To open long positions on EURUSD, you need:

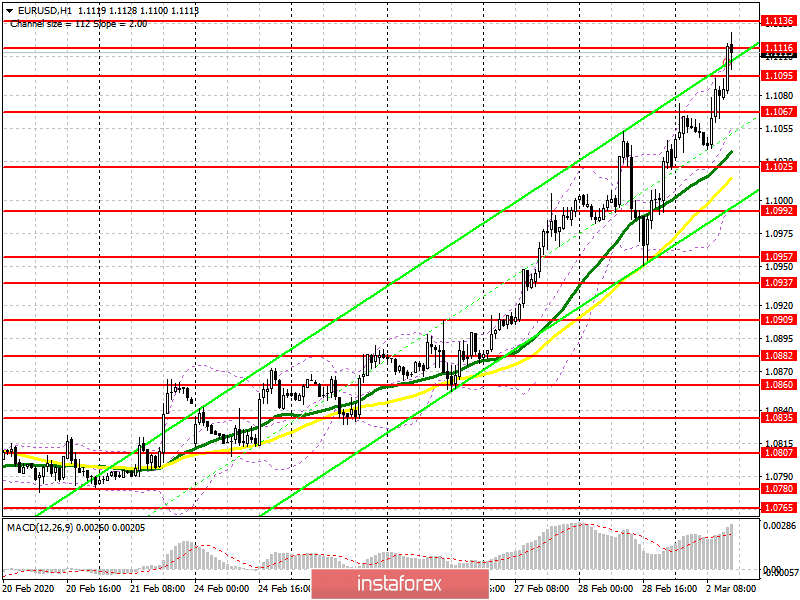

Data showing an improvement in the manufacturing sector in the eurozone allowed the euro to update the next highs and get to the level of the 11th figure. Each test of resistance, which I discussed in more detail in the morning forecast, was met with active sales from the bears. However, this only strengthened the position of buyers. At the moment, a confident consolidation above the support of 1.1067 and a breakdown of the resistance of 1.1095 will allow us to count on further growth to the highs of 1.136 and 1.1180, where I recommend fixing the profits. In the scenario of a decline in the euro in the second half of the day, it is best to return to long positions on a false breakdown from the minimum of 1.1067 or open long positions immediately on a rebound from the support of 1.1025. The US dollar can be supported by good data on the ISM manufacturing index.

To open short positions on EURUSD, you need:

Sellers are trying to return to the market, however, short positions from the level of 1.1095 only allowed us to make sure that large buyers are already in the support area of 1.1067. At the moment, I do not recommend rushing to sell euros, as there is a clear bullish trend. Only the formation of a false breakdown in the area of 1.1136 will be the first signal to open short positions, while it is best to sell the euro for a rebound at the highs of 1.1158 and 1.1180. However, I would not expect a correction of more than 20-30 points from these levels. An equally important task for sellers of the euro will be to consolidate below the level of 1.1095, which will increase the pressure on buyers and force them to close long positions. This will update the lows of 1.1067 and 1.1025, where I recommend fixing the profits.

Signals of indicators:

Moving averages

Trading is above the 30 and 50 moving averages, which indicates that the euro will continue to grow in the short term. Moving averages will also act as support.

Bollinger Bands

The downward movement can be limited to the middle of the indicator around 1.1067, however, you can buy euro immediately on the rebound from the lower border of the indicator in the area of 1.0992.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20