While investors' attention is focused on the fastest correction of the US stock market from the levels of record highs in history, and the weekly correlation of the S&P 500 and USD/JPY has grown to 64%, it is not surprising that the most interesting currency on Forex is the yen. A few days ago, it was wandering in the area of the 10-month bottom against the US dollar, but then events began to develop so rapidly that the strengthening of the currency of the Land of the Rising Sun to a 20-week high is no surprise to anyone.

Jerome Powell's statement that the Fed will act depending on the circumstances raised the chances of three acts of monetary expansion in 2020 to 80%. The futures market is absolutely sure that the federal funds rate will be reduced from 1.75% to 1.5% at the meeting on March 17 and 18, and there are rumors on forex that the central bank will do this earlier at an unscheduled meeting. The main goal is to keep US stock indices from further selling off. The weakening of monetary policy is a "bearish" factor for any currency, so the sellers of USD/JPY, thanks to the "dovish" rhetoric of the Fed Chairman, managed to conduct the most rapid daily attack since May 2017.

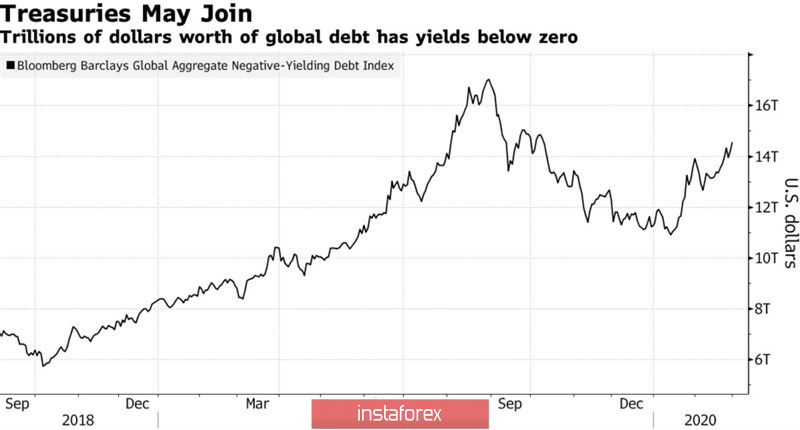

They were not deterred even by Haruhiko Kuroda's statement that the Bank of Japan would seek to ensure liquidity and stability in financial markets through asset purchases. Rumors have spread around the market that central banks issuing G10 currencies intend to implement a coordinated easing of monetary policy in order to counteract the slowdown in global GDP. In such circumstances, the scale of the global debt market with negative yields is growing, which is good news for the yen. Since mid-January, the figure has increased from $11 trillion to $14 trillion. In Japan, the yield is negative, and the reduction of the differential with US Treasury bonds is a strong argument in favor of selling USD/JPY.

Dynamics of the global debt market with negative rates

The increased attention to the yen is due not only to the S&P 500 correction but also to the saturation of the economic calendar across the States. Releases of data on business activity in the manufacturing sector and in the service sector, as well as statistics on the US labor market, will help answer the question of whether the US economy will actually slow down in the first quarter. If not, then interest in stocks issued in the United States will return, investors will talk about a good opportunity to buy, and the USD/JPY pair will find a bottom. On the contrary, disappointing statistics can add fuel to the S&P 500 pullbacks and further strengthen the yen.

One of the factors of its weakening at the end of the second decade of February was the increased risks of a recession in the Japanese economy. Nevertheless, Prime Minister Shinzo Abe said that in order to fight the coronavirus, he is ready to expand the fiscal stimulus by another $2.5 billion.

Technically, the USD/JPY pair came within arm's length of the target by 113% using the "Shark" pattern. There is also an important pivot level, which increases the probability of bottom formation with subsequent correction in the direction of 23.6%, 38.2% and 50% of the CD wave.

USD/JPY, the daily chart