Surprisingly, what happened yesterday in the market is quite logical and understandable, except for the behavior of the pound during the American session. In any case, both the growth of the single European currency and the decline in the pound are fully consistent with the logic of published macroeconomic data.

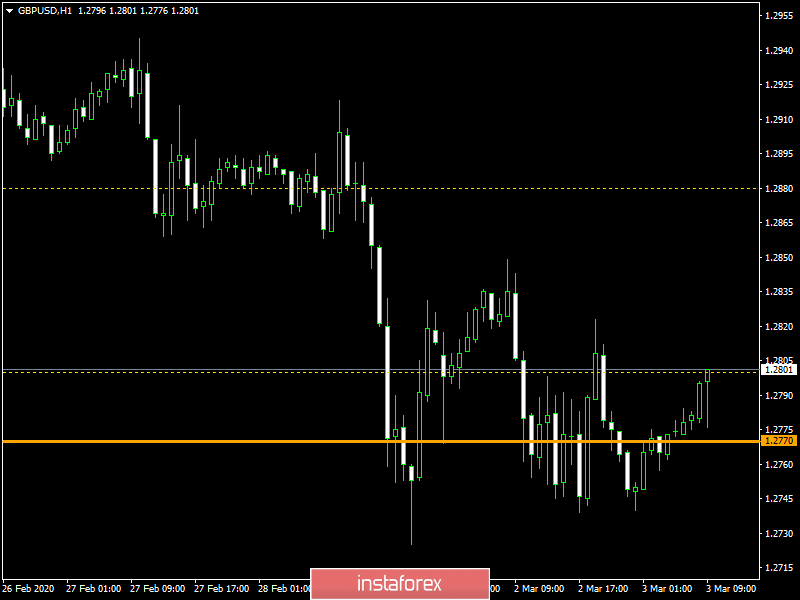

So, the single European currency continued to increase almost from the very opening of the European session, which was largely due to European statistics. The most important factor was the growth from 47.9 to 49.2 of the index of business activity in the manufacturing sector. Moreover, the data turned out to be better than forecasts, since they expected growth to 49.1. This happened due to the fact that in a number of the largest countries of the euro area this indicator turned out to be better than expected. In particular, the index in Germany increased from 45.3 not to 47.8, but to 48.0. In France, where the index was recorded declining from 51.1 to 49.8, the data still turned out to be better than forecasts, since they expected a decrease to 49.7. The situation is best in Spain, where the index of business activity in the manufacturing sector unexpectedly increased from 48.5 to 50.4. That is, the index rose above 50.0 points, separating stagnation from growth. But they were waiting for growth only to 49.1. And it was only in Italy that was a little disappointing, because we saw its decline to 48.7 instead of growing the index of business activity in the manufacturing sector from 48.9 to 49.5. But overall, the data turned out to be good and encouraging. As a result, the growth of the single European currency does not look strange.

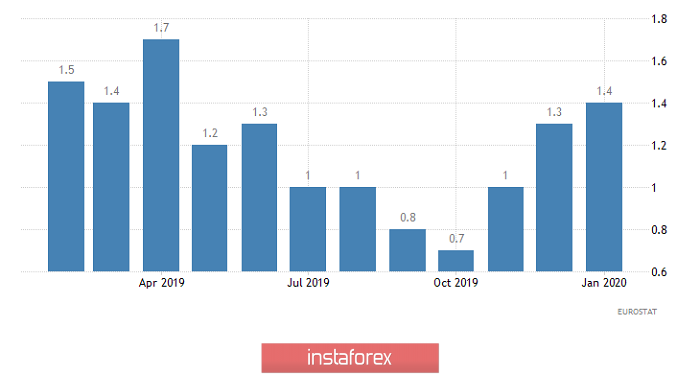

Manufacturing PMI (Europe):

