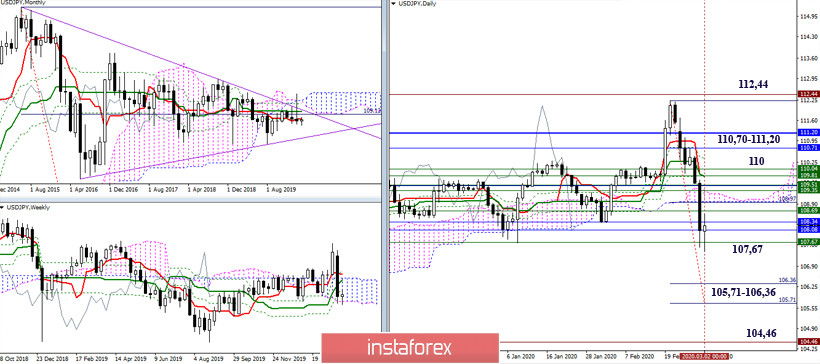

USD / JPY

In February, the bullish players made a new attempt to break through the accumulated resistance. The attempt again failed. February closed under the values of the end of January, casting up a long shadow of unrealized opportunities. As a result, the situation did not undergo significant changes and uncertainty remained. What can be expected in March? The zone of attraction, holding back the development of the situation, remains a fairly wide area of accumulation of various levels of senior time intervals in the region of 107.67 - 110 (daily cross + daily cloud + weekly cross + weekly cloud + monthly cross) . The most significant resistances remain the trend line and the monthly cloud, 110.70 - 111.20 - 112.44 may be the main value in this direction. The potential of the long upper shadow of February can now contribute to the consolidation of the pair under the monthly cross (108.34), in the bearish zone relative to the weekly cloud (107.67). In this case, the main interest of the players to lower will be directed to the fulfillment of the daily goal for the breakdown of the cloud (105.71 - 106.36), with further testing of the lower trend line and updating the minimum extremum of 104.46.

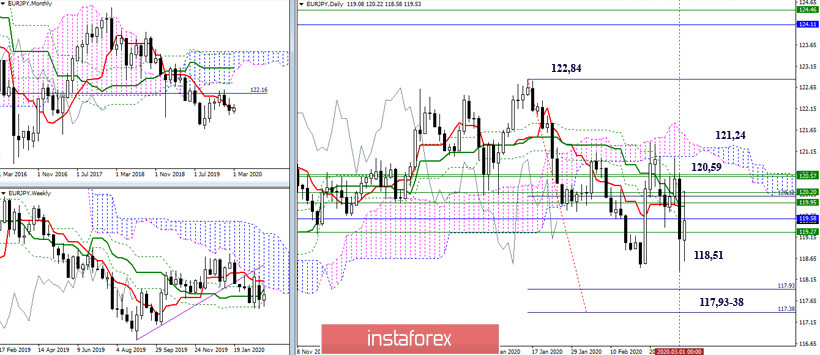

EUR / JPY

For the entire month of February, the couple spent in the zone of attraction of the weekly golden cross, having failed to liquidate it (final line 118.51). The zone of attraction and containment in February was a fairly wide area of accumulation of strong levels from different time intervals, located between 118.51 - 120.59 (daily cross + weekly cross + lower boundary of the weekly cloud + monthly Tenkan). In March, this union of levels will retain its meaning and function. The closest bearish target is the descending target for the breakdown of the daily Ichimoku cloud (117.38-93). Furthermore, the testing and updating of the minimum extremes (117.06 - 115.84) will be important. In case of consolidation above the designated zone of attraction (120.59), the breakdown of the daily cloud (121.

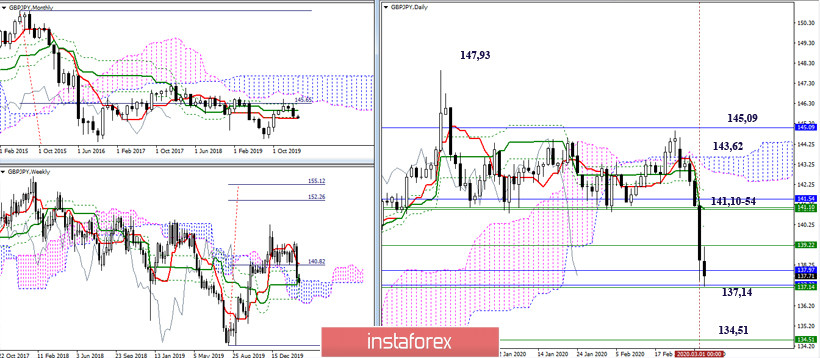

GBP / JPY

Also, the downward trend players managed to continue the weekly downward correction last month and achieved important support in the region of 137.14, where the weekly medium-term trend and the monthly short-term trend are now joining forces. Consolidation below will strengthen the bearish position and will allow you to expect a further decline. The closest reference point in this direction will be the lower border of the weekly cloud (134.51), overcoming the support will help to form new bearish prospects where the goal is to break the weekly cloud. Among the important resistance for the month of March, that we can identify is the area of 141.10-54 (daily cross + weekly cross + monthly Kijun), then the breakdown of the daily cloud (143.62), the elimination of the weekly cross Ichimoku (145.09) and exit from zones of weekly correction (147.93).

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)