News overview:

On Friday, February 21, business activity indices in the services and manufacturing sectors were released in the UK. The first index declined slightly, however, the second rose immediately to 51.9. After lunch, the indices of business activity in America were released, which were worse than traders' expectations. Thus, the British and American statistics caused an increase in demand for the pound.

The economic calendar for the US and the UK:

The news calendar for the countries of the USA and Great Britain is empty on February 24.

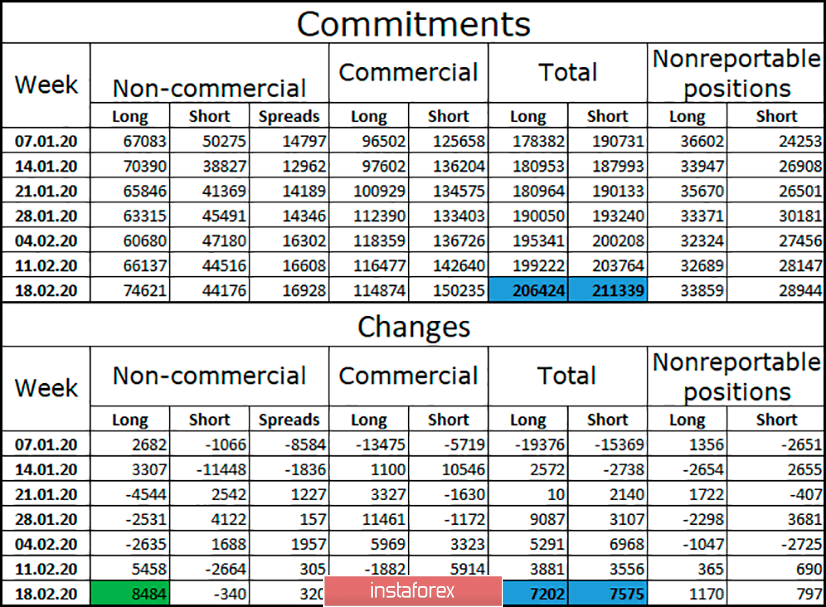

COT Report (Commitments of traders):

The first thing you should immediately pay attention to is the almost complete equality between general requests for long and short positions ("commitments"). The second is almost complete equality between the general changes for the week before February 18 in the short and long positions. Since both traders and major market players buy and sell the pound, the pair's exchange rate changes very reluctantly. That is, these events are expressed in the form of frequent corrections on the charts. On a 4-hour chart, this is the most visible picture. The goal of 1.2789 cannot be worked out for more than a week, although the trading idea for sales does not find grounds for its cancellation. According to the latest COT report, large speculators are increasing their long positions, while hedgers are increasing their short positions. The advantage is still on the side of the hedgers, but in general, there is equality.

Forecast for GBP/USD and recommendations for traders:

The trading idea is to sell the pound with a target of 1.2789, as the pair again performed a rebound from the upper line of the corridor on the 4-hour chart. However, the COT report speaks in favor of equality of positions between bull and bear traders. Thus, the fall may continue to the level of 1.2789 for another week, since the mood is now more "neutral" than "bearish".

Terms:

"Non-commercial" – major market players: banks, hedge funds, investment funds, private, and large investors.

"Commercial" – means commercial enterprises, firms, banks, corporations, and companies that buy currency for current operations or export-import operations.

"Non-reportable positions" – small traders who do not have a significant impact on the price.