Surprisingly, the pound on Friday reacted to US statistics, which the common European currency ignored. Another thing is that the pound ignored its own statistics, which were quite positive. But no growth was noticed.

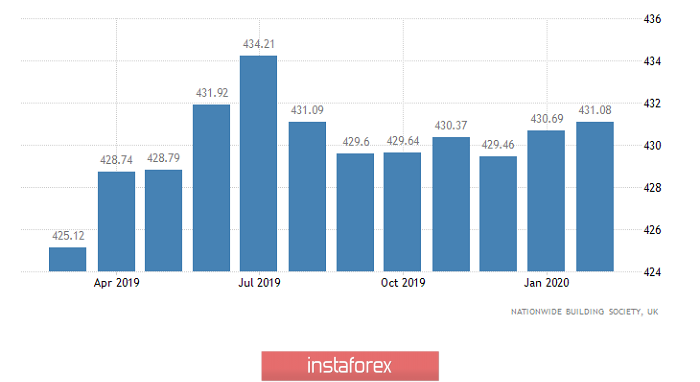

Nevertheless, nationwide data showed an acceleration in the growth rate of housing prices from 1.9% to 2.3% with a forecast of 2.0%. Given that the real estate market is almost the main criterion for determining the investment attractiveness of the UK economy, the rise in housing prices is an extremely positive factor. But strangely enough, the pound did not react to such good news.

Nationwide Housing Price Index (UK):

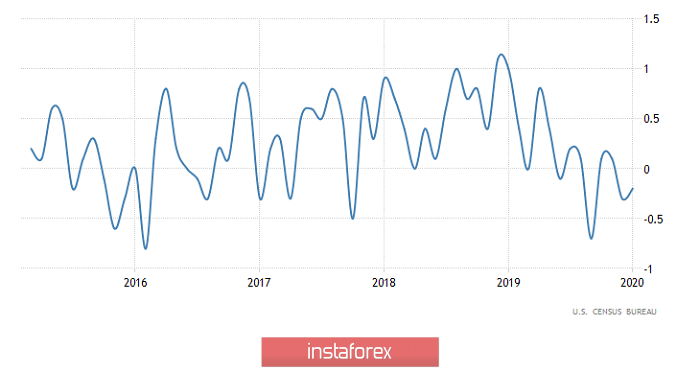

But the pound has actively reacted to US statistics, even though the reaction was excessive. Thus, personal incomes grew by 0.6%, and personal expenses by 0.2%, and, in theory, this is a negative factor, since faster growth in incomes speaks more about the potential for a decrease in consumer activity, which is the main engine of the American economy. Another thing is that in the previous month, revenues grew by 0.1%, and expenses by 0.4%. In other words, just the alignment of income and expenses. Consequently, the growth potential of consumer activity remains. But this is not enough to seriously strengthen the dollar. In addition, wholesale inventories decreased by another 0.2%, and given that they are declining for the second month in a row, this indicates a high potential for the restoration of industrial production. However, if these factors were so significant, then we would observe not only the weakening of the pound but also the single European currency. But that did not happen. And this is not surprising, since all published data speak only of prospects for the future, without guaranteeing a positive result, which consists of many factors.

Wholesale Stocks (United States):

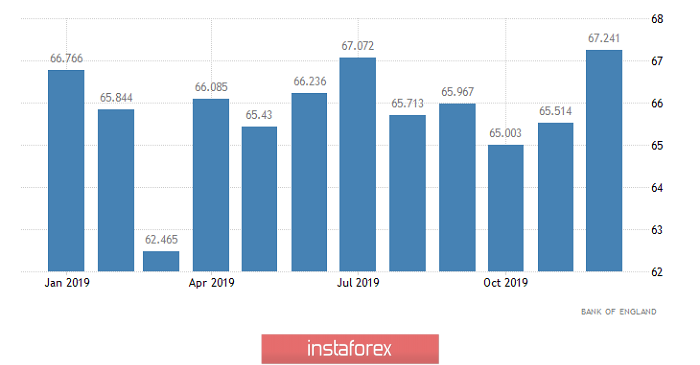

Nevertheless, such an unreasonable weakening of the pound clearly suggests that a rebound is inevitable. The only question is what will be the occasion for it. And strangely enough, today there will be such an occasion. Of course, I would like to point out the index of business activity in the UK manufacturing sector, which should grow from 50.0 to 51.9. However, preliminary data, which are already taken into account in the value of the pound, showed exactly the same thing. Today there is data on the lending market which should show an increase in mortgage lending from 4.6 billion pounds to 4.8 billion pounds. Moreover, the number of approved mortgages may increase from 67,241 to 68,200. In combination with rising housing prices, this is an excellent reason for the pound to grow, since it is only a question of the real estate market, which, as has been said many times, is the main criterion for determining the investment attractiveness of the British economy. Another thing is that optimism will be restrained, as the volume of consumer lending should only be 1 billion pounds, against 1.2 billion pounds in the previous month. So even though the pound has potential for growth, it will not be able to rebound strongly.

Mortgages Approved (UK):

Another thing is that by the evening, American statistics will come to the rescue. And do not look at the index of business activity in the manufacturing sector from Markit, which should fall from 51.9 to 50.8. The market even at the time of the publication of preliminary data took this into account in the value of the dollar. But investors have not yet included in the value of the dollar similar data from ISM, which can show a decrease in the index of business activity in the manufacturing sector from 50.9 to 50.2.

ISM Manufacturing PMI (United States):

So the pound has excellent prospects for improving its position, and during the day it can grow to 1.2875.