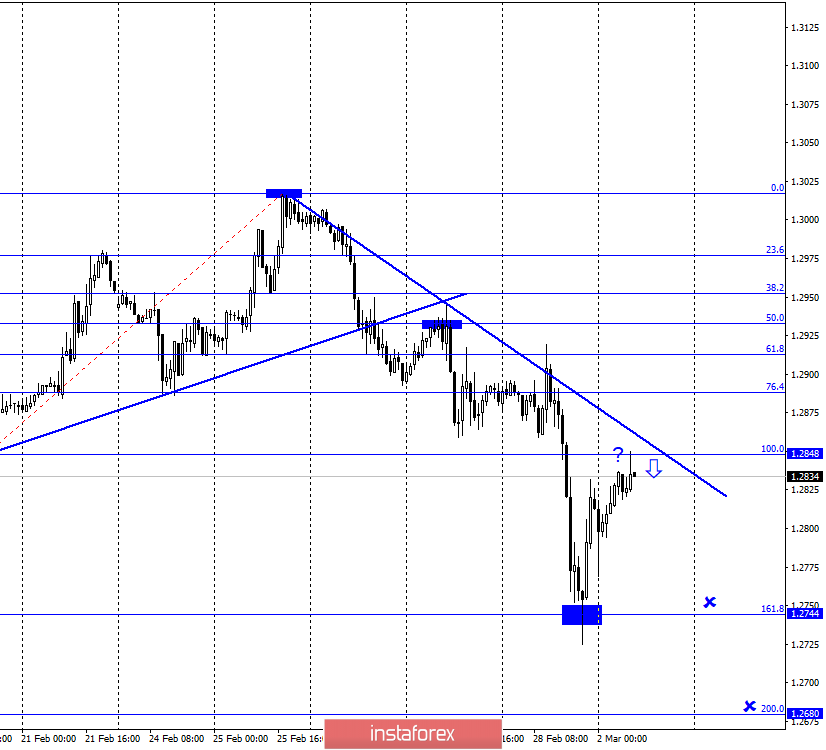

GBP/USD-1H.

Hello, traders! According to the hourly chart, the GBP/USD pair performed a rebound from the corrective level of 161.8% (1.2744), a reversal in favor of the British and a return to the Fibo level of 100.0% (1.2848). Both goals that I gave last week have been worked out by traders. Thus, sales signals with these goals are no longer relevant. But already today, a new sales signal can be formed for the pound/dollar pair if the rebound from the Fibo level of 100.0% is performed. In this case, I will expect the quotes to fall in the direction of the corrective levels of 161.8% (1.2744) and 200.0% (1.2680). New descending trend line keeps the bearish mood of traders.

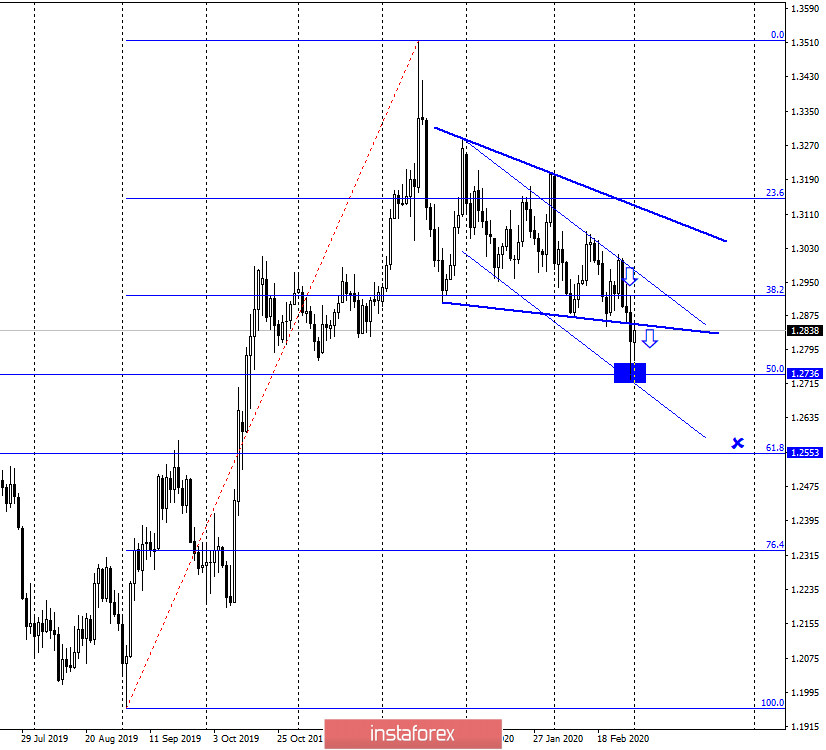

GBP/USD-4H.

