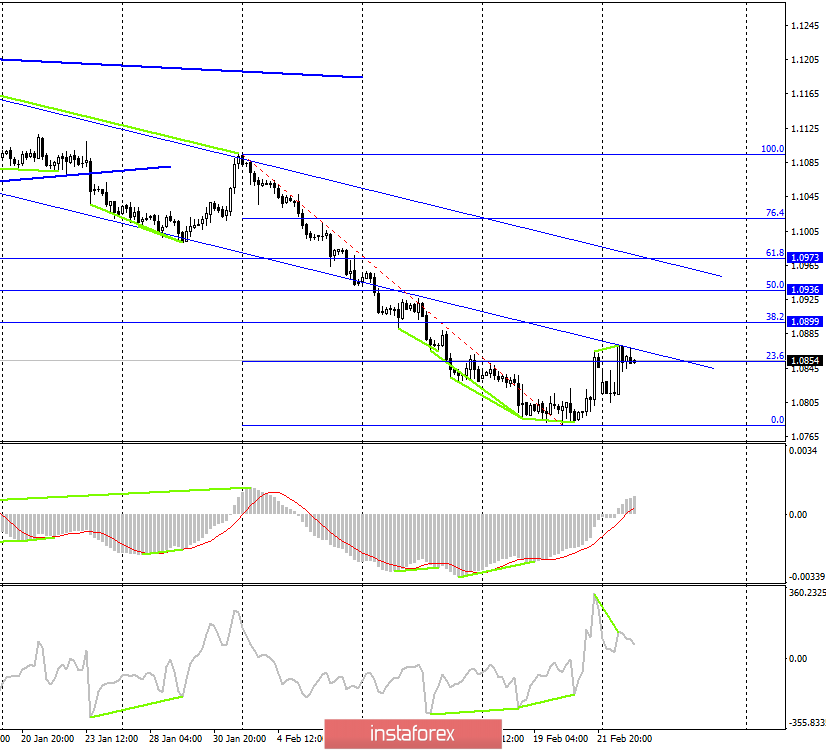

EUR/USD – 1H.

Hello, traders! According to the hourly chart, the EUR/USD pair performed a new reversal in favor of the European currency and resumed the growth process after a series of unsuccessful attempts to close at 1.0786. Thus, the current "bullish" mood has developed on the lowest chart. A new upward trend line has been formed, which now supports the new trend. Closing the pair's quotes below this line will work in favor of the US currency and the resumption of a more global downward trend. The goals for possible purchases of the euro are indicated on the higher charts.

EUR/USD – 4H.

As seen on the 4-hour chart, after the formation of several bullish divergences, the pair's quotes performed an increase to the lower line of the descending trend corridor, below which they left much earlier. A bearish divergence has formed in the CCI indicator, which allows traders to expect a reversal in favor of the US dollar and a slight fall in the direction of the corrective level of 0.0% (1.0779). Fixing the euro/dollar exchange rate above the divergence peak will increase the probability of continuing growth in the direction of the Fibo levels of 38.2% (1.0899), 50.0% (1.0936) and 61.8% (1.0973).

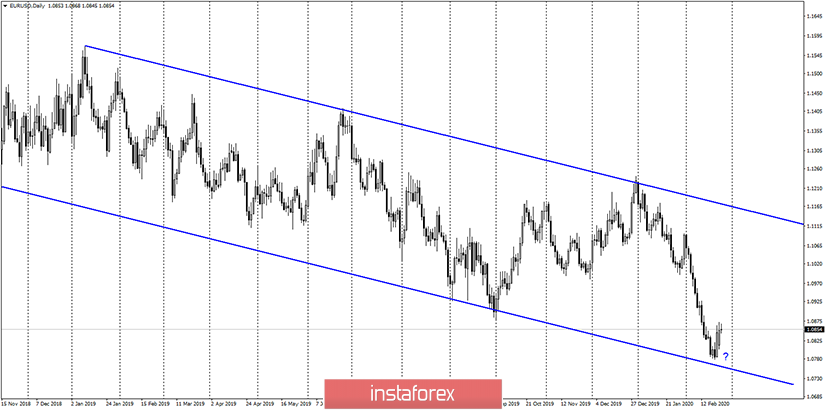

EUR/USD – Daily.

