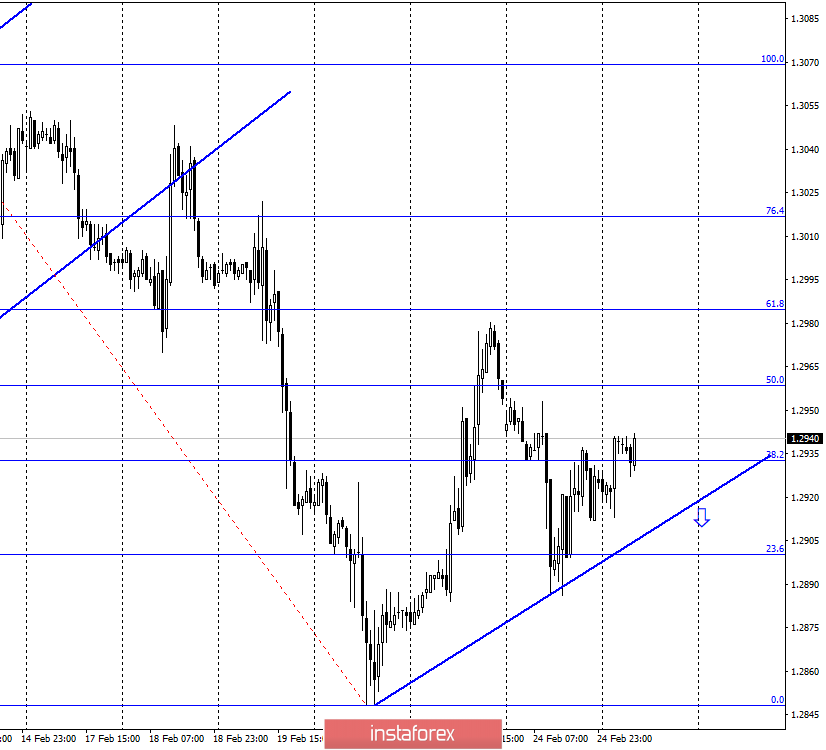

GBP/USD – 1H.

Hello, traders! According to the hourly chart, the GBP/USD pair performed a fall to the corrective level of 23.6% (1.2900), a reversal in favor of the British and a resumption of growth in quotes. An upward trend line was formed, which now supports the "bullish" mood of traders on the lowest chart. Thus, the growth process on February 25 can be continued in the direction of the corrective levels of 50.0% (1.2958) and 61.8% (1.2985). Closing the pair's rate below the trend line will work in favor of the US dollar and resuming the process of falling with the goals that will be determined on the senior charts.

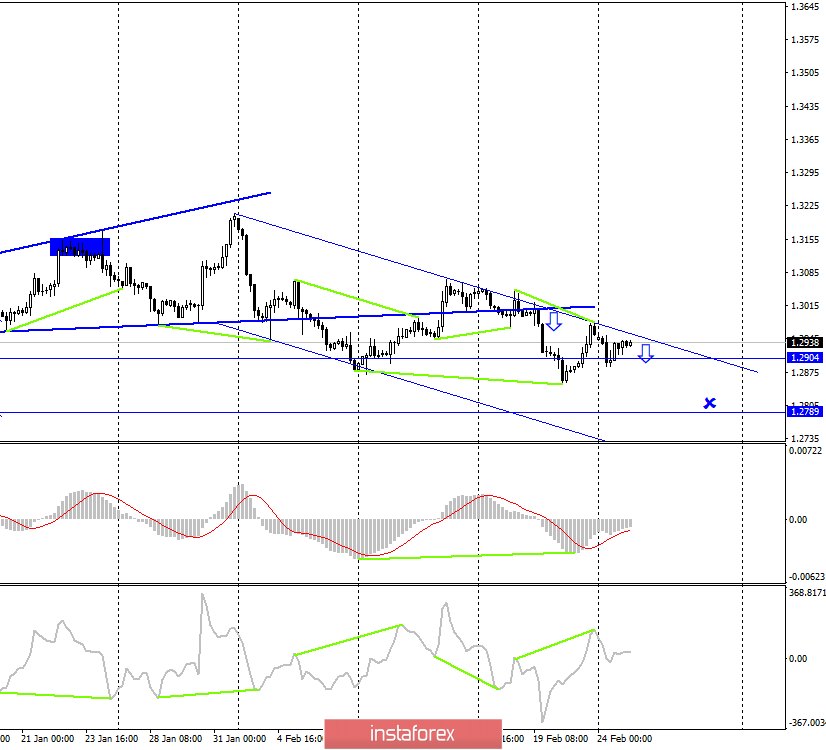

GBP/USD – 4H.

As seen on the 4-hour chart, the GBP/USD pair performed a new reversal in favor of the British currency yesterday and returned to the upper line of the downward trend corridor. Thus, now traders can again count on a rebound from this line with an attempt to resume the fall of the pair's quotes. According to the COT report, the positions of bull and bear traders are almost identical in terms of volume and quantity. Therefore, I concluded yesterday that we should not expect a sharp and strong resumption of the fall of the British dollar. Although this option is the most important. Fixing the rate of the pound/dollar pair above the upper line of the corridor will significantly increase the probability of growth of the pound and cancel all previous trading ideas and signals for sale.

