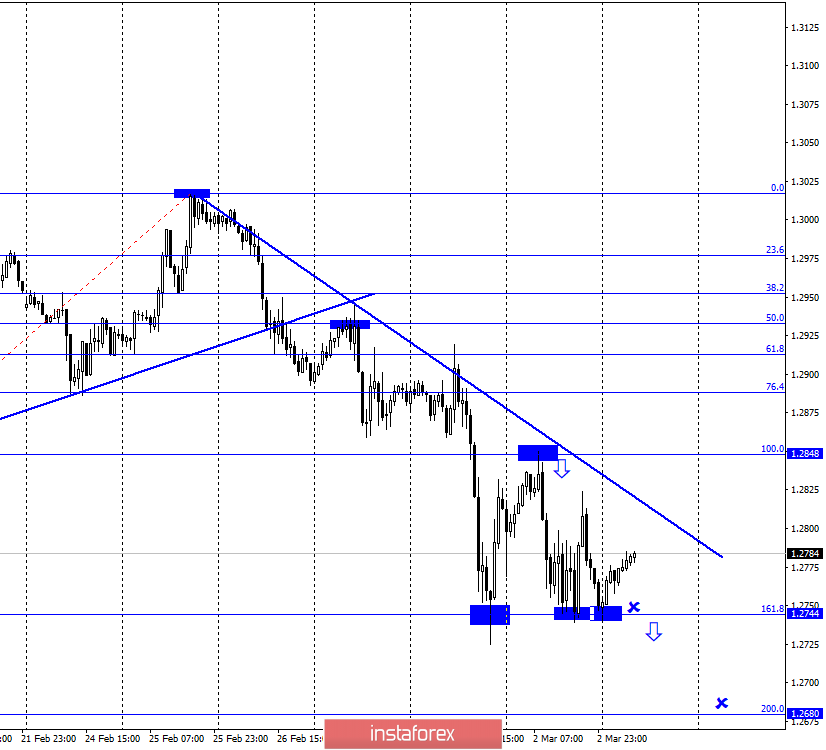

GBP/USD – 1H.

Hello, dear traders. According to the hourly chart, the GBP/USD pair pulled back from the correction level of 1.2848 (100,0%) to the level of 1,2744 (161,8% Fibonacci extention). After that, the pair rebounded and grew slightly. Later, the pair returned to Fibonacci level and rebounded again. Thus, the pair reached its first target. For the pound to continue dropping, it is preferable that the price consolidates below Fibonacci level of 161,8%. In this case, the price can continue plummeting to the next correction level of 1.2680 (200.0%). The downward trend line maintains bearish sentiment among traders.

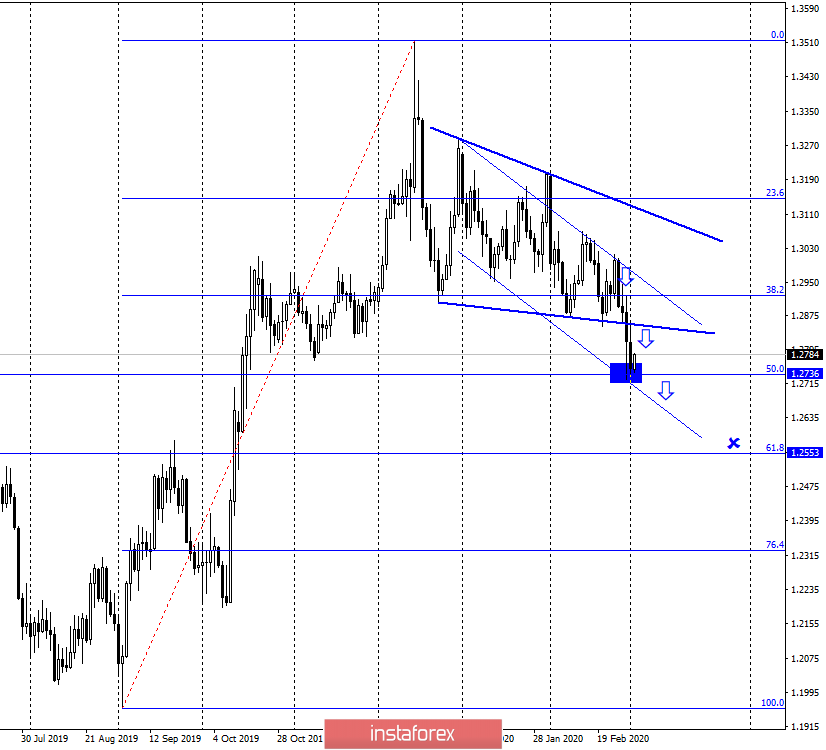

GBP/USD – 4H.