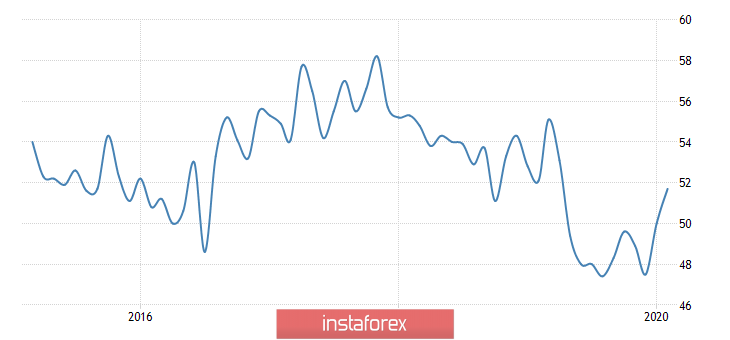

The further decline in the pound was a complete surprise, but given the macroeconomic data released yesterday, there is nothing surprising in this. The first thing that catches your attention is the index of business activity in the manufacturing sector, which increased from 50.0 to 51.7. But the fact is that growth was forecast to 51.9. That is, the data turned out to be worse than forecasts. However, this is not so important, as the data on the lending market is the most disappointing. On the one hand, the number of approved mortgage loans increased from 67.9 thousand to 70.9 thousand, which was more than the forecast of 68.2 thousand. And this seems to be wonderful, but the trouble is that the volume of mortgage lending decreased from 4.4 billion pounds to 4.0 billion pounds, although it was supposed to grow to 4.8 billion pounds. In other words, the number of mortgage loans is increasing, and lending is declining. At the same time, the volume of transactions with the most expensive real estate items belonging to the investment category is decreasing. This means that the flow of investment in British real estate is declining, and this indicator is one of the most significant for the pound. And the volume of consumer lending declined from 5.7 billion pounds to 5.2 billion pounds.To put it in another way, the decline in the pound was justified.

Manufacturing PMI (UK):

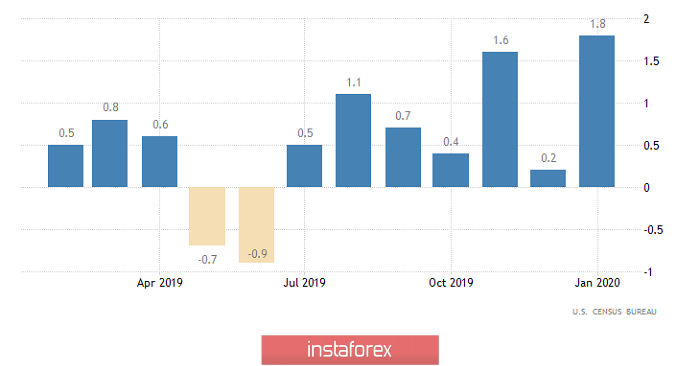

However, some strange things started during the American session. First, pay attention to the data itself, especially on the index of business activity in the manufacturing sector, both from Markit and from ISM. So, the Markit index, as expected, declined but not from 51.9 to 50.8, but to 50.7. In addition, the ISM index also turned out to be worse than expected, as it declined from 50.9 to 50.1, while they expected a decrease to 50.2. And it seems like everything is clear - the data is bad and the dollar should decline. This is exactly what happened, but the pound began to decline quite quickly again, fully recovering from the insignificant growth caused by the decline in business activity indices in the manufacturing sector of the United States. As if he was the only one to respond to data on construction costs, which increased by 1.8%. Moreover, the previous value was revised upward from -0.2% to 0.2%. Of course, this is extremely positive data, but not as significant as business activity indices. Although the construction costs to a much greater extent reflect the real situation than all kinds of indices. However, what is more remarkable is that the single European currency has ignored data on construction costs.

