To open long positions on GBPUSD, you need:

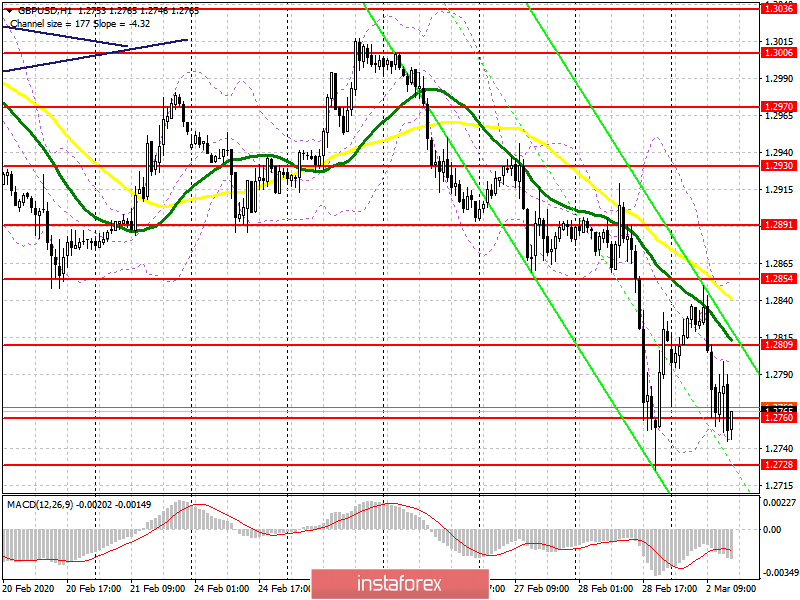

In the morning forecast, I paid attention to the possibility of reducing the pound to form the lower border of a new ascending channel, which happened. However, there is clearly not enough buyer's activity yet, and the rebound from the support of 1.2760 did not lead to the resumption of the upward correction. The task of the bulls for the second half of the day will be to hold the range of 1.2760, which will allow us to count on growth in the area of the larger resistance of 1.2809, fixing on which will give GBP/USD a boost to growth in the area of the maximum of 1.2854, where I recommend fixing the profits today. In the scenario of a further decline in the pound, I would not expect a rebound from the minimum of 1.2728, and it is best to open long positions from it after forming a false breakdown. But it is better to postpone larger long positions to the lows of 1.2664 and 1.2609.

To open short positions on GBPUSD, you need:

The sellers achieved their goal and returned the pound to the level of 1.2809, however, the key task will be to close the day below the support of 1.2760, which will keep the pair in a downward trend that can update the lows in the area of 1.2664 and 1.2609, where I recommend fixing the profits. It is unlikely that buyers will try to do anything from the lows of last month in the area of 1.2728. In the scenario of an upward correction, only the formation of a false breakdown in the resistance area of 1.2809 will signal the opening of short positions, but I recommend selling immediately for a rebound from the maximum of 1.2854. As I have repeatedly noted, the direction of the pound will depend on any news on the negotiations between the EU and the UK.

Signals of indicators:

Moving averages

Trading is conducted below the 30 and 50 daily averages, which indicates a slight advantage on the part of sellers of the pound.

Bollinger Bands

A break of the lower border of the indicator in the region of 1.2755 will increase the pressure on the pair. Growth will be limited by the upper level at 1.2854.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20