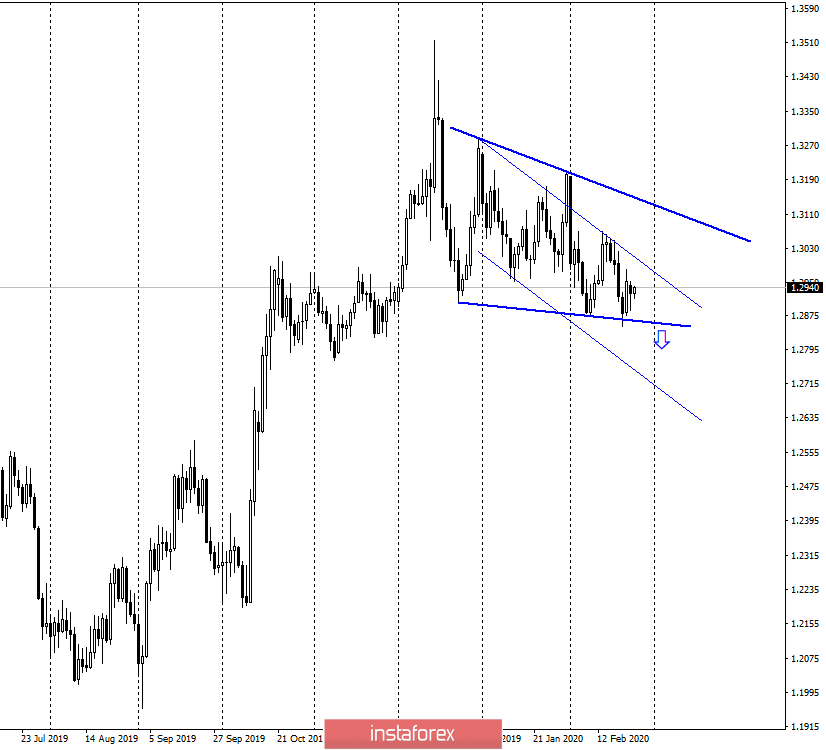

GBP/USD – Daily.

On the daily chart, in addition to two trend lines resembling a narrowing triangle, a descending trend corridor has been formed, which defines the current mood of traders as "bearish". Thus, the downward sentiment prevails now, but there are too many "buts" that do not allow the pair to fall right now. Closing quotes on the daily chart below the lower trend line will significantly increase the likelihood of a further fall in the British dollar.

News overview:

No important reports were released in the UK or the US on Monday, February 24.

The economic calendar for the US and the UK:

The news calendar for the countries of the USA and Great Britain is empty on February 25.

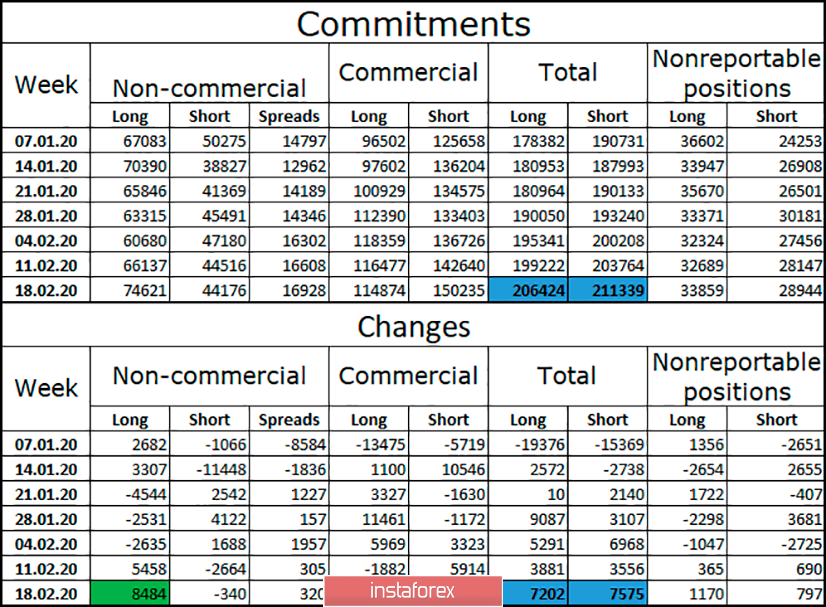

COT report (Commitments of traders):

I immediately draw the attention of traders to the almost complete equality between the general requests for long and short positions ("commitments"). The second is almost complete equality between changes ("changes") for the week before February 18 in the short and long positions. Since in general, all traders and major market players both buy and sell the pound, the pair's exchange rate changes very reluctantly, that is, these events are expressed in the form of frequent and deep corrections or the absence of a trend on the charts. On the 4-hour chart, this is what is best seen now. The goal of 1.2789 cannot be worked out for more than a week, despite the fact that the trading idea for sales does not find grounds for its cancellation. According to the latest COT report, large speculators are increasing their long positions, while hedgers are increasing their short positions. The advantage is still on the side of the hedgers, but in general, there is equality.

Forecast for GBP/USD and recommendations for traders:

The trading idea is to sell the pound with a target of 1.2789 if the pair again performs a rebound from the upper line of the corridor on the 4-hour chart. However, the COT report speaks in favor of equality of positions between bull and bear traders. Thus, the fall can continue to the level of 1.2789 for a fairly long period. Closing above the trend corridor on the 4-hour chart will cancel all sales signals.

Terms:

"Non-commercial" – major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" – means commercial enterprises, firms, banks, corporations, and companies that buy currency for current operations or export-import operations.

"Non-reportable positions" – small traders who do not have a significant impact on the price.