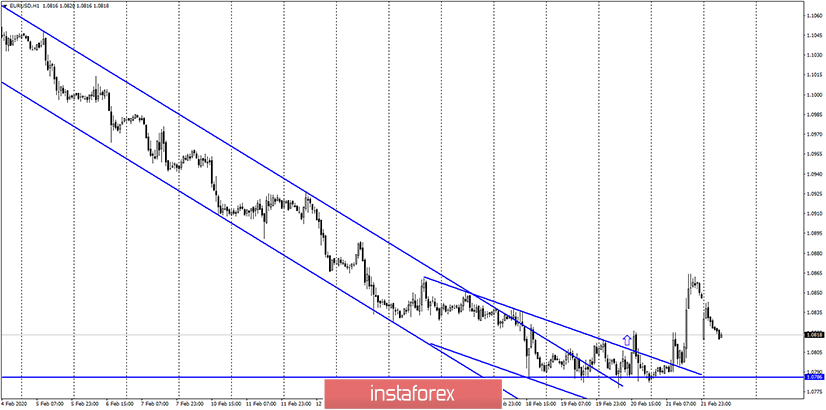

EUR/USD – 1H.

Hello, traders! According to the hourly chart, the EUR/USD pair performed a consolidation over two downward trend corridors. I also note a few rebounds from the low level of 1.0786, which did not let the quotes below itself. Thus, the euro/dollar pair performed a reversal in favor of the euro and began the growth process. At the same time, the pair's quotes are falling again today. At the very end of Friday, a reversal was made in favor of the US dollar and the process of falling was resumed. Thus, the pair's upward prospects are now ambiguous. I consider the level of 1.0786 to be the key one now. Above it, the "bullish" mood of traders remains. Below it, the mood will become "bearish" again.

EUR/USD – 4H.

According to the 4-hour chart, after the formation of several bullish divergences and falling far below the downward trend corridor, the quotes of the EUR/USD pair still performed a reversal in favor of the euro and began the process of growth in the direction of the corridor. At the same time, the situation is the same as on the hourly chart. Already, we can see a reversal in favor of the US currency and the beginning of a fall, which may result in the resumption of the process of falling quotes. Thus, on the 4-hour chart, I consider the low of the last bullish divergence to be the reference level. Closing quotes below will work in favor of resuming the fall.

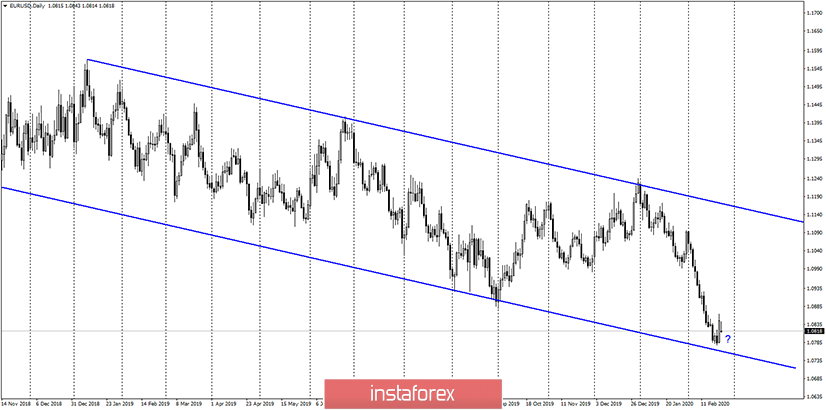

EUR/USD – Daily.

As seen on the daily chart, the euro/dollar pair fell almost to the lower line of the descending trend corridor, however, it still did not work out. Thus, this chart allows traders to assume that the price drop will resume for a more confident and clear working out of the lower line of the corridor. This period leaves opportunities for the euro to continue falling.

EUR/USD – Weekly.

The weekly chart shows that the pair is in a strategically important area - near the lower border of the narrowing triangle. So I'm still waiting for either a rebound from this line (approximately 1.0767 level) or a close below it. This line will determine the future of the pair.

News overview:

On February 21, there were several interesting economic reports in Germany, the European Union, and America. If the European and German business activity indices did not attract the attention of traders, and inflation in the European Union was at the level of December, the business activity indices in America in the manufacturing and services sectors unexpectedly fell, especially manufacturing, which forced traders to buy the euro or rather sell the dollar on Friday.

News calendar for the United States and the European Union:

The news calendar for the US and EU countries is empty on February 24.

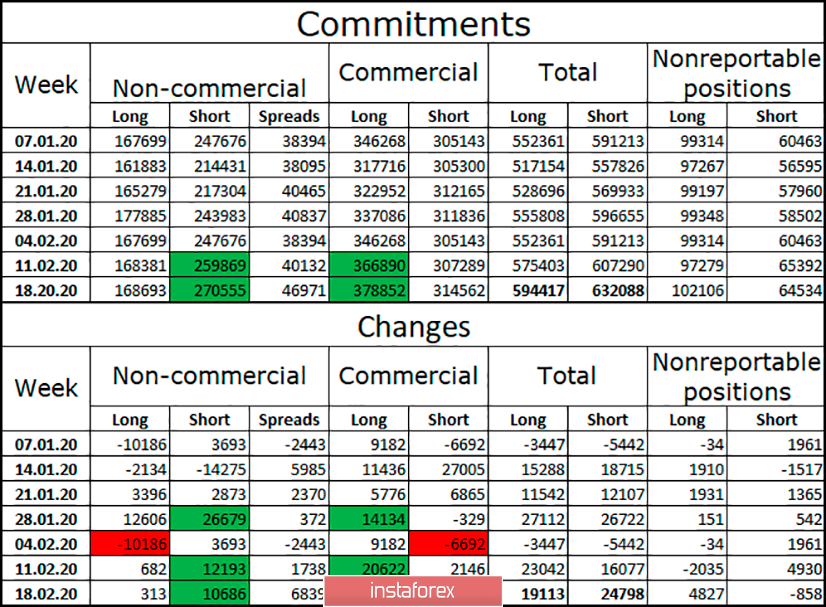

COT report (Commitments of traders):

For the week of February 18, short positions of large speculators increased to 270,555, while long positions did not change. Among the "commercial" group, both short and long positions have increased and the total number ("total") remains in favor of short. Thus, the first conclusion: the global mood of traders remains "bearish". This mood is provided mainly by speculators because companies prefer long positions to hedge risks when the euro falls. In the "changes" section, we again see a strong increase in short positions for "non-commercial" and a minimal increase in long positions. And the "commercial" group's long positions are growing, however, the number of short positions is also increasing. Thus, it is possible that the "bearish" mood has not yet dried up. Large market participants have not yet started to get rid of short and build up long positions.

Forecast for EUR/USD and recommendations for traders:

According to the latest COT report, purchases of the euro no longer look so attractive. There are buy signals on the hourly and 4-hour charts, however, they are counter-trend and clearly corrective. I would recommend that you do not rush to buy the pair yet and sell - not before closing at 1.0786.

Terms:

"Non-commercial" – major market players: banks, hedge funds, investment funds, private, and large investors.

"Commercial" – means commercial enterprises, firms, banks, corporations, and companies that buy currency for current operations or export-import operations.

"Non-reportable positions" – small traders who do not have a significant impact on the price.