The 4-hour chart indicates that the GBP/USD pair consolidated almost below the side trend corridor. As a result, the price is likely to continue decreasing to the level of 1.2581. On Monday, the pair reversed to the lower line of the corridor. Then, the price pulled back and fell. Thus, the quotes can decline to the low of 1.2581.

GBP/USD – Daily.

The daily chart is more interesting. The pound-dollar pair consolidated below the lower trend line and fell to the correction level of 1.2736 (50.0%). The pullback allows traders to expect the pound to rise to Fibonacci level of 1.2920 (38.2%). If the pair consolidates below Fibonacci level of 50.0%, the price is likely to drop to the next correction level of 1.2553 (61.8%). The downward trend line maintains bearish sentiment among traders. According to these three charts, the price is expected to continue falling as there are downward graphical formations on all the charts.

News review:

On March 2, the UK presented manufacturing activity data for February. The index decreased to 51.7. The dollar strengthened against the pound as the ISM/Markit manufacturing PMI declined. Later, however, the pound surged.

Economic Calendar for US and UK:

There is no important news in the UK and the US as of March 3.

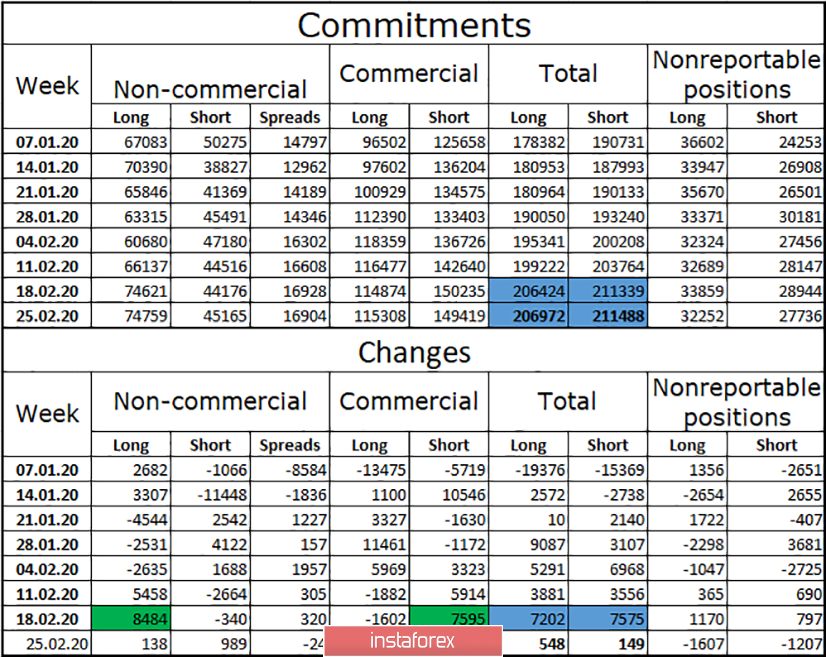

COT(Commitments of traders) report:

The COT report as of February 25 shows steady balance between major market players. There are no significant changes. The total number of Longs and Shorts is almost the same. There were few changes during the week. However, the sentiment of major market players remained the same. Bears have a slight advantage, though. The pound is not expected to fall dramatically. The pair is likely to remain below the correction level of 1.2736 (50,0%). However, only the COT report suggests it. If the pair closes below the correction level, the bearish trend can continue.

Forecast for GBP/USD:

If the closing price is below the level of 1.2744, it is preferable to sell the pound with targets at 1.2680 and 1.2553. If the pair closes above the trend line on the hourly chart, it is better to open a buy deal. However, there are no trading signals for that.

TERMS:

Non-commercial are major market players: banks, hedge funds, investment funds, private and large investors.

Commercial - commercial enterprises, firms, banks, corporations, companies that buy currency not for speculative profit, but for ensuring current activities or export-import operations.

Non-reportable positions - small traders who do not have a significant impact on the price.