As seen on the daily chart, the euro/dollar pair fell almost to the lower line of the descending trend corridor, however, it did not work out. Thus, this chart suggests that the drop in quotes may still resume to the lower border of the corridor. This period leaves opportunities for the euro currency to continue falling.

EUR/USD – Weekly.

The weekly chart shows that the pair is in a strategically important area - near the lower border of the narrowing triangle. So I'm still waiting for either a rebound from this line (approximately 1.0767 level) or a close below it. At the moment, we can say that the pair performed a rebound from the lower line of the triangle. Thus, in the long term, we can expect a fairly strong growth of the euro in the area of 1.1500. However, this goal is for the whole of 2020.

News overview:

On February 24, no important news was released in the United States and the European Union. The information background was completely empty.

News calendar for the United States and the European Union:

Germany - GDP for the fourth quarter (07:00 UTC+00).

The only report of the day is GDP in Germany, the country with the largest economy in the EU. Thus, this indicator is quite important for traders. Traders expect a value of 0.4% y/y. A value above or below the forecast will determine the mood on February 25.

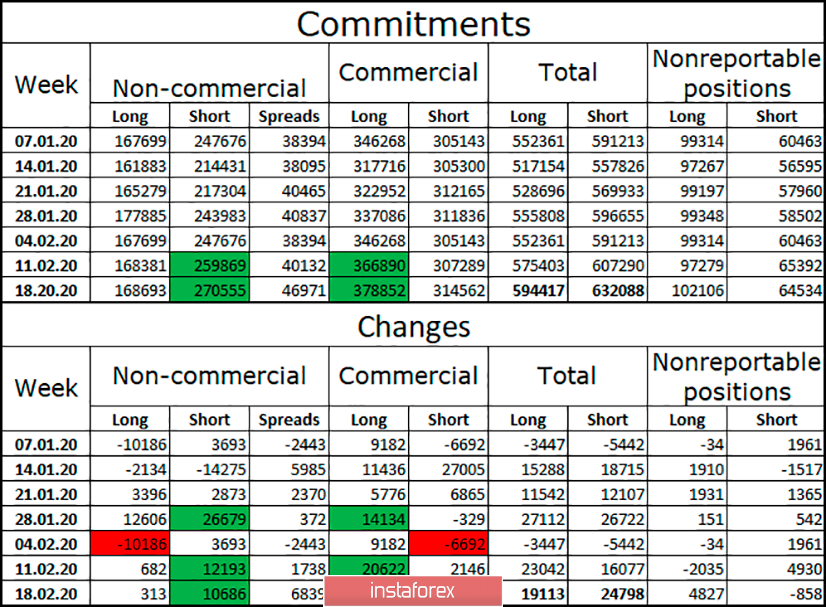

COT report (Commitments of traders):

For the week of February 18, short positions of large speculators increased to 270,555, while the number of long positions remained virtually unchanged (168,693). Among the "commercial" group, both short and long positions have increased, and the total number ("total") remains in favor of short (a margin of 36,000). Thus, the conclusion: the global mood of traders remains "bearish". This mood is provided by speculators because companies prefer long positions to hedge risks with the euro falling in recent weeks. In the "changes" section, we again see a strong increase in the number of short positions for "non-commercial" and a minimal increase in long positions. And the "commercial" group's long positions are growing, however, the number of short positions is also increasing. Thus, it is possible that the "bearish" mood has not yet dried up. Large market participants have not yet started to get rid of short positions and build up long positions.

Forecast for EUR/USD and recommendations for traders:

According to the latest COT report, purchases of the euro no longer look so attractive. However, the graphical analysis on all four charts suggests growth, which may even be long-term. So, I would recommend getting up in the long positions a bit, starting with the smallest charts – hour and 4-hour. For example, buy the euro after closing above the bearish divergence peak with targets of 1.0899, 1.0936 and 1.0973. I recommend selling not earlier than the close below the low level of 1.0786 or the trend line on the hourly chart.

Terms:

"Non-commercial" – major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" – means commercial enterprises, firms, banks, corporations, and companies that buy currency for current operations or export-import operations.

"Non-reportable positions" – small traders who do not have a significant impact on the price.