Construction Costs (United States):

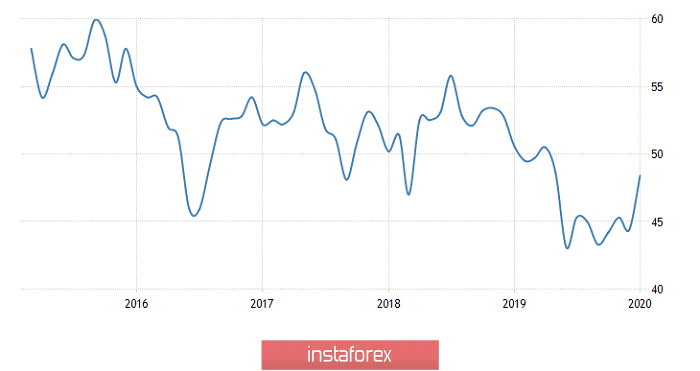

At the same time, the pound has a good chance to improve its position a little today. The reason will be the index of business activity in the construction sector, which should increase from 48.4 to 48.6. Moreover, the pound is clearly oversold, so a small rebound and correction would not hurt it.

Construction sector business activity index (UK):

So now, the single European currency is likely to complete its upward movement and return to the usual decline in recent years. It's all about preliminary data on inflation, which should show its decline from 1.4% to 1.3%. However, the forecast was the same before the publication of inflation in the largest countries of the euro area. However, the data on them came out not good, and everywhere its decline was recorded, even where inflation was expected. Only the inflation in Germany remains unchanged. Thus, there is every reason to believe that inflation will decline slightly more. For example, up to 1.2%. Firstly, the reduction in inflation is perceived by investors as a negative factor. Secondly, a decrease in inflation suggests that we should not rely on the possibility of a serious revision of the monetary policy of the European Central Bank. Third, lower inflation, paired with large panic over the coronavirus and the harm it will do to the global economy could lead to even lower interest rates for the European Central Bank. As a result, inflation data will be the starting point from which the single European currency will resume its decline.

Inflation (Europe):

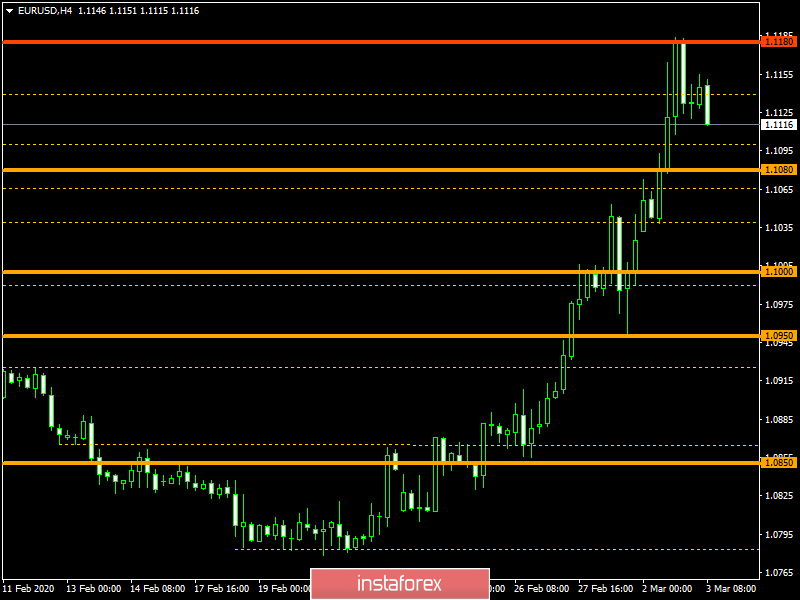

The euro / dollar currency pair is at the point of overheating of long positions due to the strong inertia of the past days. It is likely to assume that the correction course will come soon, where the nearest return point is in the region of 1.1080.

The pound / dollar currency pair continues to fluctuate within the level of 1.2770, having a characteristic amplitude. It is likely to assume that the main downward interest will continue in the market, but a temporary fluctuation is not excluded from the level of 1.2770 towards the level of 1.2845.