On Friday night, Fed Chairman Jerome Powell announced his readiness to use their tools and act accordingly to support the economy. This statement means that the Fed regards the threat of a large-scale recession amid the spread of coronavirus which is most likely requiring an immediate reaction, and therefore, scenarios of rate cuts in September became irrelevant.

Markets are inclined to believe that the rate will be reduced by 0.25% in March. Moreover, forecasts have already appeared that a decrease of 0.5% is possible right away while delaying the exit from the liquidity expansion program. These steps so far seem redundant, but the Fed, apparently, intends to prepare the markets for a sharp deterioration in the situation.

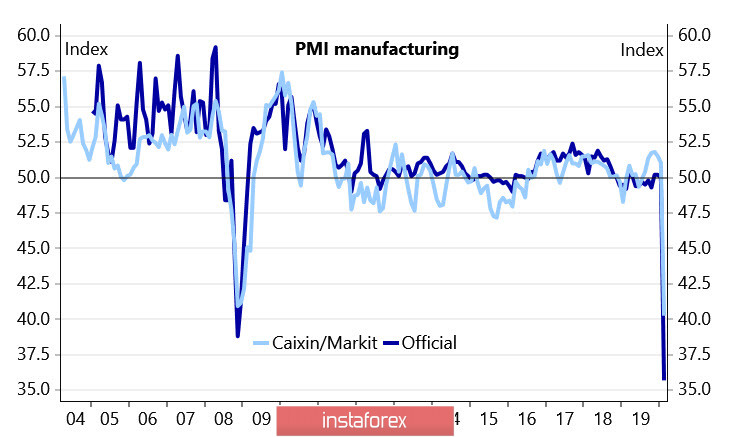

There are grounds for such a conclusion and this is a strong and hardly controlled fall in China, which will entail a drop in activity around the world. The PMI Caixin index in the manufacturing sector fell to 40.3, and the official one to 35.7, which is worse than during the 2008 crisis, the service sector drop is completely unprecedented from 54.1p to 29.6p.

A wave of decline in activity will inevitably lead to a drop in consumption, and the latest reports published on Friday confirm this conclusion that both spending and price indices in the US in January fell more than what was forecasted, and it is obvious that data for February will be much worse.

Powell's speech provoked a massive correction of the dollar, its depth will depend on the reaction of other Central Banks. This morning, the Bank of Japan has already announced emergency measures to support banks, so the weakness of the dollar is likely to be short-lived.

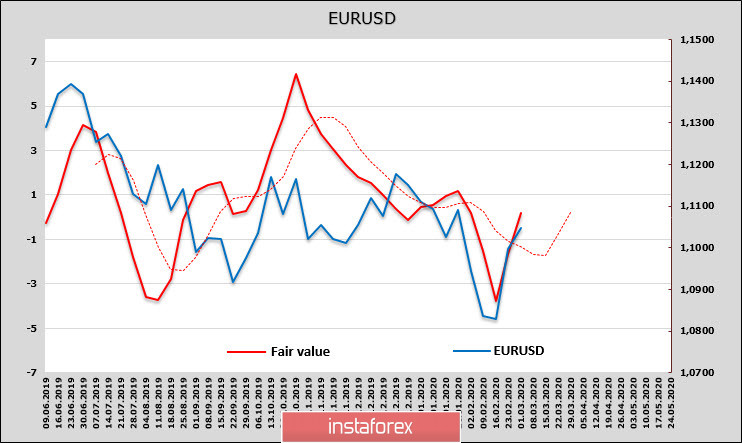

EURUSD

Bearish sentiment against the euro has increased significantly - net shorts increased by $ 3.1 billion, the volume reached 15.5 billion, or 11.4 thousand contracts. This is the biggest bearish rate on the euro in more than 3 years, and now we need to understand whether this long-term trend will develop or if the dollar is waiting for a pullback in the light of Powell's recent statements.

There are two points to pay attention to. Firstly, the strong preponderance of euro shorts did not lead to a further fall in the estimated fair price, that is, this parameter is balanced by others, such as the state of stock markets and the dynamics of returns. Secondly, the estimated and spot prices are close, so there are currently no reasons for a strong movement in one direction or another.

Further movement of the euro will largely depend on the ECB's response to the changing situation. Lagarde said last week that coronavirus would not have a lasting effect on inflation and would not require monetary policy measures. Philip Lane has a different opinion - policy mitigation should be prioritized. Jens Weidmann from the Bundesbank put it even more vaguely, saying that he could imagine higher prices due to shock supply problems.

On Friday, the probability of a decrease in the ECB rate was estimated at about 50/50, today it can grow slightly, this will restrain the strengthening of the euro. In the meantime, the upward movement should be considered a priority, an attempt to test the resistance 1.1238 is likely if it is possible to pass the nearest resistance 1.1172 on the current wave.

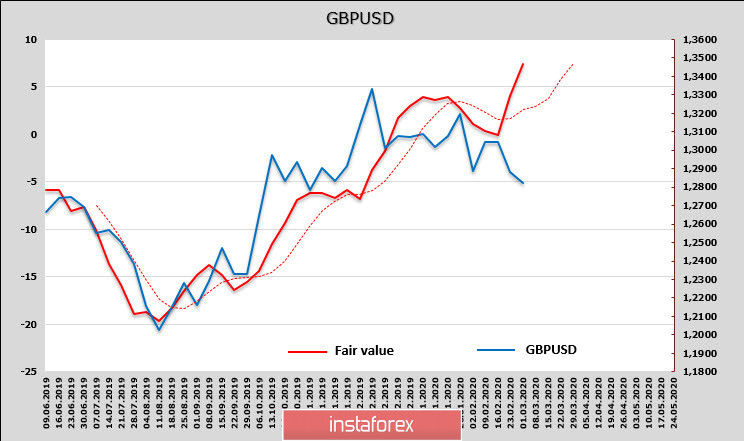

GBPUSD

The UK PMI in the manufacturing sector fell slightly in February from 51.9p to 51.7p, and consumer and mortgage lending also increased in January, which gives a good chance of consumer activity in February and will support the pound.

The estimated fair price is confidently looking up, a strong gap with the spot price gives reason to look for support at levels close to current and the resumption of growth of the pound.

Today, the EU and the UK begin a negotiated marathon on a trade agreement after Brexit. If the pound holds above the 1.2730 / 40 zone and there are no new panic comments in the next day, then the pound is likely to grow, the resistance is 1.2848, 1.2903, the goal is to return to the upper border of the downward channel 1.2940 / 50.