The single European currency is compelled to move forward no matter what. It aims for growth. However, there were no objective reasons for this. Rather, the dollar should increase its price. So, honestly, we can say that this is just the panic that the media spread around the coronavirus. Although the number of people in China who have recovered is already beginning to exceed the number of its affected cases. And although the virus is clearly spreading to other countries, the dynamics there will be clearly no worse. Everything will, most likely, smooth out as the doctors have clearly already worked out some treatment methods to help cure and eradicate the epidemic. Consequently, the growth of the single European currency is exclusively emotional and even speculative in nature. Well, this suggests that a reversal is inevitable, and it will be sharp and strong.

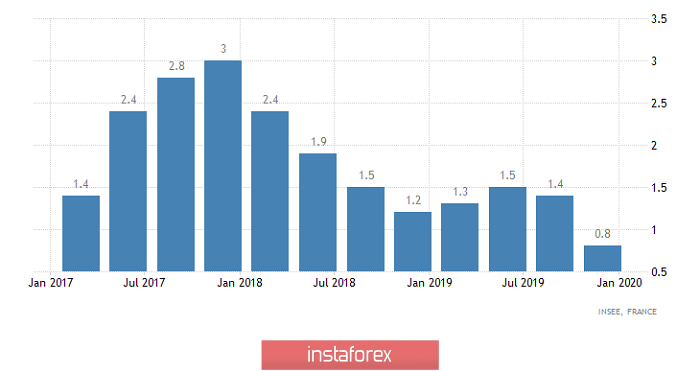

Nevertheless, European statistics are causing more and more concern. Probably the only thing that can be attributed to positive factors is the invariance of unemployment and inflation in Germany. The good news ends here. In France, they regretfully recognized that the pace of economic growth slowed down from 1.4% to 0.8%. Amidst this chaos, a decrease in inflation was reported from 1.5% to 1.4%. In Italy, they also recorded a decrease in inflation from 0.5% to 0.4%, which was also recorded in preliminary data. The most interesting part of the situation lies in the fact that they were waiting for its growth to 0.6%. Thus, there was simply no reason for the growth of the single European currency. At least, macroeconomic data for the three largest countries in the euro area suggest otherwise.

GDP growth rate (France):

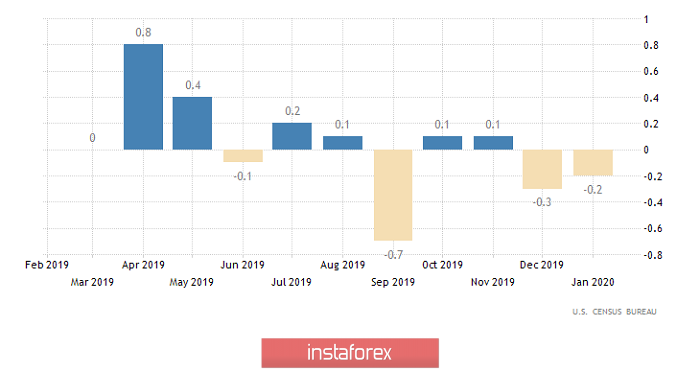

It is ridiculous, but American statistics did not give rise to the growth of the single European currency. Of course, we can say that, they say, personal incomes of Americans grew by 0.6%, and expenses by only 0.2%. Well, outstripping growth in incomes more likely indicates an increase in savings and a decrease in consumer activity. Which, of course, is a negative factor for the dollar. However, do not forget that in the previous month, revenues grew by 0.1%, and expenses by 0.4%. Consequently, the outstripping growth of income in the reporting period is nothing more than the balancing of imbalances and does not entail any risks. Moreover, wholesale inventories decreased by 0.2%. And this is their second consecutive reduction, which inspires optimism in the growth potential of the industry, which is still showing a decline.

Wholesale Stocks (United States):

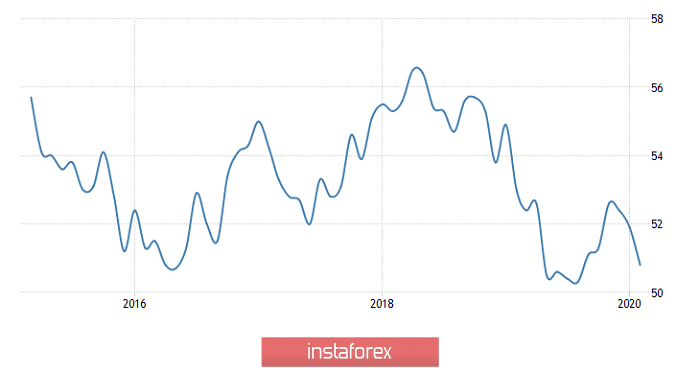

In the morning, contradictory data began to come from Europe, which were nevertheless received with optimism. Everyone paid attention only to the pan-European index of business activity in the manufacturing sector, which grew from 47.9 to 49.2. The bottom line is that growth was projected to 49.1. This is largely due to Germany, where the index of business activity in the manufacturing sector grew from 45.3 to 48.0 and not to 47.8. Spain, on the other hand, also performed well, where the index of business activity in the manufacturing sector grew from 48.5 to 50.4 with a forecast of 49.1. Incidentally, Spain reported on a further decline in the number of tourists whose total number is now by 1.4% and not by 0.9% less than the previous year. And I want to note that this is data for January when we did not think about any coronavirus in Europe yet. Then generally actively discussed that the virus spreads only among ethnic Chinese. In France, they were already waiting for a decrease in the index of business activity in the manufacturing sector from 51.1 to 49.7. But in fact, everything turned out to be a little better, since it was reduced only to 49.8. Meanwhile in Italy, the index of business activity in the manufacturing sector fell from 48.9 to 48.7. And even though the decrease is small, and you can just wave it off, it is worth noting that preliminary data showed an increase to 49.5.

In any case, it is too early to talk about some kind of revival of the European economy, since the situation in the largest countries is completely different. Somewhere signs of improvement are visible, and somewhere deterioration. Germany alone is unable to pull out the whole of Europe.

Manufacturing PMI (Europe):

Nevertheless, there is every reason to believe that at least today the growth of the single European currency will continue, as American statistics do not inspire optimism. Yes, the Markit manufacturing activity index should show a decline from 51.9 to 50.8. However, it was already taken into account by the market even at the time of publication of the preliminary data. This can not be said about similar data from ISM, which can show a decrease in the index of business activity in the manufacturing sector from 50.9 to 50.2. So the hopes for the restoration of industry, which appeared after the publication of wholesale stocks, should be put aside until better times. Thus, there is still hope for construction costs, which may grow by 0.5%. But after a decrease of 0.2%, this is more likely to equalize, rather than to increase activity in this sector. In addition, these data are coming out quite late, and the only thing they will be able to do is to stop the growth of the single European currency.

Manufacturing PMI (United States):

Thus, a single European currency may well test the 1.100 mark. But at this point, it clearly cannot gain a foothold above. Rather, preparations for the next wave of decline will begin from this level. Also, the correction has been asking for a long time making investors having a hard time bearing it thus, conducted it without any clear reason.