According to the 4-hour chart, the GBP/USD pair performed a consolidation under the almost sideways trend corridor, thus increasing the probability of a further drop in quotes in the direction of the low level of 1.2581. However, on Friday, the pullback immediately began, so the pair has every chance to return to the side corridor. Anyway, I think that now the hourly chart is more informative and a specific trading signal can be formed on it. There are no pending divergences in any indicator.

GBP/USD-Daily.

According to the daily chart, the quotes of the pound/dollar pair fell to the corrective level of 50.0% (1.2736) and rebounded from it. Thus, now the growth process can even begin, despite the fact that this chart has two signals for sales at once (rebound from the upper line of the descending corridor and consolidation under the lower trend line). However, the COT report, which will be discussed below, will show why the growth of the British is now even more preferable.

News overview:

On Friday, February 28, there was no news in the UK, and reports on changes in income and spending levels among the American population were released in the US. I can't say that these reports had any impact on trading and the mood of "traders". More global topics were on the agenda: the coronavirus, the collapse of the US stock market, and rumors of a Fed rate cut.

The economic calendar for the US and the UK:

Great Britain - index of business activity in the manufacturing sector (09:30 UTC +00).

USA - Markit index of business activity in the manufacturing sector (14:45 UTC +00).

USA - index of business activity in the manufacturing sector according to the ISM version (15:00 UTC +00).

Three reports on business activity in the UK and American manufacturing sectors. Each is important in its own way, so you should not skip them. They can change the intraday mood of traders.

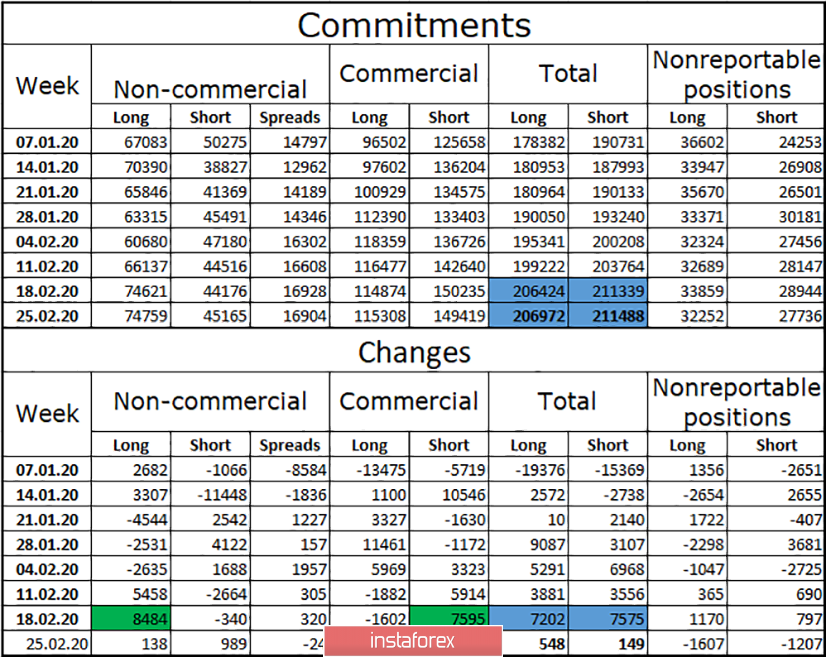

COT report (Commitments of traders):

The penultimate COT report was that there was almost complete equality between the total number of long and short positions. The changes were minimal. The last report from February 25 witnessed the same thing. There are no significant changes. The total number of long and short positions remains approximately the same. Changes over the past week are completely absent, both groups "Commercial" and "Non-commercial" signed very few new contracts, no more than 1000. General changes are minimal and insignificant. Thus, equality between bull and bear traders is maintained. This means that it is now difficult to count on the continuation of the fall of the British.

Forecast for GBP/USD and recommendations for traders:

The trading idea for March 3 is to sell the pound with targets of 1.2744 and 1.2680 if the rebound from the level of 1.2848 is completed. If the closing is performed above it and the correction line on the hourly chart, the growth will be more preferable. However, there are no trading signals for purchases now.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, and companies that buy currency not for speculative profit, but for current operations or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.